Quick Answer: This blog provides instructions on how to file and pay sales tax in Kansas using form CT-9U. This is a form for retailers where the property originates outside of Kansas and is shipped to the state. Two other common forms are ST-36 and CT-10. Form ST-36 is typically for sales that both originate and are delivered in the state of Kansas. Form CT-10 a form for taxable purchases where the retailer did not charge tax.

Do You Need to File a Kansas Sales Tax Return?

Once you have an active sales tax permit in Kansas you will need to begin filing sales tax returns. Not sure if you need a permit in Kansas? No problem. Check out our blog, Do You Need to Get a Sales Tax Permit in Kansas?

Also, If you would rather ask someone else to handle your Kansas filings, our team at TaxValet can handle that for you with our Done-for-You Sales Tax Service. We specialize in eliminating the stress and hassle of sales tax.

How to Sign in and File a Return on Kansas’s Website

Let’s start with simple, step-by-step instructions for logging on to the website in order to file and pay your sales tax return in Kansas.

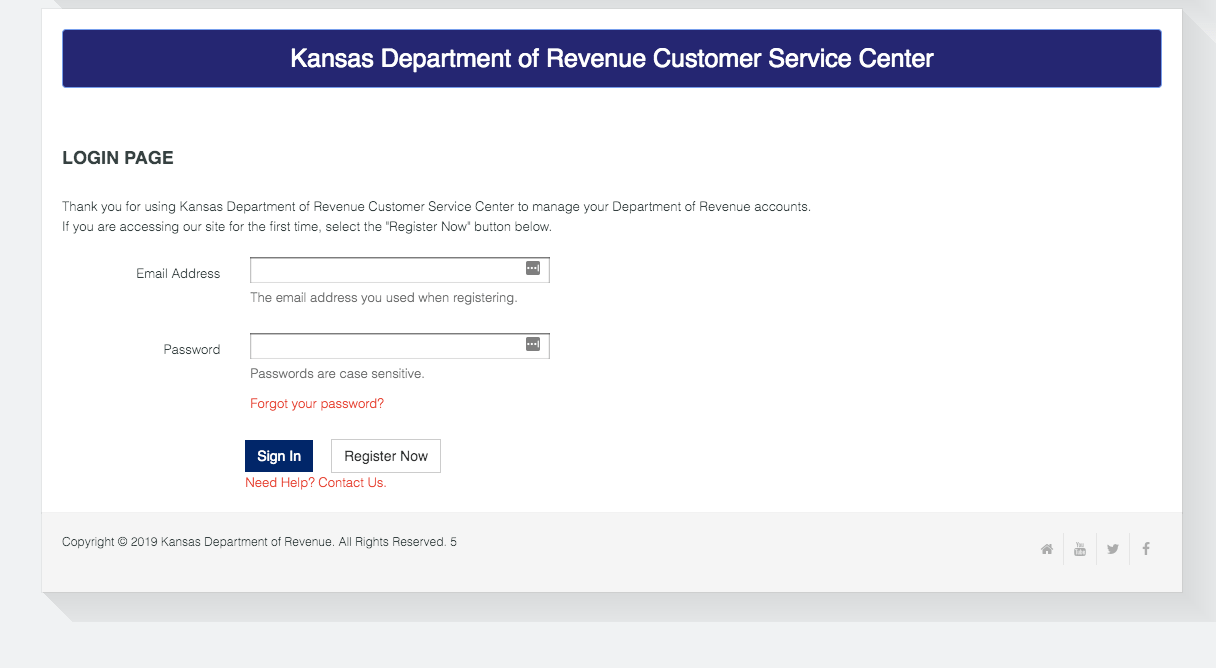

Step 1: Follow this link, https://www.kdor.ks.gov/Apps/kcsc/Login.aspx, to come to this screen:

Step 2: Sign in with your username and password.

If you do not have a username and password, then your first step is getting that all setup. These login credentials are generally created after you submit registration paperwork for a sales tax permit.

