Summary: Refunding orders without reclaiming sales tax paid to the state could be costing your business a small fortune. This blog details how sales tax for refunded transactions works, and how to avoid overpayment.

Sales Tax Guide for Refunded Orders

As many e-commerce business owners know, dealing with refunds is an unavoidable part of running an online store. However, many entrepreneurs overlook the importance of handling the sales tax implications of refunded transactions correctly. In this comprehensive guide, we’ll dive into the world of sales tax refunds, their impact on your business, and how TaxValet can help you save money (big time!) by ensuring that you address sales tax on refunded orders properly.

Understanding Sales Tax Refunds and Their Importance

When a customer returns a product and requests a refund, you’re not only refunding the item’s cost but also the sales tax you initially collected from them. Usually, you’ll be refunding the sales tax after you’ve already paid it to the state. Accurately managing sales tax refunds is crucial for several reasons:

- Maximize Your Profitability: Failing to manage sales tax refunds correctly can result in an overpayment, which can negatively impact your bottom line. We regularly see businesses overpaying sales tax in the hundreds of thousands of dollars over several years.

- Make Better Financial Planning Decisions: By handling sales tax refunds correctly, you’ll maintain accurate financial records that reflect your actual sales and tax liabilities. This makes it easier to make informed decisions and develop effective strategies for your business. Imagine if your financial data was incorrect and your margin on a product line was reported as 5.1% (the average sales tax rate) lower than it actually was. What if this meant the difference between you thinking the product line was profitable or not?

3. Minimize Audit Headaches: In the event of an audit, authorities will be looking to ensure that the data in your systems match the data you’ve reported. If they don’t, then you’ll be giving them a reason to “dig deeper” to find underlying problems.

The Impact of Ignoring Sales Tax on Refunded Orders

Neglecting to refund sales tax on returned items means that you’re essentially overpaying taxes. This can cause unnecessary financial strain on your business.

Let’s look at an example highlighting the consequences of not considering sales tax for refunds:

Example: Imagine your e-commerce store sold $10 Million last year, and you had $1 Million in refunded orders. Now, suppose you originally collected $51,000 in sales tax on those refunded orders. When you refunded the orders, you also refunded the sales tax that they paid. But by the time you refunded the orders, you already paid the sales tax to the state. In this scenario, you would overpay $51,000 in sales tax!

The worst part about all of this? Sales tax software rarely handles this correctly! This is one great reason why TaxValet is a much better solution for e-commerce business owners.

How much money you could be losing out on is highly dependent on what your total sales are, and your average return rate. Here are the average e-commerce refund rates, broken down by product category:

|

Category |

Average Return Rate |

|

Apparel |

25% |

|

Auto & Parts |

5% |

|

Baby & Toddler |

10% |

|

Books & Media |

8% |

|

Dietary Supplements |

9% |

|

Electronics & Appliances |

11% |

|

Food & Beverages |

4% |

|

Footwear |

25% |

|

Health & Beauty |

10% |

|

Home & Furniture |

20% |

|

Jewelry & Accessories |

5% |

|

Office & School Supplies |

7% |

|

Pet Supplies |

8% |

|

Sports & Outdoors |

15% |

|

Toys, Hobbies, & DIY |

12% |

Addressing Sales Tax Refunds

To ensure your business doesn’t lose money on sales tax, it’s vital to handle refunded transactions correctly. There are two main ways to deal with sales tax refunds:

1. Amended Returns:

Many states want you to file an amended return for the previous taxable period when you issue a sales tax refund. This is hugely cumbersome and expensive, and it could also pose a threat to your business. Why? Because amended returns that force the state to refund you money can trigger a sales tax audit.

The reason the state wants you to submit an amended return (rather than simply file negative transactions in a future period) is because they want to account for the possibility of a sales tax rate changing between when the transaction took place, and when the refund took place.

At TaxValet, we prepare our returns to reconcile based on the tax collected, so we simply don’t have this as a problem to deal with. Instead, we reclaim the tax over time in future period returns (see below).

The worst part about all of this? Sales tax software rarely handles sales tax refunds correctly! This is one great reason why TaxValet is a much better solution for e-commerce business owners.

2. Future Period Returns:

Another option is to create a “negative transaction” for future period sales tax returns. For example, let’s say you refunded $100 in sales tax last month, and this month you collected $1,000 in sales tax. We would prepare your next sales tax return to pay $900. In the event that doing this would result in you owing less than $0 in tax, we would continue rolling these transactions forward to future periods.

