Quick Answer: This blog provides instructions on how to file and pay sales tax in Louisiana using form R-1031. This is the Direct Marketer Sales Tax Return. The other option is form R-1029. For additional information, you can view this document released by the Louisiana Department of Revenue on November 8, 2018, in regards to Direct Marketer Requirements. Also, follow this link for more information on the Direct Marketer Sales Tax Return.

Do You Need to File a Louisiana Sales Tax Return?

Once you have an active sales tax permit in Louisiana you will need to begin filing sales tax returns. Not sure if you need a permit in Louisiana? No problem. Check out our blog, Do You Need to Get a Sales Tax Permit in Louisiana?

Also, If you would rather ask someone else to handle your Louisiana filings, our team at TaxValet can handle that for you with our Done-for-You Sales Tax Service. We specialize in eliminating the stress and hassle of sales tax.

How to Sign in and File a Return on Louisiana’s Website

Let’s start with simple step-by-step instructions for logging on to the website in order to file and pay your sales tax return in Louisiana.

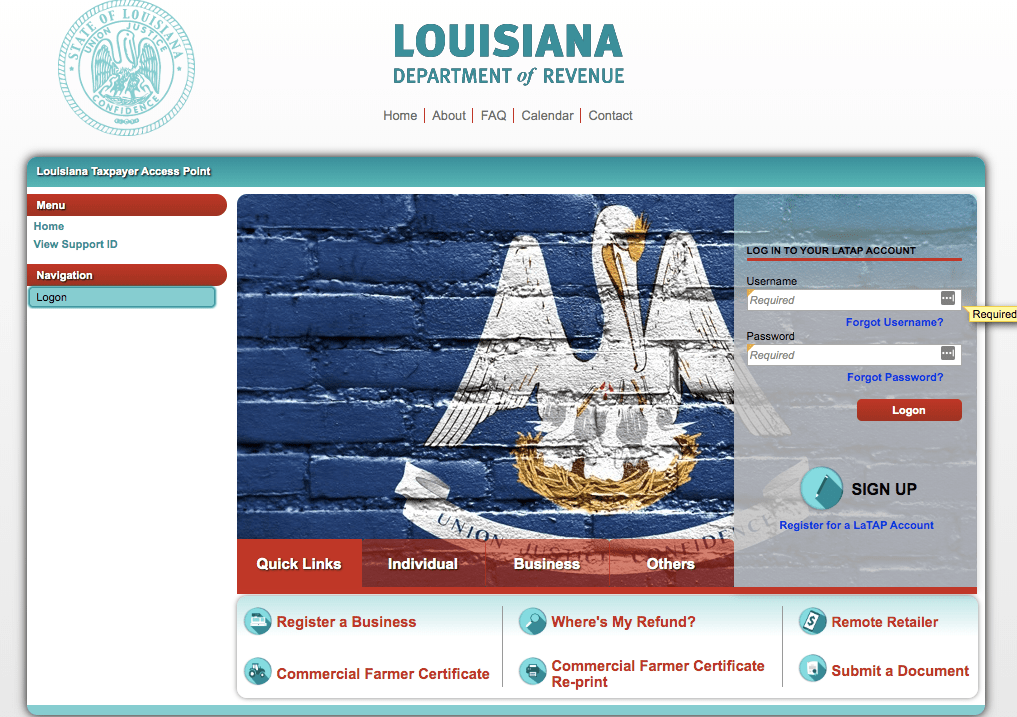

Step 1: Follow this link, https://latap.revenue.louisiana.gov/_/, to come to this screen:

Step 2: Sign in with your username and password.

If you do not have a username and password, then your first step is getting that all setup. These login credentials are generally created when you submit registration paperwork for a sales tax permit. If you are not interested in doing the work of getting the permit or a state login yourself, TaxValet can handle that for you with our Sales Tax Permit Registration Service.