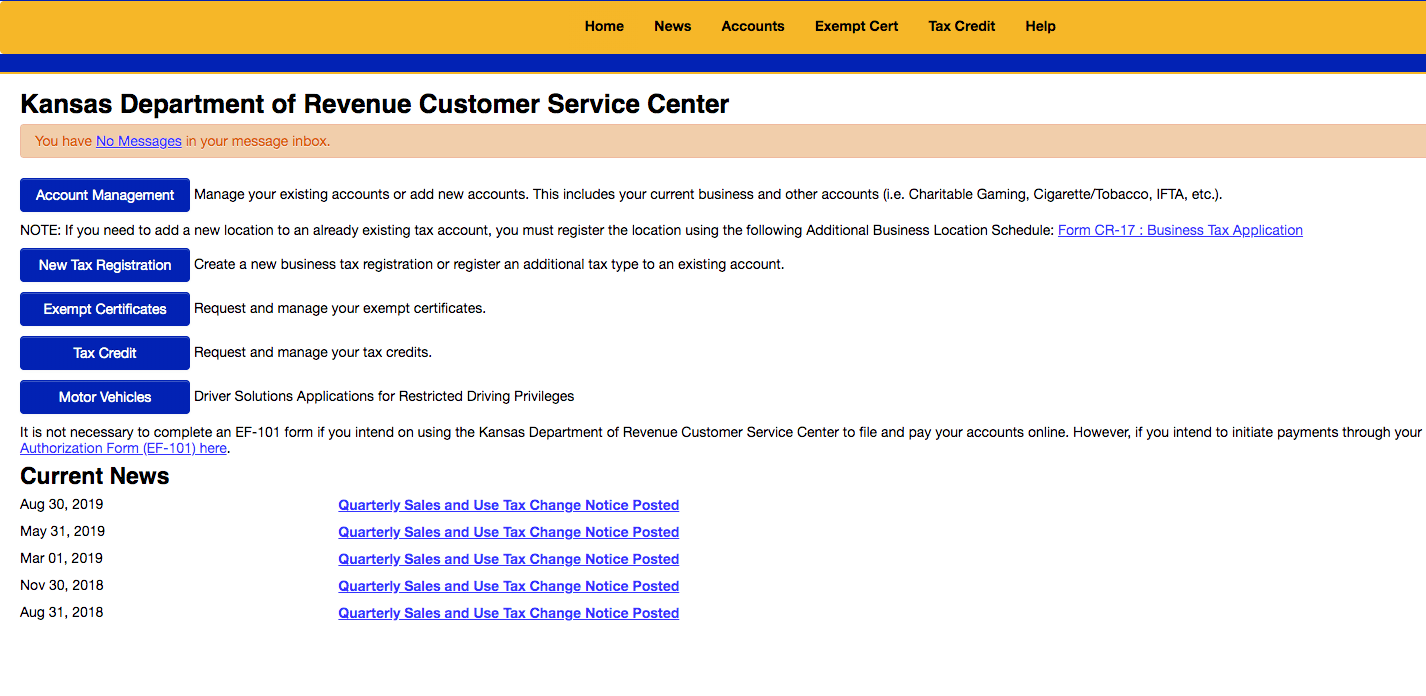

Step 3: You will be directed to the dashboard for the state.

On the Kansas portal, the yellow banner at the top is the best way to navigate around. Take a minute here to click through these tabs and familiarize yourself with them. You can see any news that you need to be aware of under the “News” tab. Also notice the “You have No Messages in your inbox” banner that is near the top of the screen. If this notice tells you that you have any messages, be sure to read them before continuing.

Once you feel that you have a good understanding of the dashboard, proceed by selecting the “Account” tab in the yellow banner. You should see an account here that you have previously set up in the registration process. If you do not see that, you might want to reference our “How to Register for a Sales Tax Permit in Kansas” blog to be sure that you have everything set up properly.

Click the account number related to the account that you wish to file a return for. Proceed to the next step.

