Quick Answer: In this blog, you will learn how to register for a sales tax permit in California. The registration process is best completed online via the California Department of Tax and Fee Administration. More detailed information is included below.

Registration Fee: The sales tax permit registration fee in California is free.

Renewal Required?: Sales tax permit renewal is not required in California.

Turnaround Time: In California, it takes around 2 weeks to process your sales tax permit application.

Do You Need to Get a Sales Tax Permit in California?

The first step in registering for a sales tax permit is determining if you even need one. In general, you need a sales tax permit in California if you have a physical presence or meet economic nexus requirements. For more detailed information on the necessity of getting a permit, you can learn more at our blog post “Do I Need to Get a Sales Tax Permit in California?”.

If you are not sure where you should get sales tax permits, we can help determine that for you with our Done-for-You Sales Tax Service.

Once you’re sure you need a sales tax permit in California, you can proceed with registering.

For a comprehensive overview of California sales tax, including the latest rules and regulations, visit our California Sales Tax Guide. This resource provides all the information you need to ensure compliance and understand your tax obligations in the state.

Types of Sales Tax Permits Available

California offers a Seller’s Permit for businesses selling items or goods into the state.

How much does a sales tax permit in California cost? There is no fee to register for a Seller’s Permit with the state of California.

Where to Go If You Need Help Registering for a Sales Tax Permit

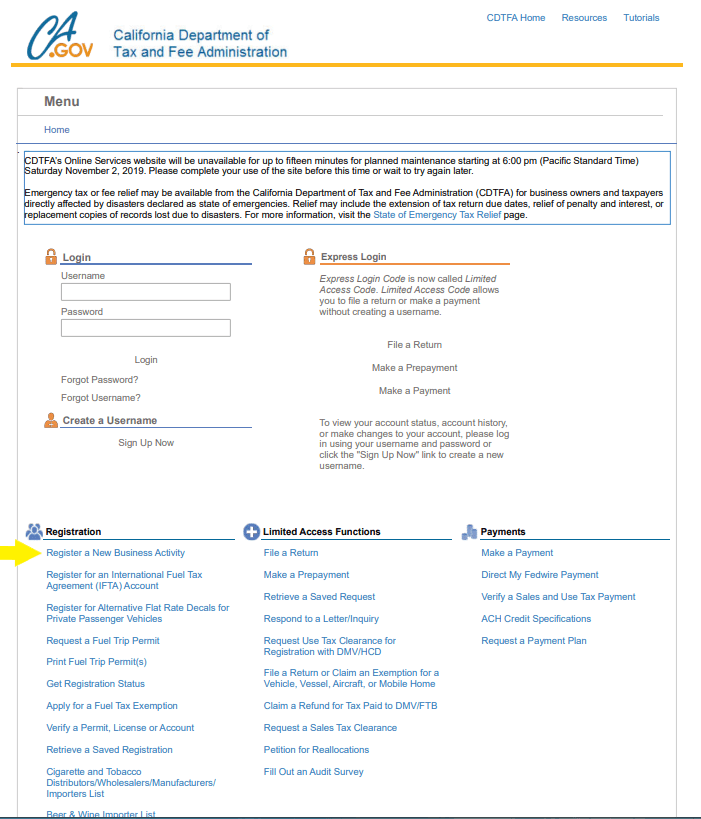

You can register for a California Seller’s Permit online with the California Department of Tax and Fee Administration.

How to contact the California Department of Tax and Fee Administration (CDTFA) if you have questions: You can contact the CDTFA by calling 1 (800) 400-7115, Monday through Friday (except state holidays), 8:00 am to 5:00 pm pacific time.

How to contact TaxValet if you want someone to handle your permit registration for you: You can learn more about our sales tax permit registration service by clicking here.

Information Needed to Register for a Sales Tax Permit in California

Before you begin the process of registering with the state, make sure you have access to the following information:

- Your Social Security number(s)

- Your driver’s license(s) or state identification number(s). Other forms of acceptable ID include a US Passport, US military ID, Visa (E-2) or Consular Identification Card.

- Business and contact email address

- Federal Employer Identification Number (FEIN)

- State Employer Identification Number (SEIN), if applicable

- For corporations: corporate name, corporate number, states, and date incorporated. Sometimes California requests a copy of your Articles of Incorporation or Organization.

- Name, address, and phone number of partner(s), corporate officer(s), member(s), or manager(s).

- Name(s) and phone number(s) of personal references

- Name(s) and address(es) of supplier(s)

- North American Industry Classification System (NAICS) number

- Standard Industrial Classification (SIC)

- Bank Information (name and address).

- Name and account number of your merchant credit card processor (if you have one)

- Name, address and phone number of the person(s) who maintains the books and records.

To get started, choose the link titled “Register a New Business Activity” on the website.

