Quick Answer: Utah offers a few different types of sales tax returns. This blog gives instructions on how to file and pay sales tax in Utah using the TC-62M Sales & Use Tax Return, a return commonly used by out-of-state sellers.

Do You Need to File a Utah Sales Tax Return?

Once you have an active sales tax permit in Utah, you will need to begin to file and pay sales tax returns. Not sure if you need a permit in Utah? No problem. Check out our blog, Do You Need to Get a Sales Tax Permit in Utah?

Also, If you would rather ask someone else to handle your Utah filings, our team at TaxValet can handle that for you with our Done-for-You Sales Tax Service. We specialize in eliminating the stress and hassle of sales tax.

How to Sign-in and File a Return on Utah’s Website

Special note: Your online session will timeout after 60 minutes of inactivity. Save your work if you will be away from your computer.

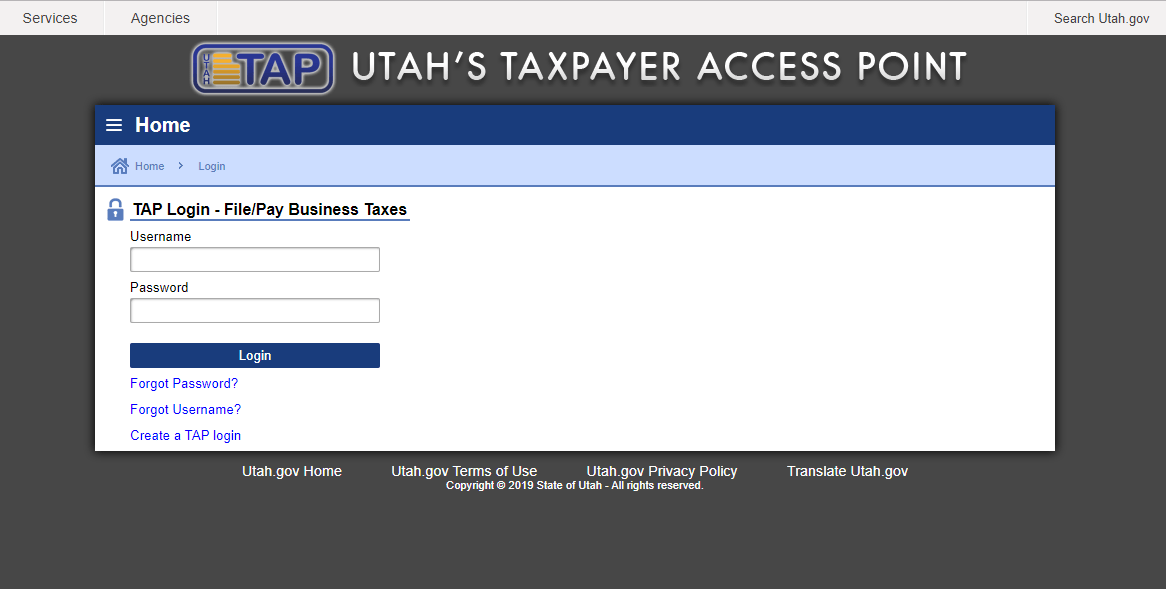

The first step in filing your Utah sales tax return is to log in here.

If you do not have a username and password, you need to click on “Create a TAP login!” and then follow the instructions for signing up. If you are not interested in doing the work of getting the permit or a state login yourself, TaxValet can handle that for you with our Sales Tax Permit Registration Service.

