NEXUS DETERMINATION AND REVIEWS

Eliminate guesswork from your sales tax

Knowing where you owe sales tax is crucial for compliance. But with constantly changing regulations and complex nexus rules, it's easy to make costly mistakes. TaxValet provides expert nexus determination and reviews, ensuring you have the right permits in every state and avoid penalties.

Here's how we do it:

- Determine precisely where you have nexus

- Craft a custom sales tax strategy to minimize exposure

- Identify cost-saving opportunities

- Execute the plan

300+ fast-growing brands trust TaxValet to save an average of $301,496 in audit costs

.png?width=600&height=400&name=TaxValet%20Website%20Logos%20(2).png)

.png?width=600&height=400&name=TaxValet%20Website%20Logos%20(4).png)

Understanding nexus

Why sales tax expertise matters more than automation

What is sales tax nexus?

Nexus, in simple terms, means having a significant presence in a state that triggers a sales tax obligation. If your business has nexus in a state, you are legally required to collect and remit sales tax on sales made to customers in that state. Failing to understand your nexus obligations can lead to hefty penalties, back taxes, and significant disruptions to your business.

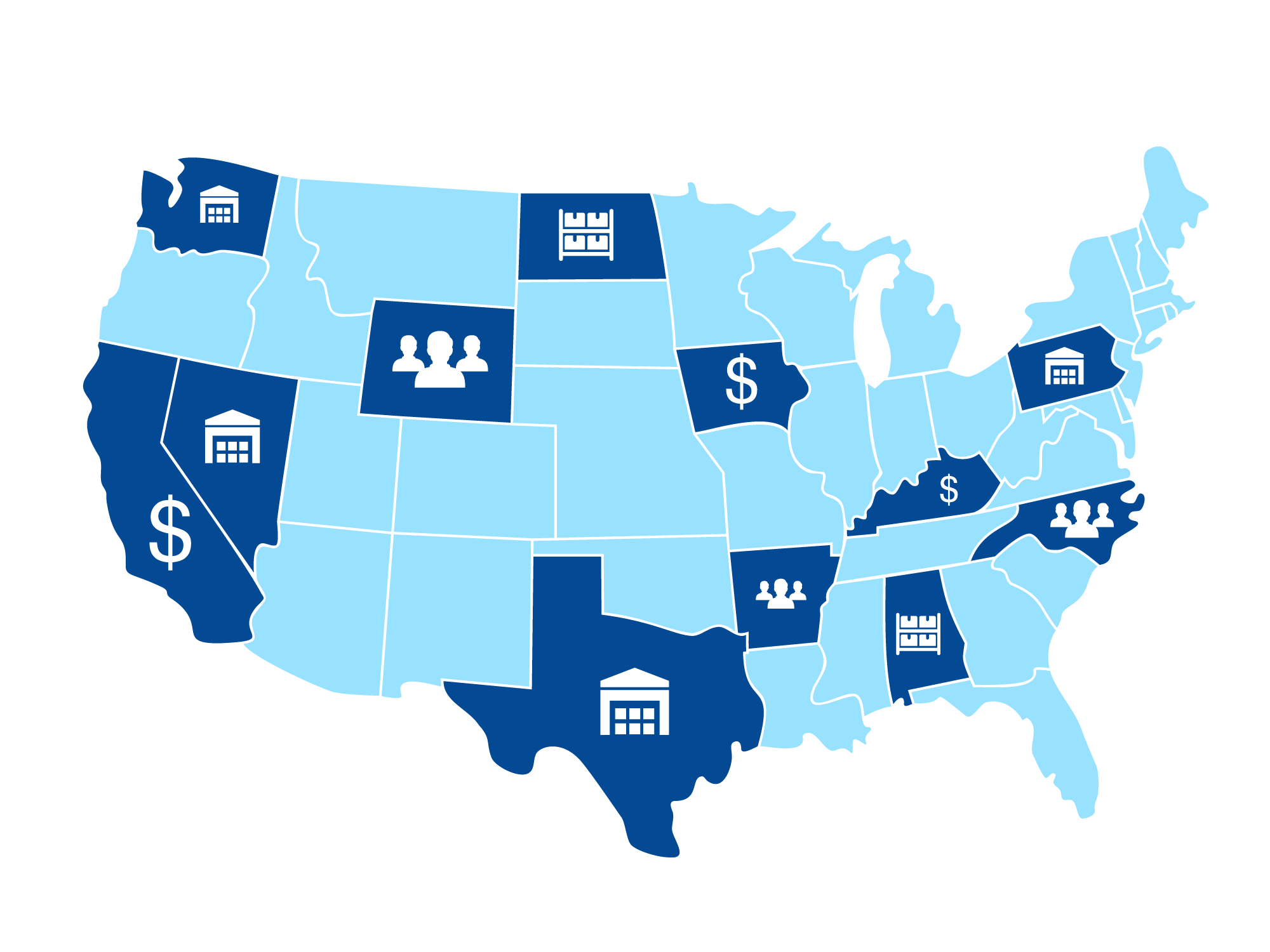

Where is your nexus?

