Short Summary: The Kentucky Department of Revenue recently threatened e-commerce sellers by issuing letters indicating that they will forcibly register the business for a sales tax permit if they do not respond to the letter.

What the Kentucky Shakedown Letter Says

The Kentucky Department of Revenue recently threatened e-commerce sellers in a letter indicating that they will forcibly register the business for a sales tax permit if they do not respond. The letter requests that merchants either confirm or deny (in writing) that their business has crossed Kentucky’s economic nexus thresholds. If the merchant does not reply to the letter, Kentucky claims they will open up a sales tax permit account on their behalf.

This is important because once a sales tax account is created, assessments, penalties, and interest can be levied against the merchant. If assessments are ignored, funds can then be pulled directly from the business’s bank account.

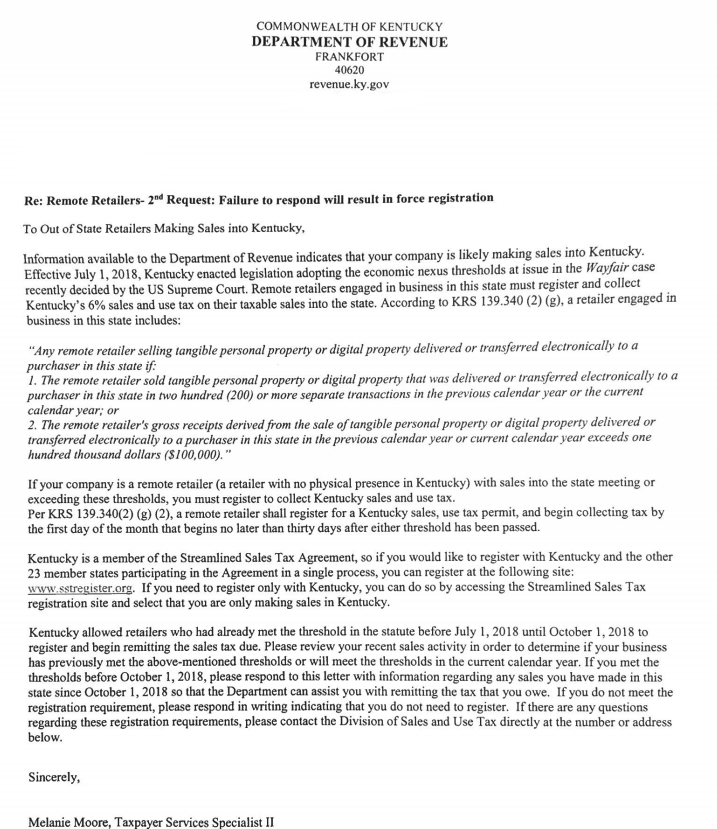

Here is a copy of the shakedown letter from the Kentucky Department of Revenue.

Avoiding the Perjury Trap

If you have sales tax nexus in Kentucky, the last thing you should do is respond to this letter indicating that you do not have nexus. If you knowingly lie to Kentucky, you could be subject to a Class D felony. If charged and convicted, expect a minimum of 1-year in prison.

To make matters worse, we don’t know where Kentucky is getting this information from. It could be possible that they acquired transaction data from third-party marketplaces. Or it could be possible that they are bluffing and simply searching for business contact information from the internet.

One thing is for sure, if they do have transaction information proving you have economic nexus in their state, they will use that information against you if you show intent to evade.

What If You Have Sales Tax Nexus?

The first thing you should do is determine what your historical exposure is so you can plan to pay it back. Our team can help you determine what back sales tax you owe (if any) and help you apply for a payment plan with the state.

If you’re interested in having us eliminate the stress of sales tax for you, check out our Done-for-You Sales Tax Service.

Get in Touch

Company

Disclaimer: Nothing on this page should be considered tax or legal advice. Information provided on this page is general in nature and is provided without warranty.

Copyright TaxValet 2023 | Privacy Policy | Site Map

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.