Sales tax compliance for ecommerce

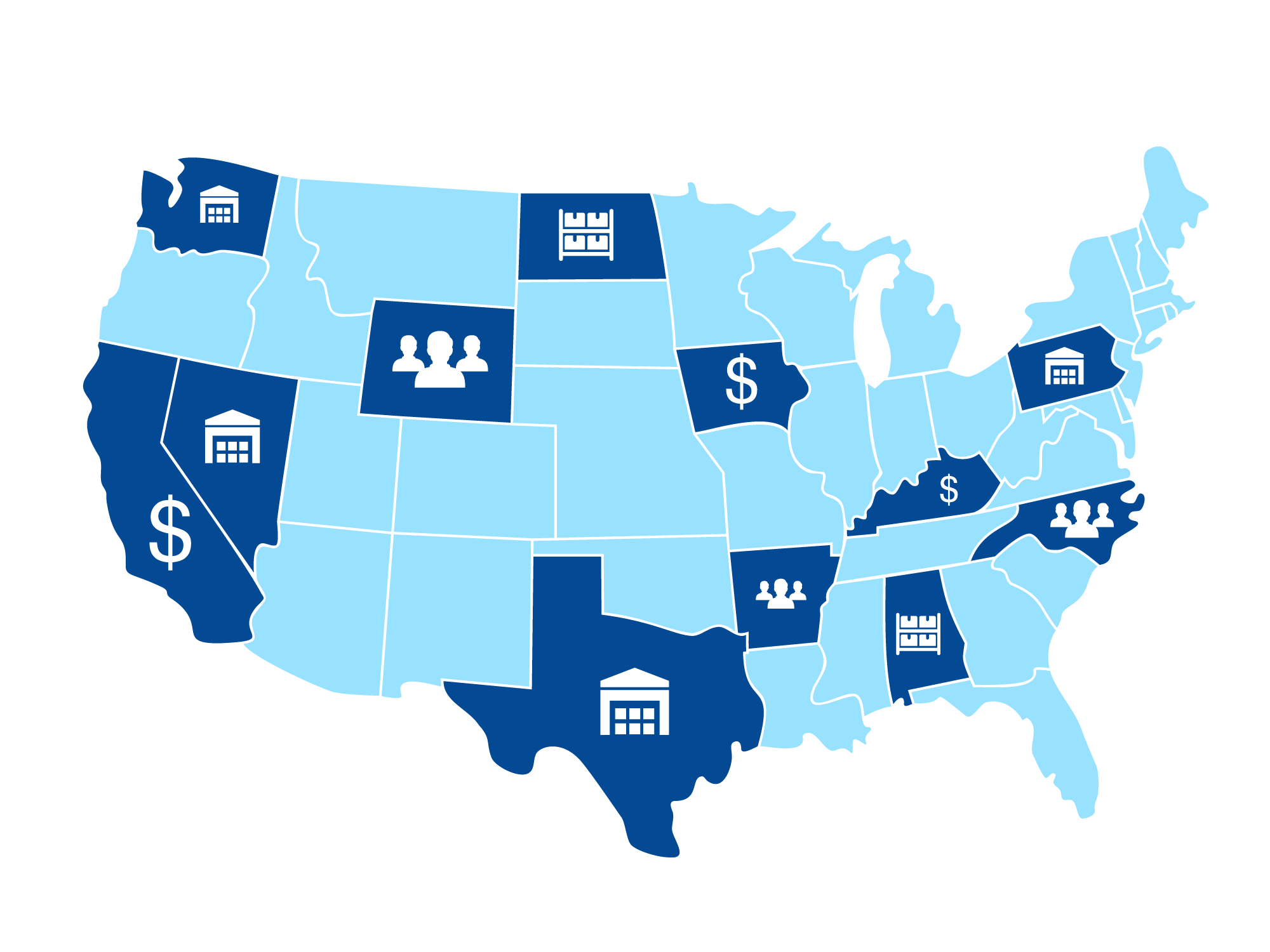

Selling online nationwide means navigating a complex web of state-specific sales tax rules. Determining your nexus is tricky, with a lot of economic thresholds and physical presence factors like third-party logistics and Fulfillment by Amazon.