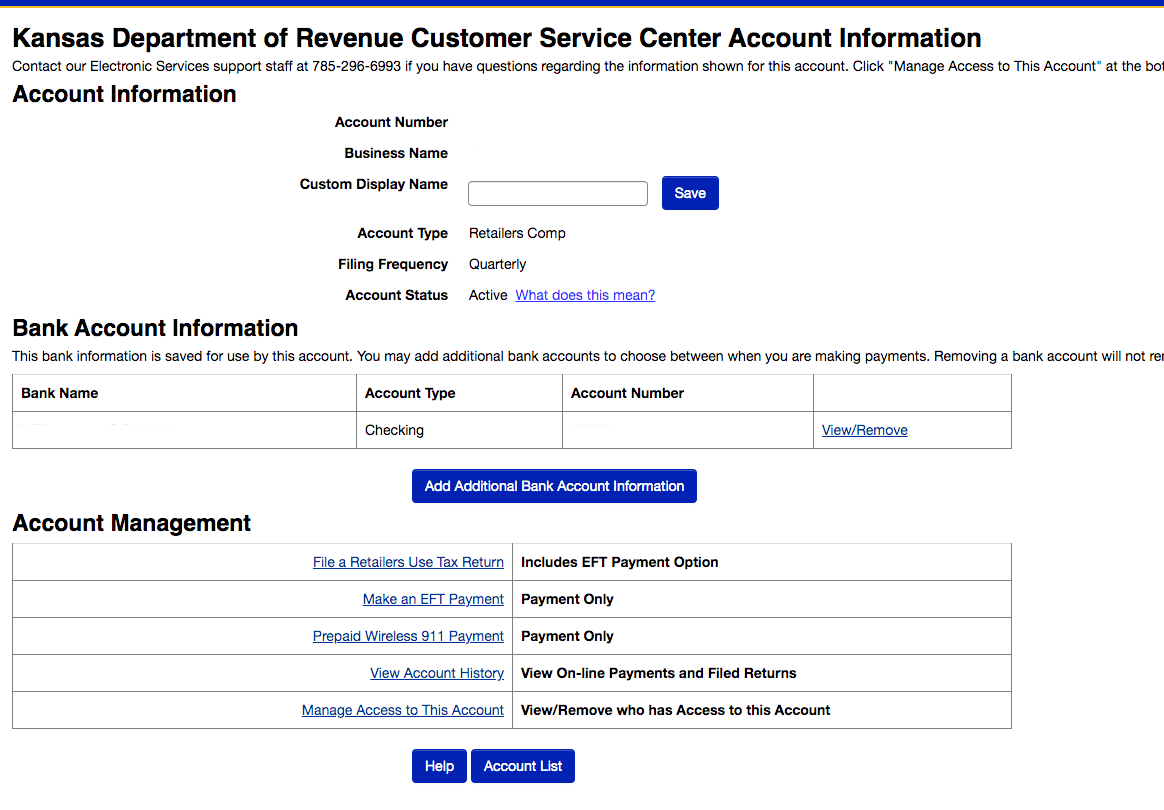

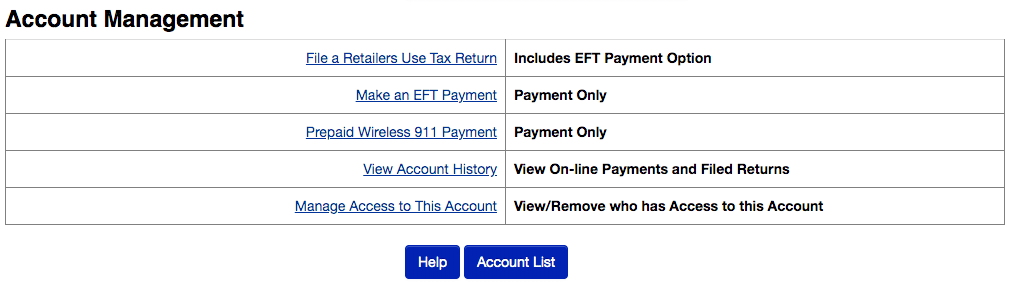

Step 4: You will be directed to this page.