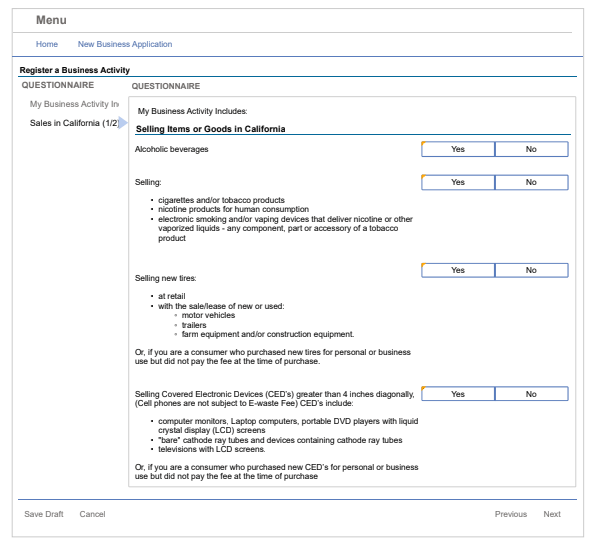

Select your business activity and then choose “next”. Follow the prompts that walk you through the process of registering with the state of California.

It is helpful to make a note of the filing frequency listed in the registration process before you submit your permit application.

It is very important to note your confirmation number after you submit your permit application because you will need to use that number to access your online account and Seller’s permit.

What Happens After You Apply for a Sales Tax Permit in California?

Keep in mind, once you have an active sales tax permit in California, you will need to begin filing sales tax returns. Our team can handle your sales tax returns for you with our Done-for-You Sales Tax Service. You can also learn more about how to file and pay a sales tax return in California by clicking here.

If the state of California needs additional information or documents in order to register you for your Seller’s Permit, they will contact you through the email you provided when registering. It is common for them to request additional documentation such as the business’s Articles of Incorporation or Organization.

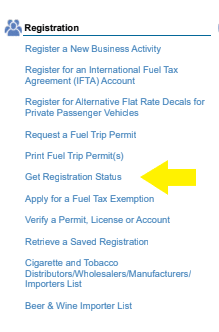

Once your permit has been approved, you can access your permit by clicking the link “Get Registration Status”. Enter your email and the confirmation code you saved. This will provide you with a screen that will list your account number and a limited access code. Do make a note of those numbers because you will need them to gain online access.

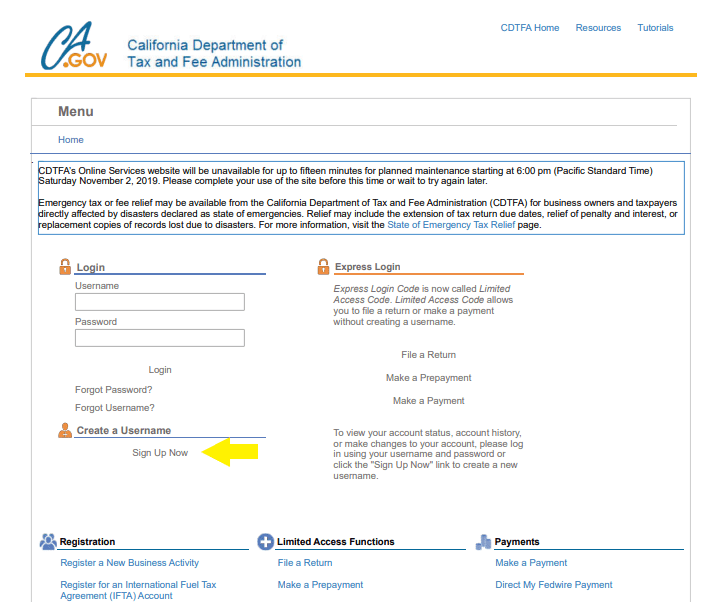

At this point, go back to the home screen and select “Sign Up Now,” listed under “Create a Username."

Follow the prompts until you get to the screen that says “Have you received a letter in the mail with a security code?“

Answer the question. If you select “NO” then the state of California will generate a security code via letter for you.

If you select “YES” (after you receive the code in the mail), then you will enter the information that California is requesting.

There are two places where you can access your Seller’s Permit for printing. First, you can print your Seller’s Permit from your account page once your login has been created. Second, you can print your Seller’s Permit from the same page where you retrieved your account number and limited access code.

California does not require you to renew your permit. However, if you change your location you need to contact the CTDFA to close the existing location and open a new location.

A Note About California E-Waste

If you sell electronic devices greater then four inches, you could be subject to an E-Waste fee with the state of California. This will be a question asked in the permit fee application.

If at any point you are stuck and want a team of experts to handle all of this for you, don’t hesitate to contact us.

More from TaxValet:

How to File and Pay Sales Tax in California

by Christine Pope

Do You Need to Get a Sales Tax Permit in California?

by Jenniffer Oxford

Get in Touch

Company

Disclaimer: Nothing on this page should be considered tax or legal advice. Information provided on this page is general in nature and is provided without warranty.

Copyright TaxValet 2023 | Privacy Policy | Site Map

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.