Quick Answer: Wyoming offers a few different types of sales tax returns. This blog gives instructions for filing and paying sales tax in Wyoming using the Form 41-1, Sales & Use Tax Return for licensed vendors (monthly and quarterly), a return commonly used by out-of-state sellers.

Do You Need to File a Wyoming Sales Tax Return?

Once you have an active sales tax permit in Wyoming, you will need to begin filing sales tax returns. Not sure if you need a sales tax permit in Wyoming? No problem. Check out our blog, Do You Need to Get a Sales Tax Permit in Wyoming?

Also, If you would rather ask someone else to handle your Wyoming filings, our team at TaxValet can handle that for you with our Done-for-You Sales Tax Service. We specialize in eliminating the stress and hassle of sales tax.

How to Sign-in and File a Return on Wyoming’s Website

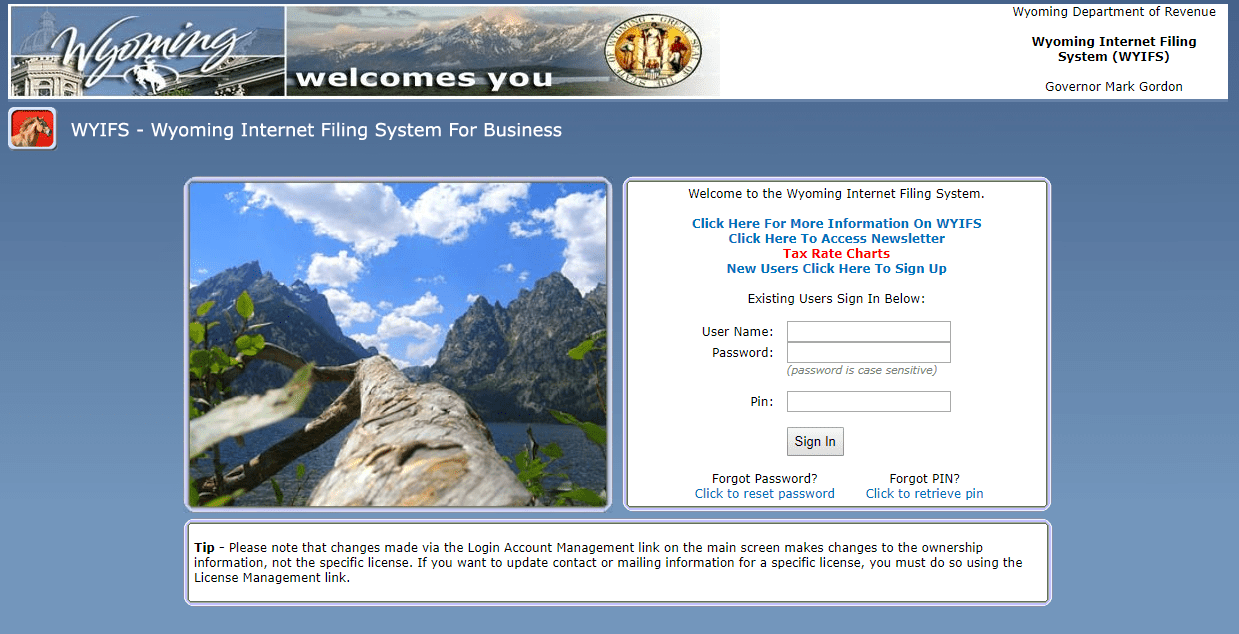

The first step in filing your Wyoming sales tax return is to log in here.

If you do not have a username, password, and PIN number, you need to click on “New Users Click Here To Sign Up” and then follow the instructions for signing up.

If you are not interested in doing the work of getting the permit or a state login yourself, TaxValet can handle that for you with our Sales Tax Permit Registration Service.