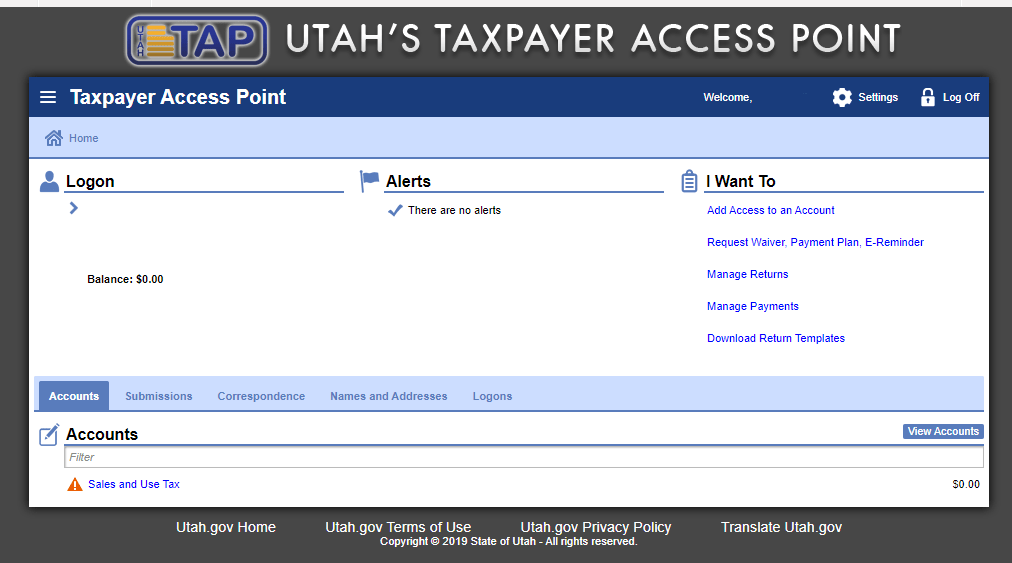

Step 1: You should now be on your homepage. Click on “Sales and Use Tax” to get started.

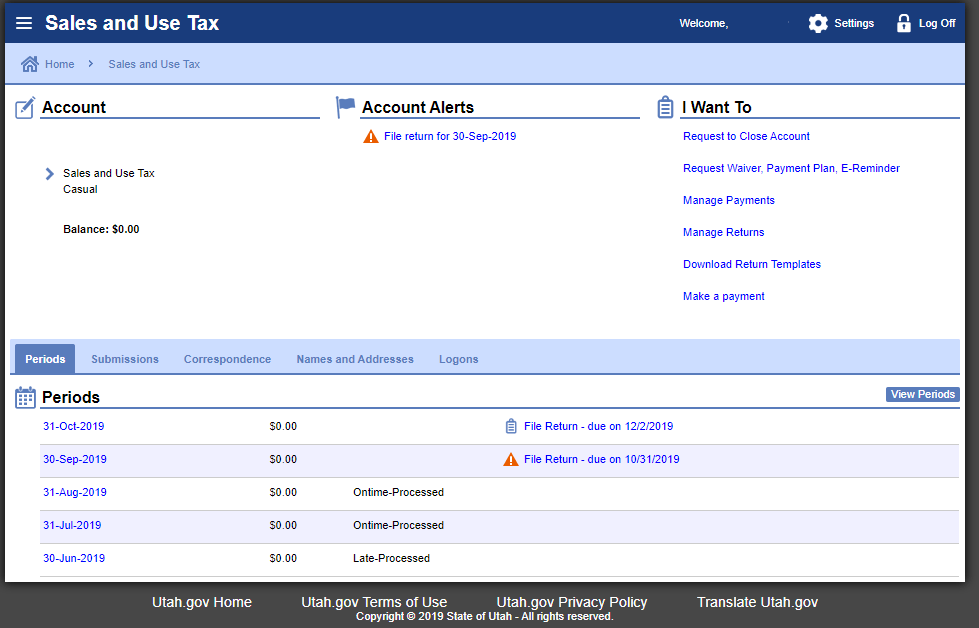

Step 2: Click on the period you want to file. Then click on “Current Attributes.”

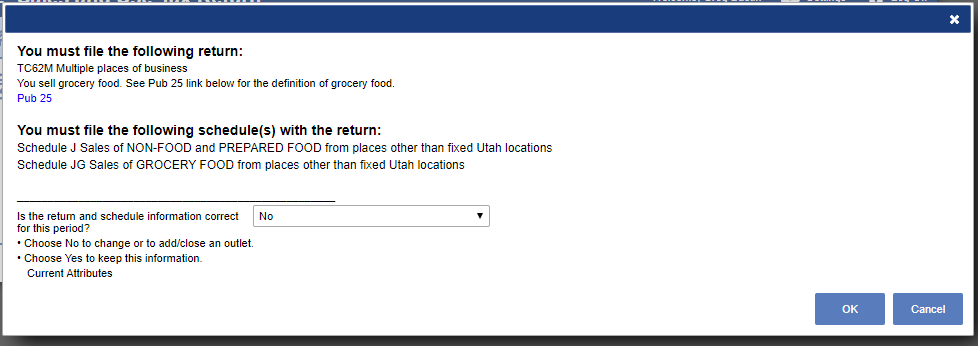

Step 3: Read the next screen and make sure it has the correct return and schedule information. If it does, change to yes and click “OK.” If not, leave the “No” and click “OK” in order to change.