TaxValet simplifies the process. Our experts analyze your business, pinpoint your obligations, and create a plan to ensure compliance in every state, so you can focus on growth, not paperwork.

300+ fast-growing brands trust TaxValet to save an average of $301,496 in audit costs

.png?width=600&height=400&name=TaxValet%20Website%20Logos%20(2).png)

.png?width=600&height=400&name=TaxValet%20Website%20Logos%20(4).png)

Want to protect your ecommerce business from audits, penalties, and lost profits? Get sales tax right.

Finding your way through the ecommerce nexus maze

Figuring out sales tax nexus is rarely easy. Each state has its own rules, thresholds, and quirks, making it hard to stay compliant, especially as your business grows.

Here's why you need expert guidance:

- Audit protection: One small nexus mistake can trigger an expensive audit. When the average audit bill is $301,496, you need experts to make sure your compliance is bulletproof to safeguard your business from financial ruin.

- Economic nexus thresholds: These thresholds differ a lot between states, and they change often. Selling through marketplaces like Amazon makes it even more complex, as facilitator laws can affect your nexus obligations.

- Physical presence factors: Using third-party logistics providers (3PLs), Amazon FBA, or storing inventory in various places can all trigger physical presence nexus. This requires careful monitoring and management.

- Other nexus triggers: Online ads that target specific states, affiliate marketing, and drop shipping can create nexus obligations that are often overlooked.

Managing sales tax data from multiple ecommerce channels

Running a successful online business often involves selling through multiple channels. But dealing with sales tax data from various platforms – like your Shopify store, Amazon marketplace, and Big Commerce shop – can quickly become a compliance headache.

Here's why you need expert guidance:

- Consolidating data is tricky: Pulling sales data from multiple sources, each with its own format and quirks, takes time and can lead to errors. Making sure everything is accurate and consistent across all platforms is key for compliant reporting, but doing it manually is a recipe for trouble.

- Double-counting risks: Orders often move between platforms, with fulfillment happening through different channels. Without careful management, this can lead to counting transactions twice and overpaying sales tax, cutting into your profits.

- Returns create complications: When handling customer returns, you need to adjust your sales tax correctly to avoid paying too much. A lot of software has trouble dealing with refunds accurately, which can cause you to overpay significantly.

- Software limitations: A lot of sales tax software has trouble smoothly connecting with all your ecommerce platforms, especially if you use custom integrations or niche marketplaces. This can create gaps in your data and compliance, leaving you open to penalties.

Untangling product taxability for ecommerce

When you sell products online, figuring out how each item is taxed across all 50 states can get very confusing. Rules and regulations vary a lot, and even simple products like clothing or supplements can have complex tax rules depending on the state.

Here's why you need expert guidance:

- State-by-state differences: What's taxed in one state might be exempt in another. Manually researching and applying these differences across all your products takes a lot of time and can lead to mistakes.

- Getting tax settings right matters: Wrong tax settings on your online platforms can lead to collecting too little or too much sales tax. This creates compliance headaches, potential penalties, and can even affect your customer relationships.

- Software doesn't always get it right: Trusting software alone to determine product taxability can be risky, as it may not catch the details of state-specific rules or product classifications.

Selling your ecommerce business? Don't let sales tax hold you back

If you're planning to sell your online business or get funding for future growth, sales tax compliance is a key factor that potential buyers and investors will look at closely during their due diligence. Any red flags in your compliance history can derail your plans and significantly impact your business's value.

Here's why you need expert guidance:

- Due diligence scrutiny: Buyers and investors want to be sure your sales tax compliance is impeccable. They'll thoroughly review your records, looking for any signs of risk or potential liabilities.