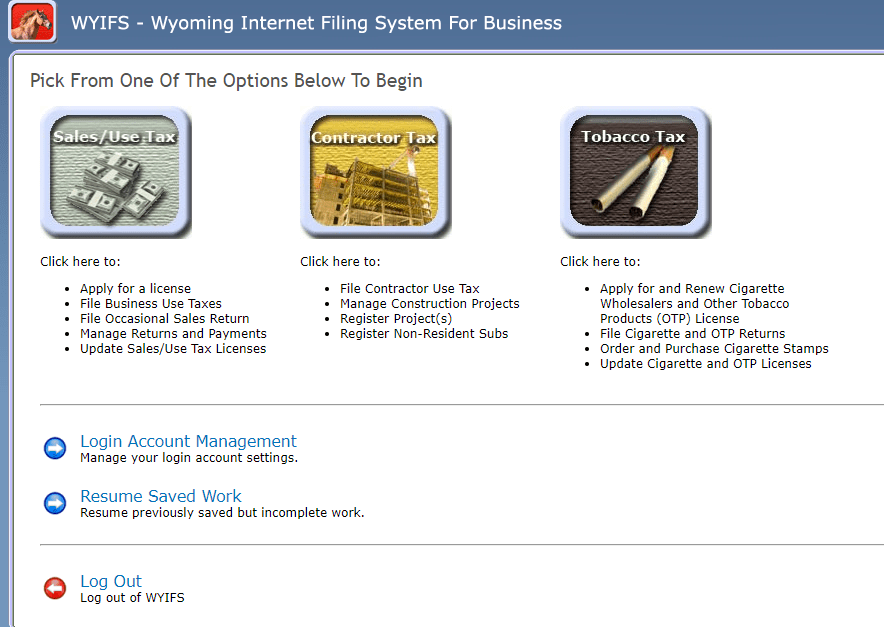

You should now see a screen like this:

Step 1: Click on Sales/Use Tax (top left button). You should now see your business name and account number.

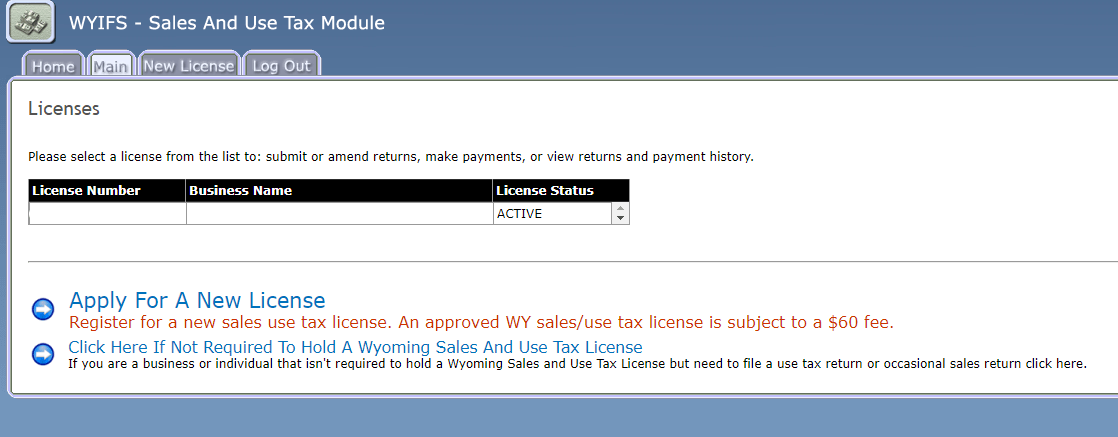

Step 2: Choose and click on the return you would like to file.

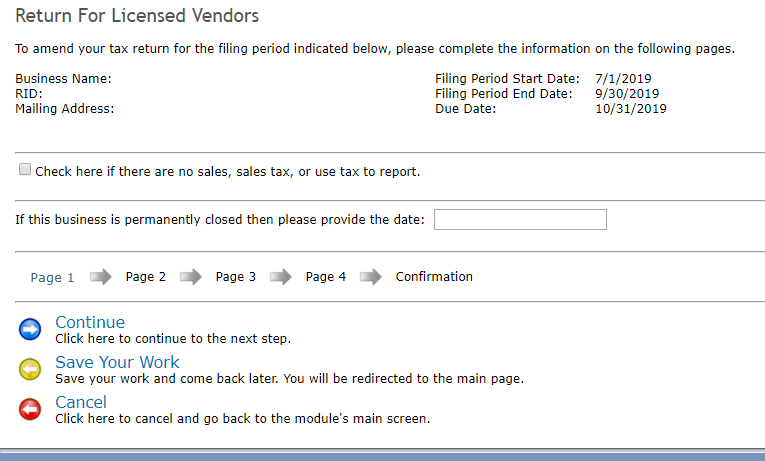

Step 3: Now you will start answering various questions and entering your sales data. If you didn’t have sales this filing period to report and/or your business closed and this is your last return, you can check and/or fill out the appropriate box. Once complete with this page, click “Continue.”