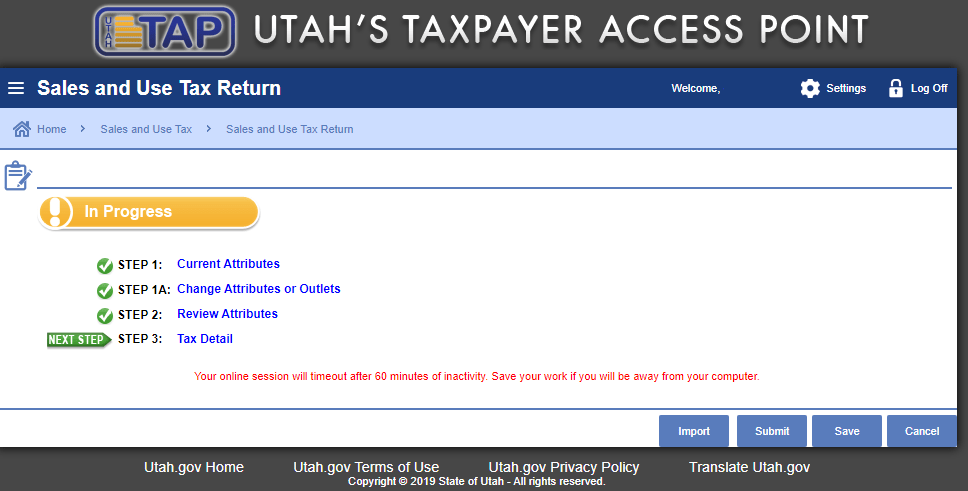

Step 4: You are already at Utah’s third step in the return! Chose “Tax Detail” to move on to the next step.

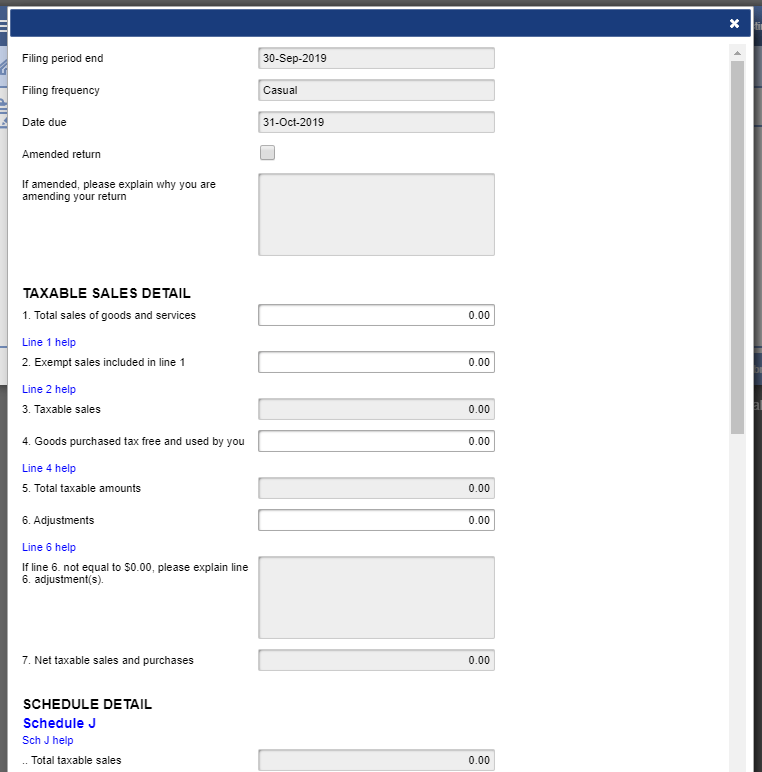

This takes you to the screen where you start entering your data. Enter your gross sales, exempt sales, goods purchased for use, and any adjustments.

Next, click on “Schedule J” to enter your location and net taxable sales. Once you have completed your locations you can move on by clicking “OK.”