On this page you should do a few things. The first would be to verify that the business name at the top of the page is correct. Next, verify that the bank information is accurate in the middle of the page. If you do not have see any bank information and you wish to pay electronically, you will need to add your bank information here.

Now that you have verified everything, click the “File a Retailers Use Tax Return” link.

After you click this link, you may see a message before you are ready to enter sales data. If you see a message alert, be sure to read it. This message will be something that you must read in order to ensure sure that your return is filed properly.

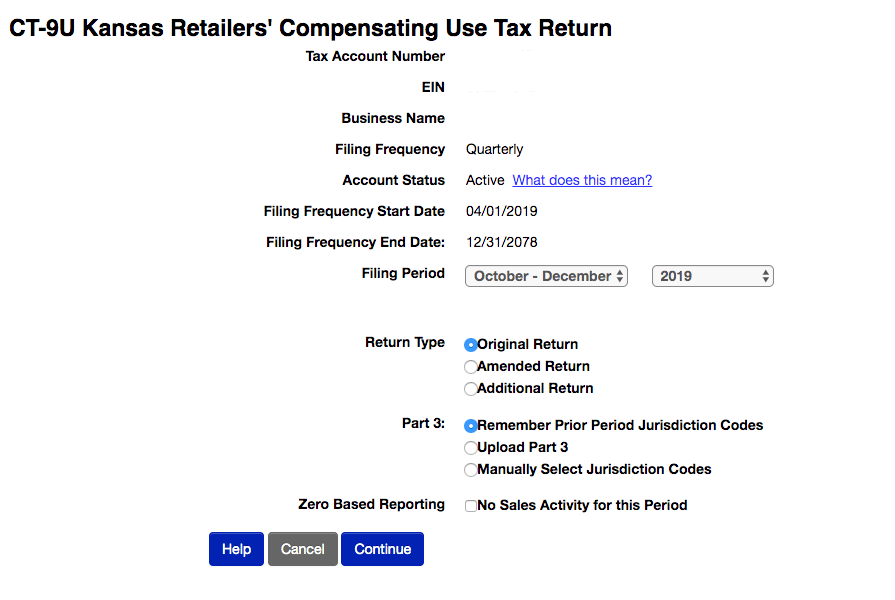

You will now see this page.

Be sure to select the appropriate filing period, return type, and whether or not you would like to manually enter the jurisdiction codes or upload your data. (Hint: If you are manually entering your data, it may be easiest to manually select jurisdiction codes depending on how consistently you sell to the same locations.)