Do your sales exceed state thresholds?

Do you have a physical presence in a state?

Are you overlooking other nexus triggers?

Can you trust your software to get nexus right?

Most sales tax software often oversimplifies nexus calculations, which can lead to mistakes and put your business at risk by:

Getting permits you do NOT need

The software might say you have nexus in a state when you really don't, because it usually just looks at your total sales. It doesn't consider the complicated exceptions that state laws allow. You end up registering and filing returns when you didn't need to, creating extra work and costs.

Missing permits you DO need

The software might not catch all the ways you could have nexus. It only looks at economic nexus factors, and ignores the dozens of other things that create nexus. You might not get permits in states where you actually need them. And if you're not collecting taxes when you should be, you could face penalties later.

TaxValet's 5-step nexus review process

At TaxValet, we do nexus differently. Our team of experts looks at the full picture to make sure your business is fully compliant and not at risk. We don't just rely on basic software. Instead, we do a thorough, customized review that covers all the bases.

1. Determine your precise nexus

We analyze your business activities in detail, going beyond simple sales data to pinpoint your obligations in every state:

- Economic nexus: We carefully analyze your sales data, applying the right thresholds for each state. We consider taxable sales, marketplace rules, and grace periods to ensure accuracy and avoid getting permits you don't need.

- Physical presence: We look closely at your physical presence in each state, including employees, inventory, and other activities that could create nexus. We even consider short-term or temporary presence to make sure nothing is missed.

- Other nexus triggers: We investigate all other potential nexus triggers, such as online advertising, affiliate relationships, and drop shipping. Our thorough review reduces the risk of overlooking any obligations.

2. Craft a custom sales tax strategy

Once we've accurately determined your nexus, we work with you to develop a custom strategy:

- Smart registration planning: We prioritize your permits based on risk and cost savings, creating a strategic plan.

- Using grace periods: We find state grace periods that let you legally delay tax collection and reduce initial compliance work.

3. Identify cost-saving opportunities

We're committed to finding ways to save you money on your sales tax compliance:

- Voluntary Disclosure Agreements (VDAs): We'll see if a VDA can resolve past nexus issues and lower penalties.

- Amnesty Programs: We’ll see if a state you have nexus in is providing amnesty for past-due tax.

- Closing unneeded permits: We'll find permits you no longer need and close them to simplify compliance.

- Correcting permit types: We'll make sure you have the right permit type in each state to reduce compliance work.

4. Execute the plan

Once your strategy is in place, our team handles the execution:

- Permit management: We handle all permit applications, renewals, and changes for you.

- State communication: We deal with all state tax authority interactions on your behalf.

- Past-due returns: If needed, we'll prepare and file any past-due returns to address historical liabilities.

5. Ensure ongoing compliance

We provide ongoing monitoring and support to keep you compliant and minimize future risks:

- Yearly nexus check-ups: We do a complete review of your nexus obligations every year.

- As-needed reviews: If your business activities change, just ask us for an extra nexus review anytime.

Get clarity on your sales tax obligations and a plan to stay compliant

"I highly recommend TaxValet for their exceptional nexus study and sales tax consultation services. Their expertise in navigating our complex company structures and our licensing deals was invaluable."

— Samantha P.

"Tax Valet has made the process easy for getting sales tax nexus set up in many different states. They take that burden off my hands and it frees me up to be able to run my business."

— Laura Woellner

"So many of the other solutions are completely automated, have long lag times for support, don't monitor nexus requirements, or work with every state the same way. TaxValet has made compliance as easy and human as possible, which is significant given I have economic nexus in 29 states."

— Daniel Whitehouse

Your Fractional Sales Tax Department

Sales tax strategy and planning

Develop a proactive sales tax strategy that minimizes risk and maximizes efficiency. We'll help you create a custom plan tailored to your business goals.

Sales tax audit defense

Never fear a sales tax audit again. Our expert team will guide you through the entire process, minimizing your liability and protecting your business.

Dedicated sales tax expertise and expert guidance

Get personalized guidance and support from a dedicated sales tax expert who understands your unique business needs.

Get your free, personalized sales tax consultation

During your call, we'll cover:

😵💫 Notices, back-taxes & other sales tax messes: to help you stop the bleeding, minimize liabilities, and regain control over your sales tax situation.

😱 The biggest sales tax risks for YOUR business: to identify your specific vulnerabilities, so you can prioritize compliance efforts and proactively protect your business from audits.

😡 How to eliminate sales tax software: to address the limitations of software and ensure accurate, reliable compliance moving forward.