SALES TAX STRATEGY AND PLANNING

Let experts navigate your sales tax journey

Don't just react to sales tax laws - get ahead of them. TaxValet's expert team will create a customized strategy to minimize your risk, optimize your costs, and help you navigate the complexities of multi-state sales tax compliance with confidence.

Here's how we do it:

- Uncover hidden risks and opportunities

- Develop a strategic roadmap

- Explore cost-saving solutions

- Continuously manage your compliance

300+ fast-growing brands trust TaxValet to save an average of $301,496 in audit costs

.png?width=600&height=400&name=TaxValet%20Website%20Logos%20(2).png)

.png?width=600&height=400&name=TaxValet%20Website%20Logos%20(4).png)

Get proactive with your sales tax compliance

Sales tax done right is more than just paperwork. It's protecting your biggest asset - your business.

Neglecting your sales tax strategy is like walking a tightrope without a safety net. One small mistake, like missing a due date, getting a calculation wrong, or not realizing you have nexus, can cause a lot of problems. You could face expensive audits, big fines, and interruptions to your cash flow that can quickly throw you off track.

Most sales tax software uses basic formulas and one-size-fits-all solutions for sales tax calculations. But every business is different. We go beyond simple automation to create a personalized sales tax plan that fits your unique needs, goals, and growth plans. Finally feel heard, understood, and guided every step of the way.

Let’s get to know your business

To create a plan that works, we take time to fully understand your business. We'll look closely at:

Your systems

We review how your accounting, order, point-of-sale, and e-commerce systems affect your sales tax compliance.

Your products

We check how your products are taxed in different states, considering differences in rules, exemptions, and unique product categorizations.

Your sales channels

We analyze your sales data from online marketplaces, wholesale, and direct-to-consumer to find potential nexus triggers and compliance needs.

Your technology

We review your current tech setup, evaluate the need for third-party tax calculation tools and find ways to simplify your sales tax processes.

Going the extra mile and digging deeper

We don't just cover the foundation; we dig deep to find hidden risks and opportunities.

Detailed nexus reviews

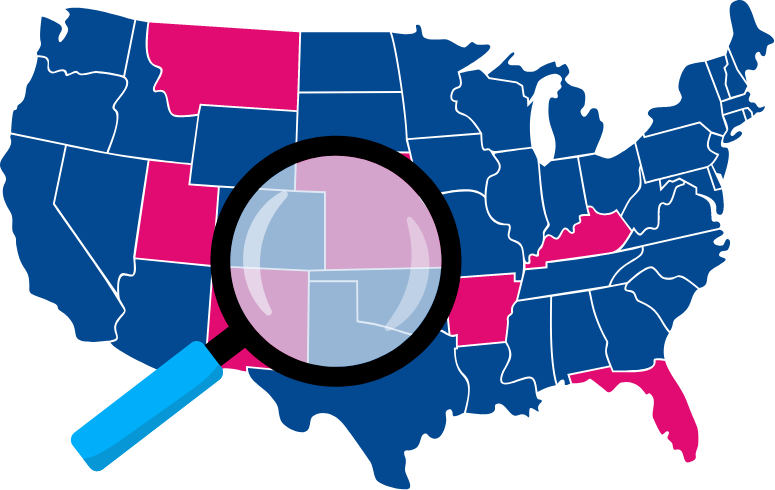

We look at every part of your business to accurately figure out where you have nexus. We make sure you have the permits you need and avoid unnecessary risks. We also check your current permits to see if we can close any you don't need to save money or change them to a better type.

Smart permit planning

We help you prioritize registrations, use grace periods, and optimize your permits to be as efficient and cost-effective as possible. We also look at your past data to find any previous nexus triggers and make a plan to deal with any potential issues.

Sales tax calculation checks

We review your sales tax settings and calculations across all your sales channels to make sure they're accurate. We take into account your specific invoices and communication to minimize unnecessary risks and ensure compliance. We also analyze your customers to identify any possible exemptions and manage resale certificates.

Product taxability know-how

We'll take a close look at how your products are classified to make sure they're being taxed the right way in each state. If it's ever unclear, we'll recommend a legal opinion from a tax attorney to be extra sure, and point you in the right direction.

Sales tax compliance can feel like a moving target. So we adjust.

Sales tax is always changing. Laws change, your business grows, and new challenges come up. With TaxValet you get ongoing support and updates to your plan so we keep your compliance strong, no matter what happens in the future.

Always watching and letting you know

We don't just make your plan and then leave. Our team is always watching sales tax laws, rules, and decisions in all states. We'll let you know right away about any changes that affect your business and work with you to make any needed changes. This way, you'll always stay ahead of the game.

Regular check-ins to keep things running smoothly

We set up regular check-ins to go over your sales tax plan, talk about your business growth, and find any areas that could be better. These check-ins make sure your plan still matches your goals and changes with the sales tax world.

Making due diligence easy

Planning to sell your business or go through a due diligence process? TaxValet's thoroughness and expertise make this process easier and give confidence to possible buyers and investors. Our careful paperwork and proactive compliance management show that you take sales tax compliance seriously and help avoid any roadblocks.

Get your expert guides through your sales tax journey

"Tax Valet took an extremely complicated process and broke it down into efficient phases, with knowledgeable strategy, staff and resources to assist every step of the way. This has allowed our company to focus on growing our business, without having the worry about tax compliance."

— Jonathan Collins

"They manage the whole thing with patience and transparency. Now I feel much more comfortable knowing that our business is compliant and I have the tools I need to navigate decisions as we grow as a company."

— Alexandra Smith

"We came to TaxValet with zero prior experience in the sales tax realm and no idea where to start. Building from the ground up, TaxValet helped us understand how sales tax applied to our business model and services, planning and developing processes to ensure compliance into the future."

— Daniel Whitehouse

Your Fractional Sales Tax Department

Nexus determination and reviews

Unsure about your sales tax obligations? We pinpoint your exact nexus in every state, ensuring compliance and minimizing risk.

Sales tax audit defense

Never fear a sales tax audit again. Our expert team will guide you through the entire process, minimizing your liability and protecting your business.

Dedicated sales tax expertise and expert guidance

Get personalized guidance and support from a dedicated sales tax expert who understands your unique business needs.

Get your free, personalized sales tax consultation

During your call, we'll cover:

😵💫 Notices, back-taxes & other sales tax messes: to help you stop the bleeding, minimize liabilities, and regain control over your sales tax situation.

😱 The biggest sales tax risks for YOUR business: to identify your specific vulnerabilities, so you can prioritize compliance efforts and proactively protect your business from audits.

😡 How to eliminate sales tax software: to address the limitations of software and ensure accurate, reliable compliance moving forward.