The result? You paid the correct amount of tax to the state without filing amended returns (an audit hazard) and you aren’t overpaying sales tax with your hard-earned money!

Most sales tax software will not automatically create negative transactions in future periods for all states! This is one of the reasons why TaxValet is a much better option than sales tax software.

Common Challenges and Solutions for Sales Tax Refunds

Managing sales tax refunds can be challenging for e-commerce business owners. Here are some common issues and their solutions:

Challenge: Having accurate refunded transaction data. Not all sales channels provide the necessary information in order to reclaim sales tax on refunded orders.

Solution: Make sure that you can download a report of all of your refunded orders with all the information that is necessary to reclaim the sales tax. This is where TaxValet’s all-inclusive service comes in handy! We’re e-commerce experts and know the ins-and-outs of pretty much every sales channel.

Challenge: Managing sales tax refunds for multiple states or jurisdictions.

Solution: Invest in a sales service (like TaxValet) that can handle refunded orders in every state. This will save you a TON of money over time.

Challenge: Staying up-to-date with changing sales tax laws and regulations.

Solution: Partner with a sales tax company (like TaxValet!) who can keep you informed of changes and help you navigate complex tax regulations. We review dozens of tax updates every day to examine what new rules have passed (or may pass soon) so we can stay ahead of the curve for our clients. You can schedule a free initial consultation by clicking here.

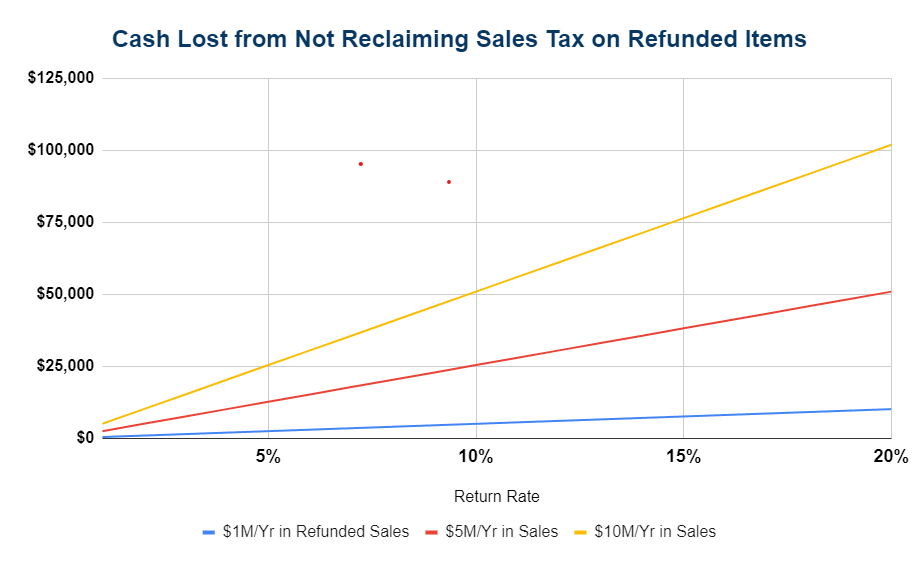

How TaxValet’s Interactive Spreadsheet Can Help You Save Money

Many sales tax software solutions don’t handle refunded orders effectively, which can cost your business a significant amount of money. That’s where TaxValet comes in. Our interactive spreadsheet is designed to help you determine how much money you could be losing if you worked with a sales tax software company that doesn’t manage refunded orders properly.

By using TaxValet’s interactive spreadsheet, you can quickly identify how much money you might be losing due to unaddressed sales tax refunds and make informed decisions about the best solution for your business.

Conclusion

Handling sales tax refunds properly is crucial for e-commerce businesses to maintain accurate financial records, and a healthy bottom line. By understanding the implications of sales tax refunds and using a service provider like TaxValet, you can save your business money and simplify your sales tax management. If you’d like to have a chat with our team of experts regarding how we can take sales tax off your plate forever, consider scheduling a free initial consultation with us.

Get in Touch

Company

Disclaimer: Nothing on this page should be considered tax or legal advice. Information provided on this page is general in nature and is provided without warranty.

Copyright TaxValet 2023 | Privacy Policy | Site Map

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.