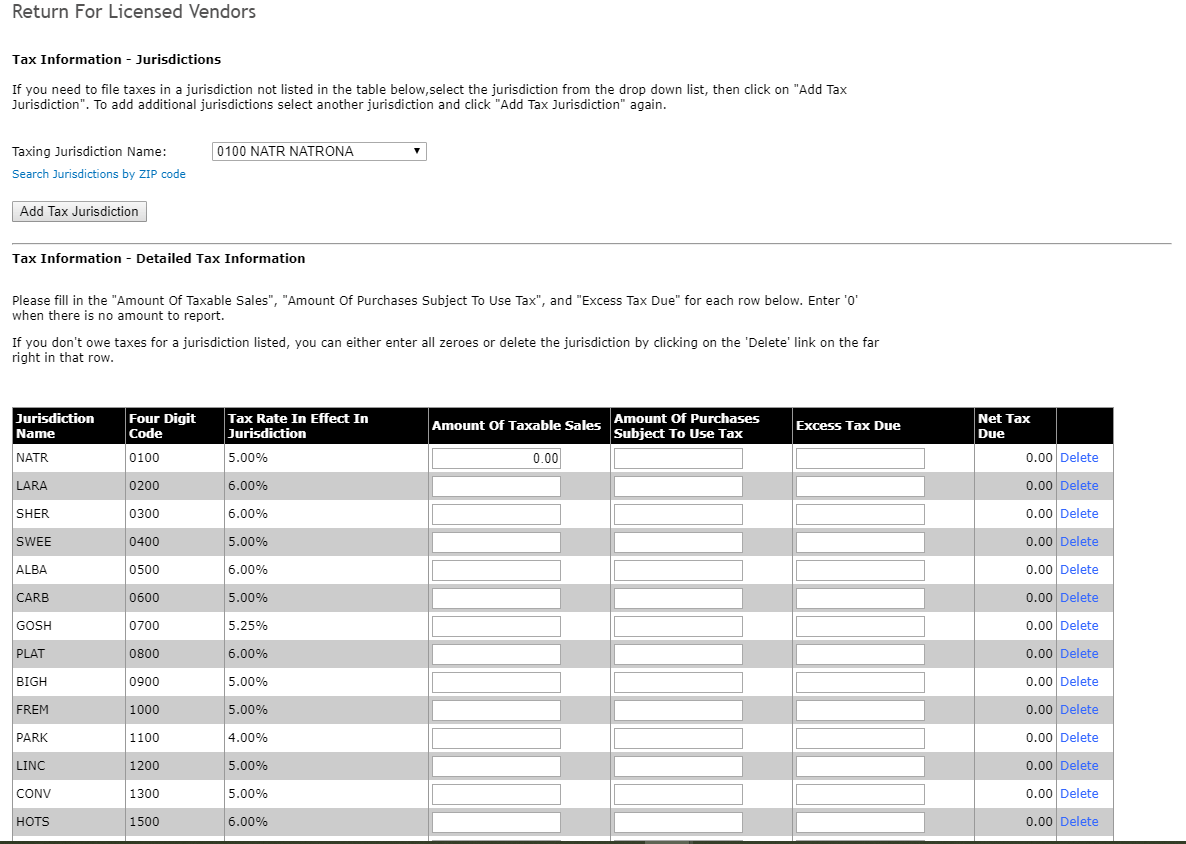

Step 4: Enter the amount of taxable sales, taxable purchases and any excess tax due for each jurisdiction. You may add or delete jurisdictions as needed.