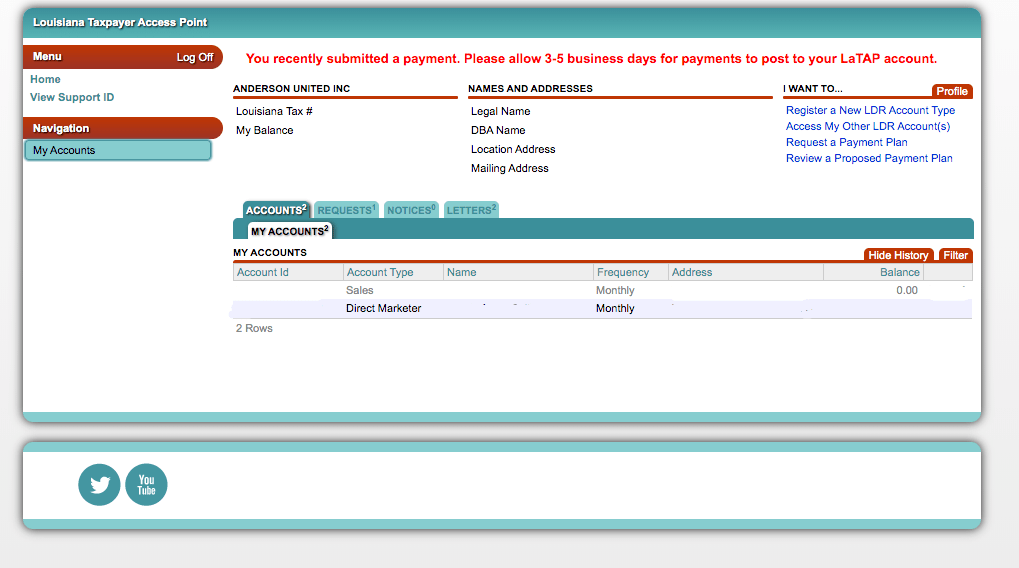

Step 3: You will be directed to the dashboard for the state.

Think of this page as your home base. You can always come back to this page if you get lost.

Take a minute here to explore. You can see that this business has a notification about their last submitted payment. You can also click through the tabs in the middle of the screen to see if the state of Louisiana has sent you any notices or letters. It is a good practice to get into the habit of checking this page thoroughly.

Once you feel that you have a good understanding of the dashboard, proceed by selecting the appropriate account. In this case, we will be using the “Direct Marketer” account as this business is required to file a direct marketer sales tax return.

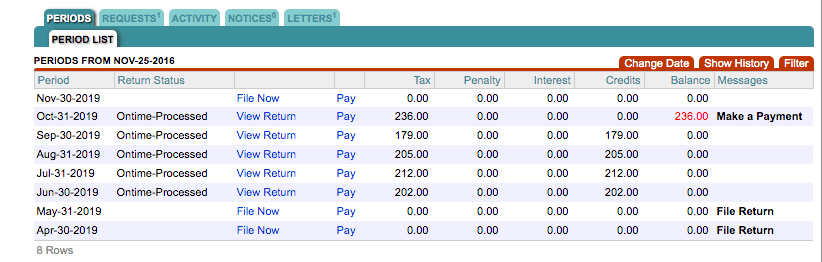

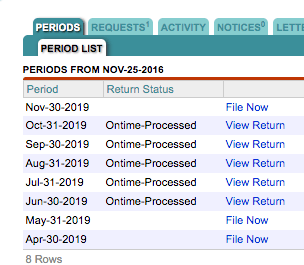

Step 4: You will be directed to this page.

On this page, you should be able to see all of the periods that you previously filed as well as the filing period that you actively need to file. You can also see the status of any of the previously filed returns.

If you have a return due, you will see the option to file the return to the right of the corresponding period. Select the “File Now” link.