Step 5: Key in Sales Data

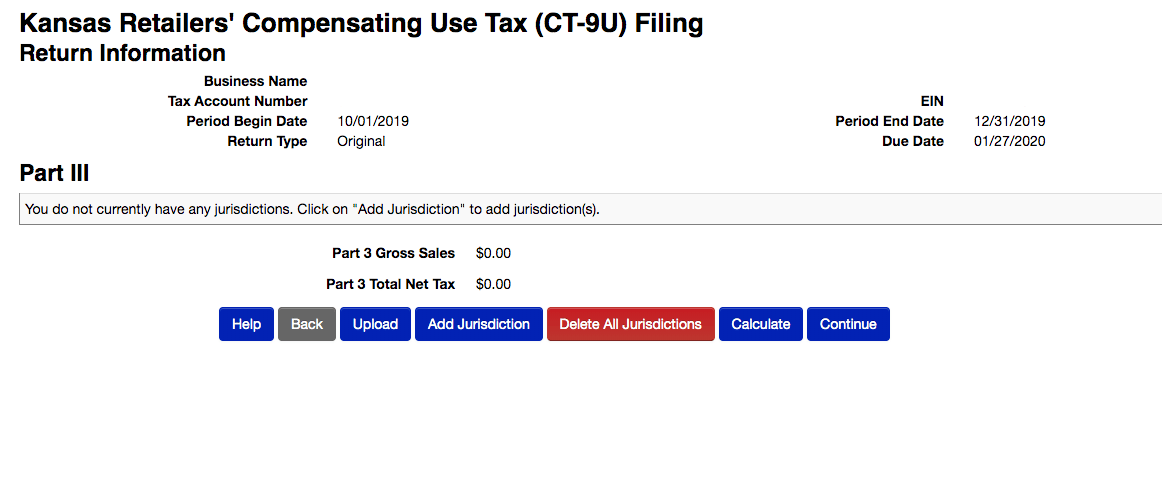

You are now faced with a screen that looks something like this:

I selected the “Manually Select Jurisdiction Codes” option. I find it easiest to first add your jurisdictions. So select “Add Jurisdictions.”

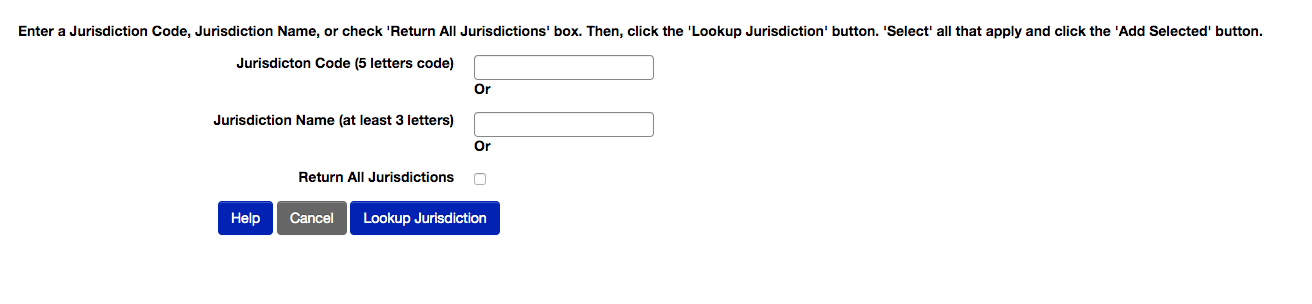

Now add the jurisdiction code and press enter. You will see the jurisdiction below. Check the box and click “Add Selected”.

At this point, you need to go through and add each jurisdiction in which you made sales. This is the most time-consuming part of the return.

After you have added each jurisdiction, you now need to go back through and add the gross sales and deductions for each. I find it easiest to tab through the boxes to enter in the data. Once you have all of the data entered you can select the “Calculate” button at the bottom. Double check the tax due and total gross sales against what is in your system to ensure proper data entry. Now select “Continue”.