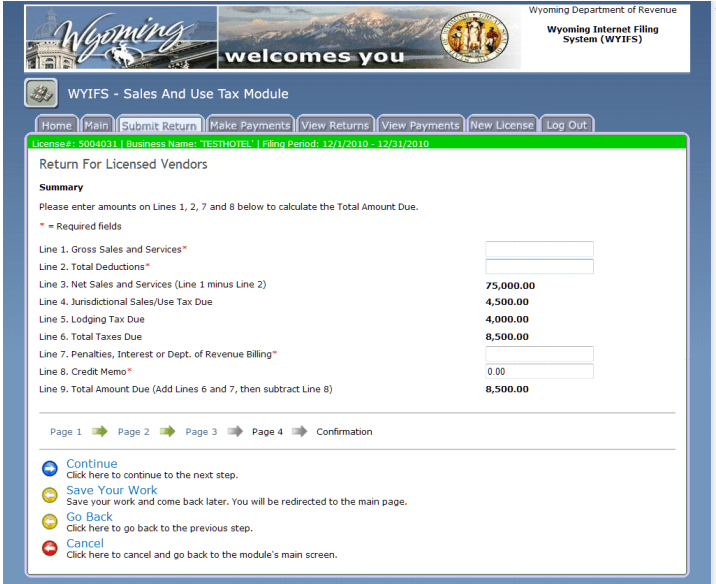

Step 5: Fill out lines 1, 2, 7, and 8 of the form. Line 3 is brought over from the previous page. This information is compared to the result obtained by subtracting line 2 from line 1. Lines 4, 5, and 6 are also brought over from the previous screen. Line 9, “Total Amount Due,” is calculated by adding lines 6 and 7, and then subtracting line 8. Phew. You got this!

Step 6: Provide the submitter’s name, title, phone number, and PIN. Click “Submit the Return.”

Hooray! You have submitted your return! Don’t forget to save or print a copy for your records. You may now make a payment or print a voucher for mailing your payment at a later date.

How to Pay Wyoming’s Sales Tax

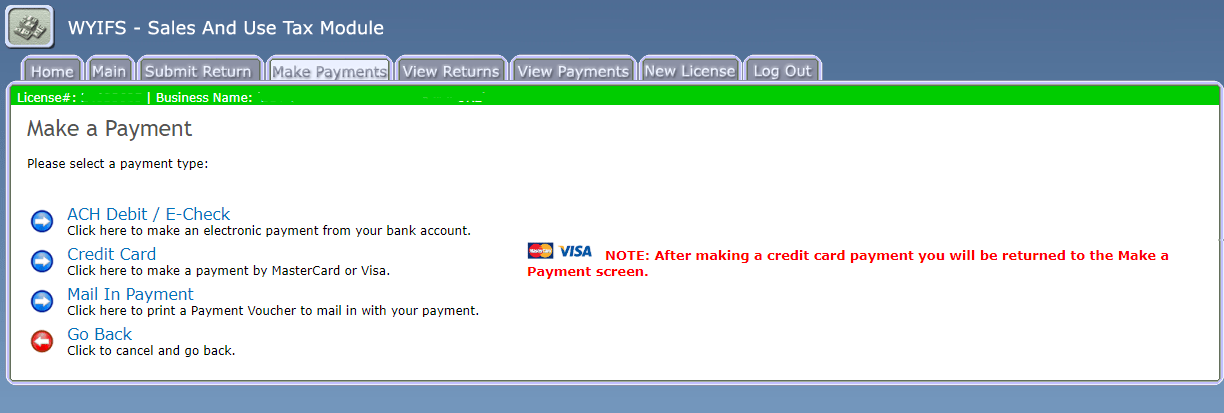

You may make a payment using the “Make Payments” tab on the home page. You can also choose to print a voucher and mail your payment as well. For our example, we are going to make a payment with ACH Debit/E-Check.

All you need to do is select ACH Debit/E-Check and select the type of payment you are making (likely sales/use tax). Enter your payment information and click “Continue.”

Things to Consider After Filing a Sales Tax Return in Wyoming

You can view and print copies of your past returns if you go back to the homepage and click the “View Returns” tab. This is also where you would file an amended return if needed.

How to Get Help Filing a Wyoming Sales Tax Return

Lastly, here is the contact information for the state if case you end up needing help:

Phone: (307) 777-5200

E-mail: dor@wyo.gov

But if you are looking for a team of experts to handle your sales tax returns for you each month, you should check out our Done-for-You Sales Tax Service. Feel free to contact us if you’re interested in becoming a client!

Get in Touch

Company

Disclaimer: Nothing on this page should be considered tax or legal advice. Information provided on this page is general in nature and is provided without warranty.

Copyright TaxValet 2023 | Privacy Policy | Site Map

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.