Step 5: Key in Sales Data

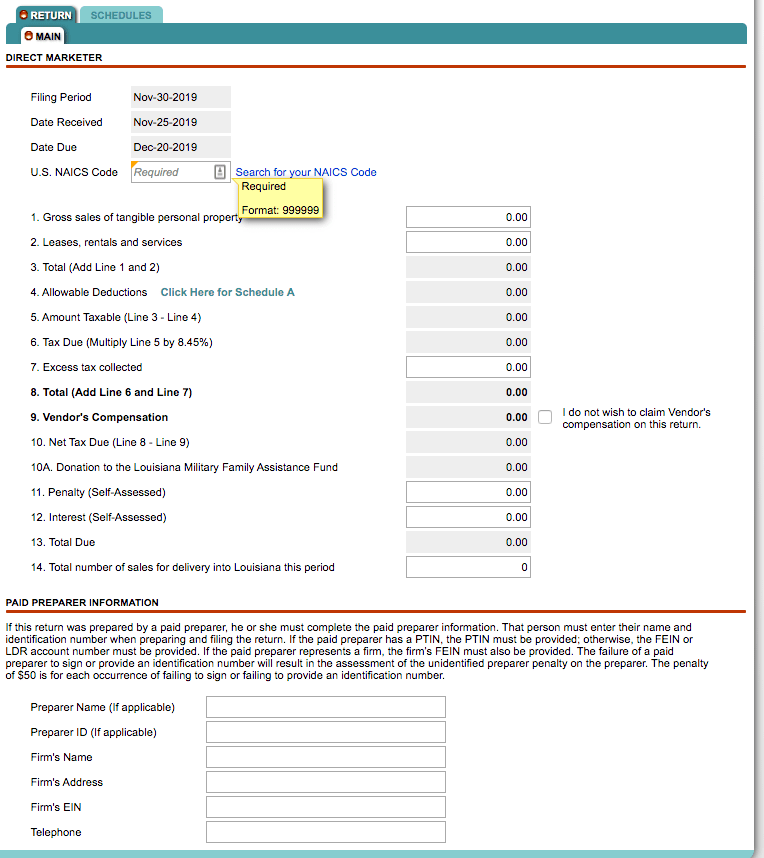

You have now arrived at the page where you will enter your sales data. The direct marketer return is actually quite simple, so you’re in luck!

You are now faced with a screen that looks something like this:

The one unique thing that you will need for your Louisiana return, is your NAICS code. In case you do not already know, your NAICS code is a code that classifies your business by the type of economic activity in which you engage. If you do not know your NAICS code, you can use the search function that Louisiana gives you.

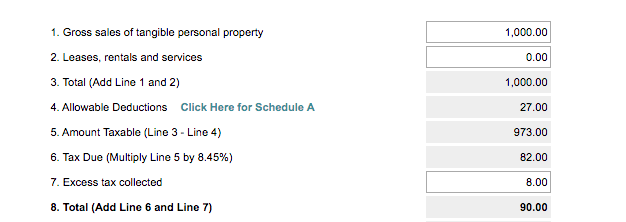

Let’s start at the top. On line 1, enter your gross sales for the entire state of Louisiana. On line 2, enter any leases, rentals, and service sales that you made. If you did not make any sales that fall into those categories, just skip those lines.

We now need to input your allowable deductions. You can do this by selecting the “Click Here for Schedule A” link.

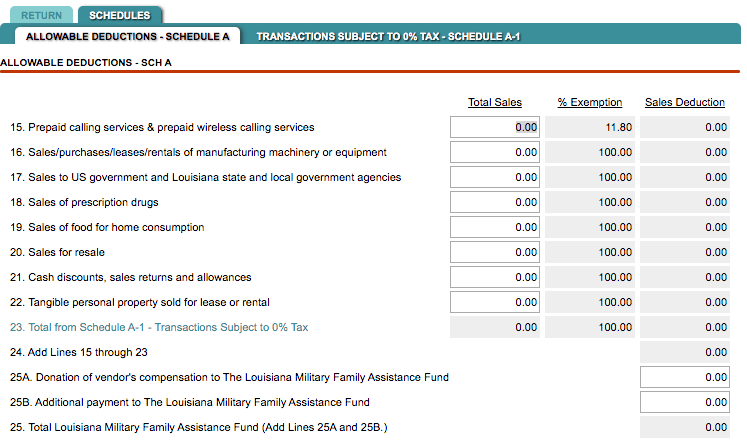

You will see this screen:

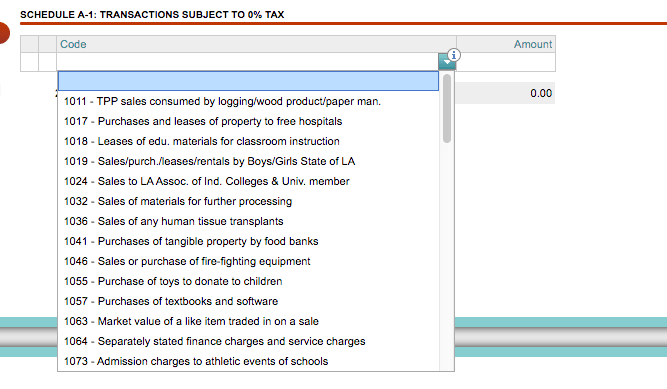

Read each line carefully to determine if your deductions fall into any of these categories. If not, you can select the link on line 23. This will take you to a page where you can choose from a dropdown list of deductions.

After you choose the correct code, enter in the amount. Then you can select the “Return” tab at the top of the page to get back to the main form.

You should be able to see the deductions that you just entered reflected on line 4. If not, you did not fill out Schedule A correctly.

The next line to consider is line 7. This is the place where you can tell Louisiana about any excess tax you may have collected.