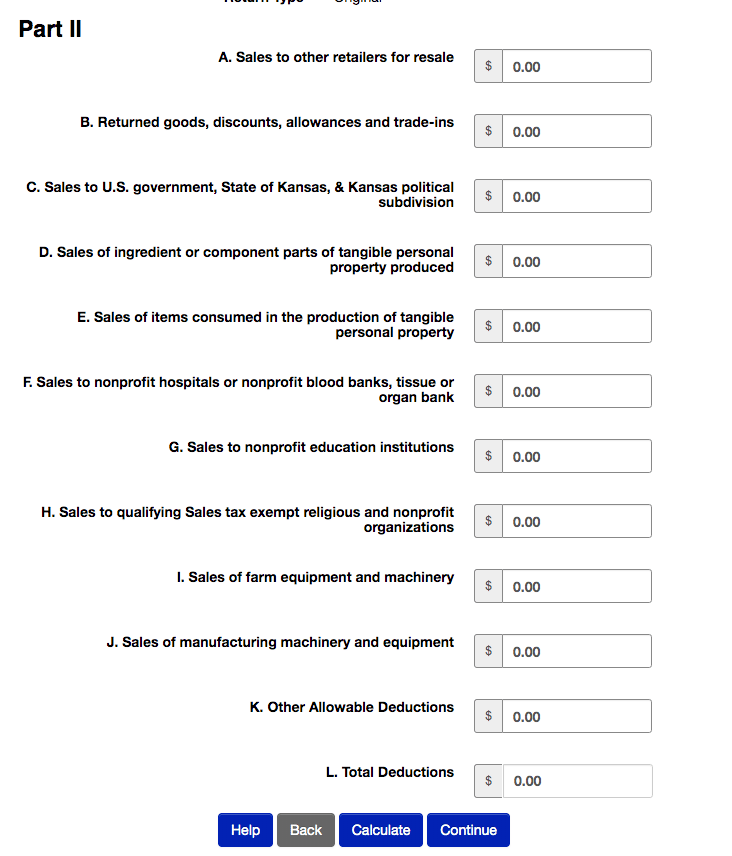

You will now see Part II.

You may not have any information to enter on this page. However, be sure that you read and carefully consider each line. After you are finished with this, select “Continue”.

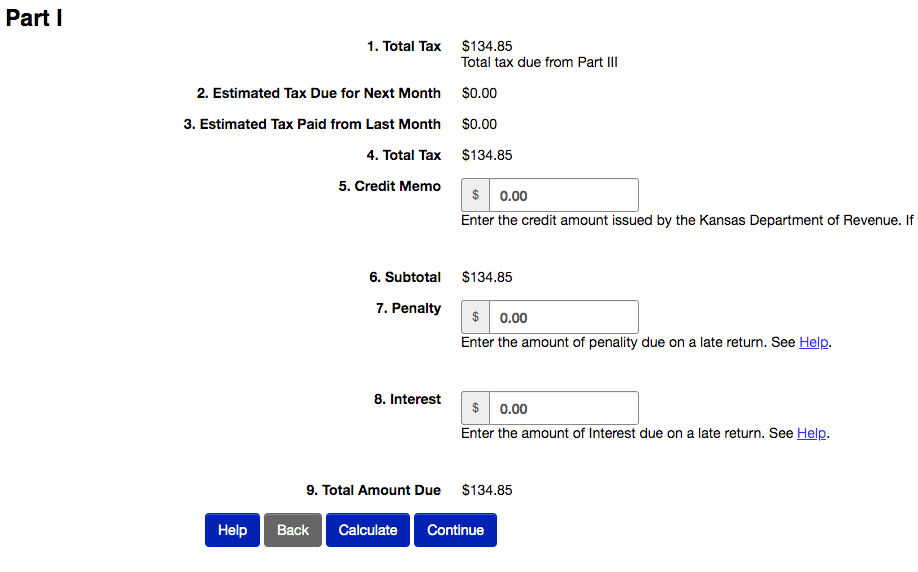

The next page will be a summary page. If you have a credit for overpayment, put that in line 5. If you are filing this return on time you will not have any penalty and interest. If this return is late, select the “Help” link to determine how much penalty and interest is due. Select “Continue”.

At this point you are finished with the data entry of the return, and we will move on to payment options. That wasn’t so bad, right?