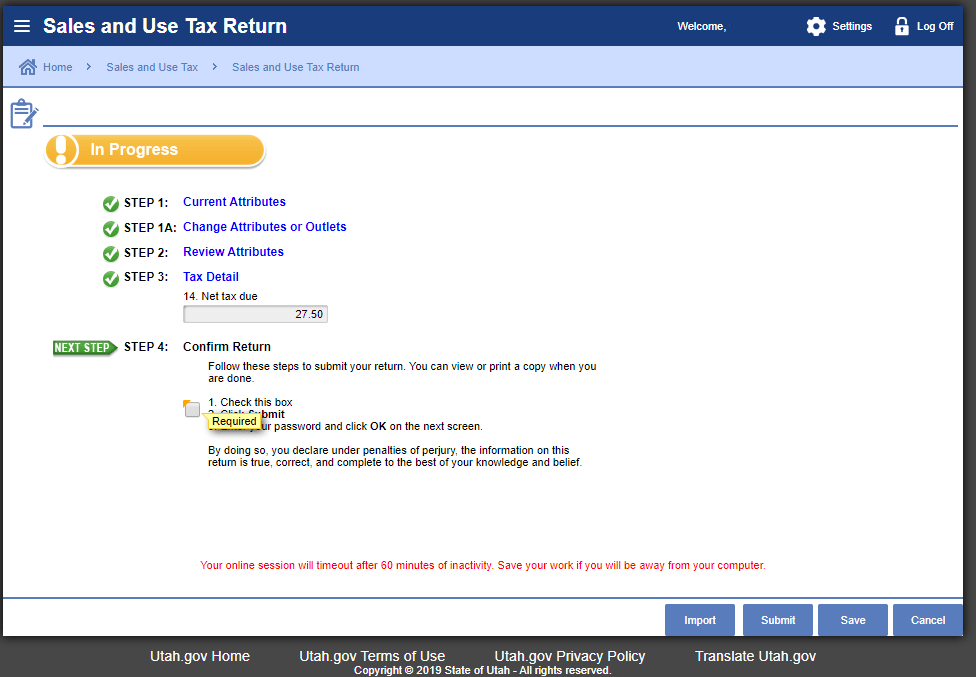

Step 5: You now are ready to confirm your return and submit.

If you need to make any changes click on “Step 3: Tax Detail” and you can make the corrections you need. If the information is correct, click “Submit.” Please note that once you click “Submit” you will not be able to make additional changes.

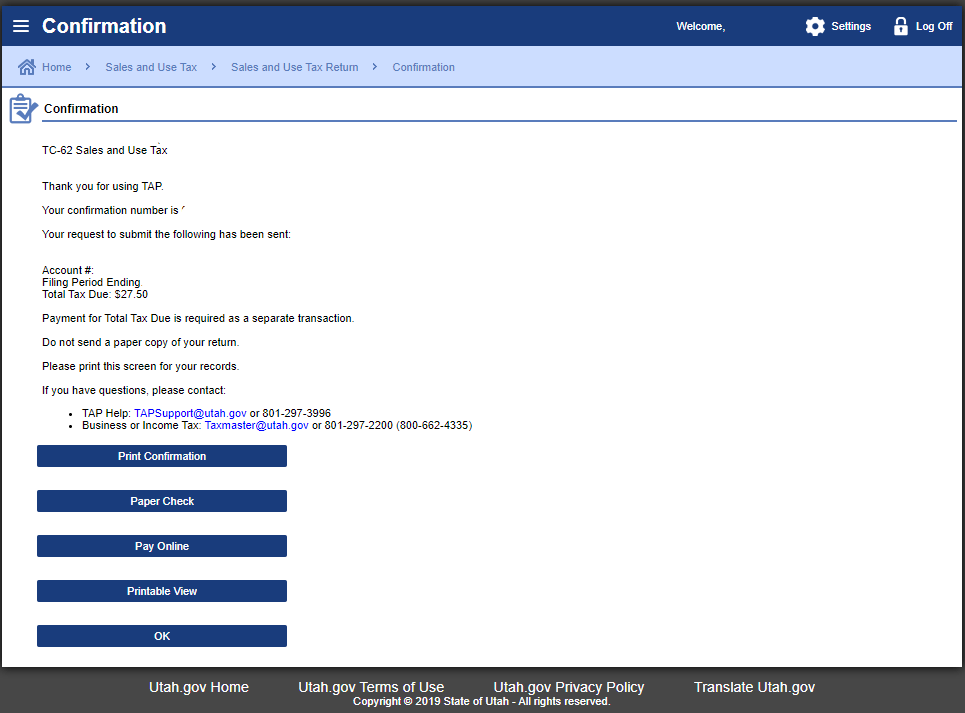

Hooray! You have now filed your return.