The excess tax collected is the tax that you collected that is above the amount that you technically owe. If you see the example below, the tax due is $82.00. If you actually collected $90.00 from your customers, you will need to put 8.00 on line 7.

You should now be able to see the total tax due on line 8. Line 9 will automatically calculate with your vendor’s compensation. The vendor’s compensation is a discount given by Louisiana for filing your return on time. If, for whatever reason, you do not wish to claim this amount, check the box next to line 9.

Now it is time to consider lines 11 and 12. If you are filing this return late, you will need to self-assess penalties and interest. See the Louisiana DOR webpage to reference how to compute this amount.

Finally, look at line 14. Louisiana wants you to put your “total number of transactions with Louisiana customers in the reporting period.” This essentially means that you need to count all of your transactions that you made in Louisiana, and put that total in this blank. However, we have received unofficial guidance from a Louisiana Revenue Tax Specialist that line 14 is optional. Louisiana reported that, “The purpose of the transaction count is for data collection purposes.”

If you have any questions about what you should put on this return, see here for instructions on the Direct Marketer Sales Tax Return.

You are almost there! If you are self-preparing this return, you do not need to fill out the bottom portion of the return. If you are a paid preparer, fill in the appropriate information. Double-check the return for data entry errors, and now you are ready to submit. Scroll back up to the top of the page, and click the “Submit” button. You will be prompted to re-enter your password.

That’s it! You are now finished with your Louisiana sales tax return. If you wish to make the payment with the return, continue reading below.

How to Pay Louisiana Sales Tax

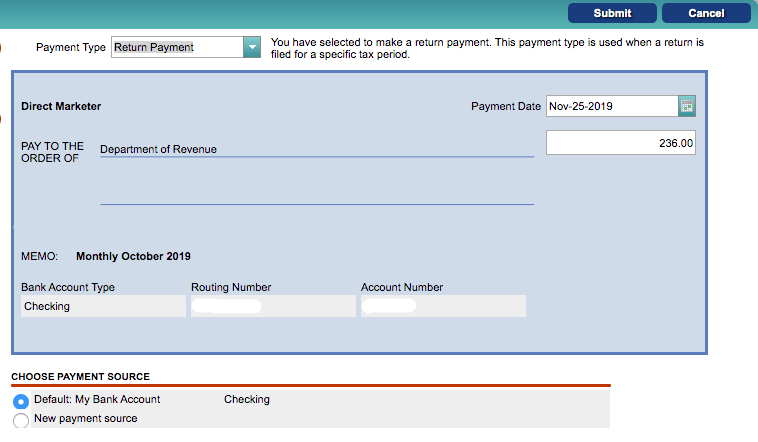

If you wish to pay your sales tax due while submitting the sales tax return, select that option after filing your return. You can also go back to the dashboard, select “Direct Marketer”, then select “Pay” next to the return that you just filed. You will see a screen that looks like the one below.

Carefully, fill in your bank information, the amount due, and select the appropriate due date. Make sure your payment date is scheduled no later than the due date of the tax return.

Once you are sure that everything is entered correctly, hit “Submit” at the top of the page.

(Note: This is an ACH Debit payment method. If you wish to pay with a credit card, select the “Credit Card Payment” option at the bottom of the page.)

Things to Consider After Filing a Sales Tax Return in Louisiana

If you forgot to print or save a copy of your sales tax return, no need to worry. You can easily go back into the period to view and/or print the return that you just filed. Go back to the dashboard and select the “Direct Marketer” account. Find the period that you need. To the right of that period, you should see the option to “View Return”.

Select that option and then select “Print” at the top of the next page to save and/or print the return for your records.

How to Get Help Filing a Louisiana Sales Tax Return

If you are stuck or have questions, you can contact the state of Louisiana directly at (855) 307-3893 between 8:00 a.m. and 4:30 p.m. CST. You can also find additional resources at the Louisiana Department of Revenue (DOR) website.

Instead, if you are looking for a team of experts to handle your sales tax returns for you each month, you should check out our Done-for-You Sales Tax Service. Feel free to contact us if you’re interested in becoming a client!

More from TaxValet:

Do You Need to Get a Sales Tax Permit in Louisiana?

by Jenniffer Oxford

Receive Important Sales Tax Updates to Your Inbox!

Join our mailing list to receive free updates that could help protect your business from audit.

Get in Touch

Company

Disclaimer: Nothing on this page should be considered tax or legal advice. Information provided on this page is general in nature and is provided without warranty.

Copyright TaxValet 2023 | Privacy Policy | Site Map

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.