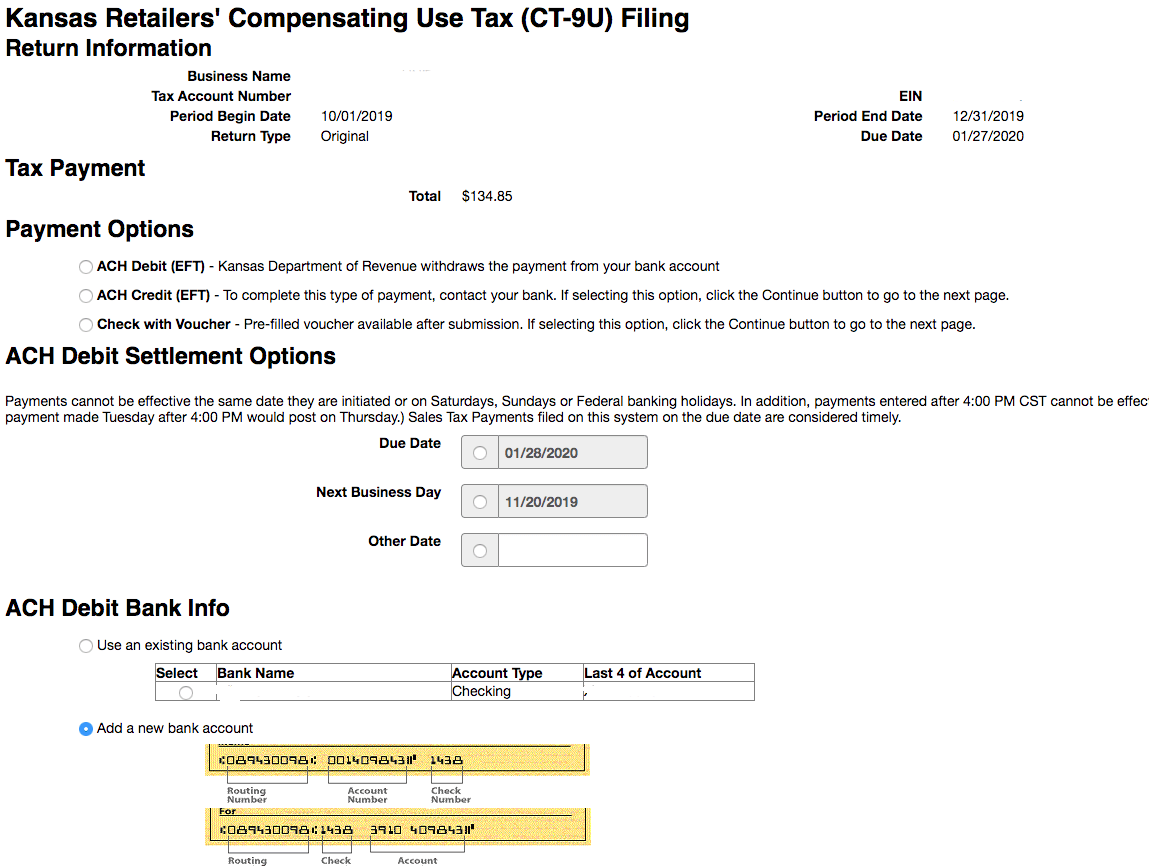

How to Pay Kansas’s Sales Tax

If you wish to pay your sales tax due while submitting the sales tax return, select that option on this page. Remember, this is still the page before you have submitted anything. Kansas gives you the option of submitting both the payment and the return at the same time.

If you previously entered your bank information, you should see that as a selection option. At this point, be sure to select the appropriate payment date. The payment date should be scheduled at least by the due date of the return. Nobody likes late fees!

Once you are sure that everything is entered correctly, hit “Continue” and finish submitting the return and payment.

Things to Consider After Filing a Sales Tax Return in Kansas

If you forgot to print or save a copy of your sales tax return, you’re in luck. You can easily go back into the period to view and/or print the return that you just filed. Go back to the dashboard and select the “Accounts” link in the yellow banner. Select the account number. Now at the bottom, select “View Account History”.

Select “View” off to the left of the return that you wish to print. Now select “Print” at the bottom of the screen to print the return.

How to Get Help Filing a Kansas Sales Tax Return

If you are stuck or have questions, you can contact the state of Kansas directly at (785) 362-8222 between 8:00 a.m. and 4:45 p.m. CST. You can also find additional resources at the Kansas Department of Revenue (DOR) website.

Instead, if you are looking for a team of experts to handle your sales tax returns for you each month, you should check out our Done-for-You Sales Tax Service. Feel free to contact us if you’re interested in becoming a client!

More from TaxValet:

Receive Important Sales Tax Updates to Your Inbox!

Join our mailing list to receive free updates that could help protect your business from audit.

Get in Touch

Company

Disclaimer: Nothing on this page should be considered tax or legal advice. Information provided on this page is general in nature and is provided without warranty.

Copyright TaxValet 2023 | Privacy Policy | Site Map

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.