Make sure to save the confirmation number that comes up on the screen. We also recommend saving your return for your records.

How to Pay Utah’s Sales Tax

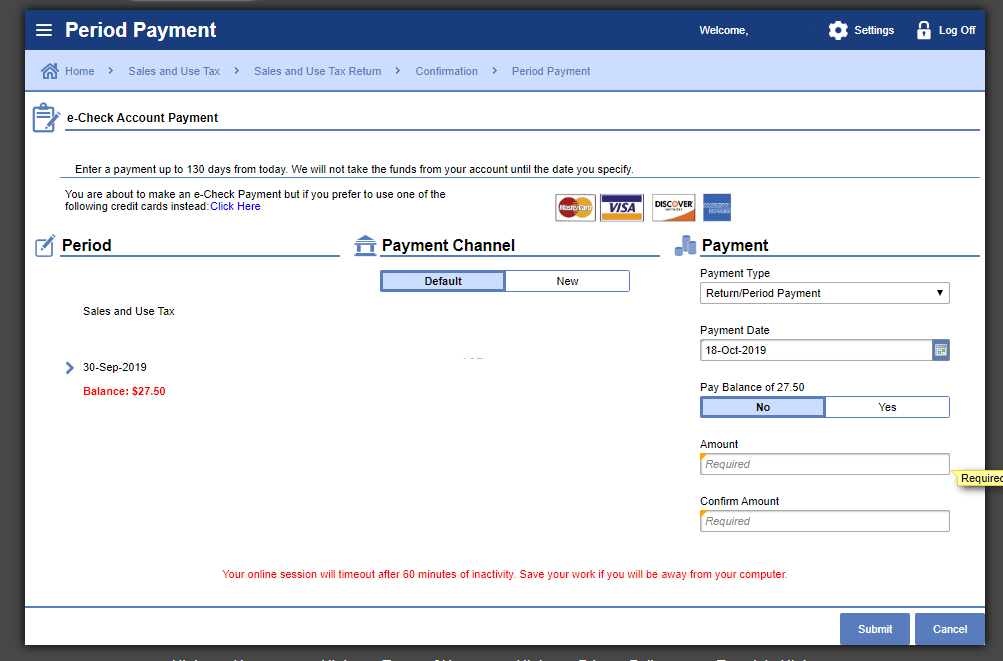

You are now ready to make your payment. On that confirmation page (above) note that you can either select “Pay Online” or “Paper Check” for your payment. In this example, we are going to select online payment.

The first step is to fill out your banking information, the amount you are paying, and the payment date. You are given the option of saving your banking information for next time, too. Once complete, click “Submit.”

You have now made your payment. Don’t forget to save your confirmation number.

Things to Consider After Filing a Sales Tax Return in Utah

If you forgot to print or save a copy of your sales tax return, you still can! Go to your homepage and click on the submissions tab. Easy enough, on the right-hand side you will see “Print Submission.” This will also allow you access to a copy of your return.

How to Get Help Filing a Utah Sales Tax Return

Lastly, here is the contact information for the state if case you end up needing help. You can contact them by telephone at (801) 297-2200 or (800) 662-4335. There is also the option to contact the state of Utah by email at taxmaster@utah.gov.

But if you are looking for a team of experts to handle your sales tax returns for you each month, you should check out our Done-for-You Sales Tax Service. Feel free to contact us if you’re interested in becoming a client!

Receive Important Sales Tax Updates to Your Inbox!

Join our mailing list to receive free updates that could help protect your business from audit.

Get in Touch

Company

Disclaimer: Nothing on this page should be considered tax or legal advice. Information provided on this page is general in nature and is provided without warranty.

Copyright TaxValet 2023 | Privacy Policy | Site Map

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.