Never think about sales tax again.

TaxValet eliminates the hassle, stress & risk of sales tax by doing it all for you.

Sales tax is a pain for e-commerce and SaaS companies.

Don't have the time, resources, or expertise to keep up with changing laws, deal with constant compliance headaches, and avoid costly mistakes?

We do.

The problem with sales tax software.

Don’t be fooled by software platforms that claim to put sales tax on auto-pilot. They just automate filing & payments. What about everything else?

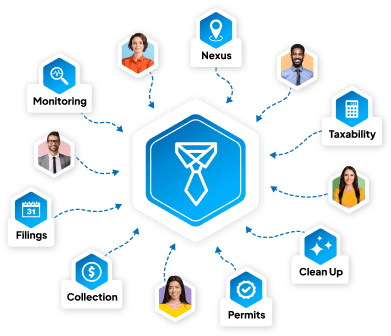

The complete sales tax solution.

With 360º Sales Tax Compliance, you’ll never even think about sales tax—past, present, or future. We’ve got it covered. All of it.

“Dealing with sales tax sucks ... but I can't imagine how they could have possibly made it any easier.”

Andrew Wilder

NerdPress“TaxValet is a one-stop shop for all your sales tax compliance needs.”

Mark Goldman

Formaticum“TaxValet has been a godsend.”

Danny Fein

Litographs“Tax Valet is supremely professional and has a true proven process that is evident in everything they do.”

Doug Striker

Savvy Training & Consulting Inc.“I've always found TaxValet to be efficient, informed, trustworthy, prompt, & a pleasure to work with.”

Ocean Robbins

Food Revolution Network“I can now sleep at night knowing that my taxes are up to date and being handled by an amazing team!”

Lisa Blourock

5StrandsThe TaxValet Guarantee

We stand behind our promise to take sales tax completely off your hands.

White glove support.

Whenever you have sales tax questions, you can call, text, e-mail or set up a meeting with your dedicated sales tax team.

360° Audit Protection.

TaxValet not only manages the entire sales tax audit process for you. We'll also take care of any penalties, interest, and tax due. (See agreement for details)

Unlimited transactions.

Unlike competitors, we won’t charge you extra for more transactions. We charge a flat rate to handle all your sales tax work.

See what all the fuss is about.

Hundreds of businesses just like yours have complete peace of mind knowing their sales tax is always done. And done right.

Trusted by:

Ready to take sales tax off your

to-do list for good?

Here are 3 easy ways to get started now:

Find answers

Visit our library of free sales tax resources for expert advice & quick answers.

Talk to an expert

Schedule a call to find out how to make all your sales tax worries go away for good.