Ecommerce nexus determination

- Our experts thoroughly analyze your business activities, considering economic nexus thresholds, physical presence factors, and other often-overlooked triggers.

- We stay up-to-date with the latest state-specific rules and thresholds, ensuring your nexus obligations are always accurate.

Multi-channel data management

- We seamlessly integrate with all your ecommerce platforms, pulling sales data from multiple sources and consolidating it into a single, accurate view.

- Our advanced data validation processes eliminate the risk of double-counting transactions and overpaying sales tax.

- We make processing returns easy and get your sales tax right, so you don't overpay an audit. Most software doesn't handle refunds well, but TaxValet creates "negative transactions" in your future filings to get back the sales tax you refunded.

Product taxability analysis

- Our team meticulously researches and applies state-specific taxability rules to your entire product catalog, ensuring accurate tax settings across all your ecommerce platforms.

- We stay current with changes in product classifications and exemptions, providing ongoing updates and guidance.

- Our expert review process catches the nuances that software alone may miss, protecting you from costly errors.

Exit planning support

- We provide meticulous documentation and a proven track record of success in sales tax compliance, giving potential buyers and investors the confidence they need during due diligence.

- Our proactive compliance management identifies and resolves any historical liabilities, protecting your business value.

- With TaxValet handling your sales tax compliance, you can focus on achieving your goals, whether it's a successful exit or securing funding for growth.

Your Fractional Sales Tax Department

Our comprehensive service ensures that every aspect of your ecommerce sales tax compliance is accurate, efficient, and stress-free.

Ecommerce nexus determination and review

Not sure where you need to collect sales tax? We analyze your online sales and business activities to determine your exact nexus obligations in each state, ensuring compliance and minimizing risk.

Ecommerce sales tax audit defense

Don't let a sales tax audit disrupt your ecommerce operations. Our expert team will guide you through the entire process, minimizing your liability and protecting your online business.

Ecommerce sales tax strategy and planning

Develop a proactive sales tax strategy that aligns with your ecommerce growth plans. We'll help you create a customized plan that minimizes risk and maximizes efficiency across all your online sales channels.

Dedicated ecommerce sales tax expertise

Get personalized guidance and support from a dedicated sales tax expert who understands the unique challenges of ecommerce businesses like yours.

Navigating U.S. sales tax as an international ecommerce?

From establishing a U.S. bank account for payments to obtaining necessary identification numbers and dealing with varying state requirements, as a foreign business you face unique obstacles. TaxValet specializes in helping international sellers like you overcome these hurdles, providing tailored solutions and expert guidance to ensure smooth, compliant sales tax management across the states where you do business.

Comprehensive compliance and unlimited growth without any of the risk

30 day risk-free

If in the first month you don't think we’re the best solution for your sales tax hassles, you don’t pay.

360° Audit-protection

If you ever go through an audit and we mess up, we cover all your costs.

Unlimited transactions

Unlike software, we guarantee no extra charges for additional transactions as you grow.

Get your ecommerce sales tax experts on your side

"There is no substitute for being able to talk to a competent tax professional in the ecommerce space… TaxValet has made compliance as easy and human as possible, which is significant given I have economic nexus in 29 states."

— Daniel Whitehouse

"Sales tax management for our ecommerce business used to be an absolute nightmare - vague guidelines, unsure of how to structure the systems and very time-intensive. Now it's a breeze. I spend exactly 0% of my mental energy worrying about sales tax these days."

— Stephen Steinberg

Get your free, personalized sales tax consultation

During your call, we'll cover:

😵💫 Notices, back-taxes & other sales tax messes: to help you stop the bleeding, minimize liabilities, and regain control over your sales tax situation.

😱 The biggest sales tax risks for YOUR business: to identify your specific vulnerabilities, so you can prioritize compliance efforts and proactively protect your business from audits.

😡 How to eliminate sales tax software: to address the limitations of software and ensure accurate, reliable compliance moving forward.