Quick Answer: This blog offers instructions on how to file and pay sales tax in Florida using form DR-15. Florida also has form DR-15EZ. If you are using that form, note that there may be differences.

For a comprehensive overview of Florida sales tax, including the latest rules and regulations, visit our Florida Sales Tax Guide. This resource provides all the information you need to ensure compliance and understand your tax obligations in the state.

Doing business in Florida? If you’ve got a physical presence or meet economic nexus in the Sunshine State, you’ll most likely need to pay state sales tax. Read on for our step-by-step guide on how to file and pay sales tax in Florida using form DR-15. You’ll need your gross sales data and banking information on hand to streamline the process.

Do You Need to File a Florida Sales Tax Return?

Once you have an active sales tax permit in Florida you will need to begin filing sales tax returns. Not sure if you need a permit in Florida? No problem. Check out our blog, Do You Need to Get a Sales Tax Permit in Florida? Also, If you would rather ask someone else to handle your Florida filings, our team at TaxValet can handle that for you with our Done-for-You Sales Tax Service. We specialize in eliminating the stress and hassle of sales tax.

How to Sign In and File a Return on Florida’s Website

We will begin with simple step-by-step instructions for logging on to the website in order to file and pay your sales tax return for Florida.

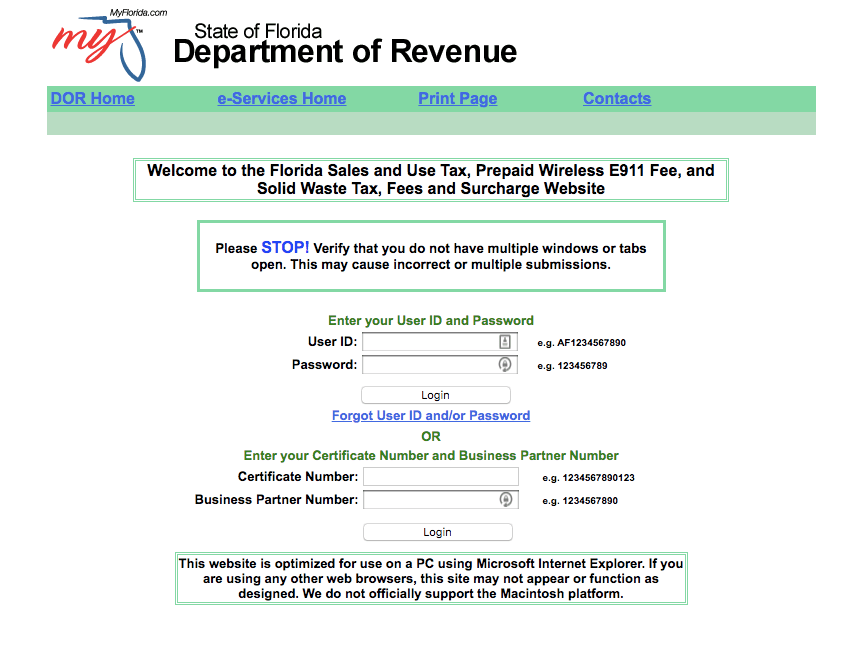

Step 1: Follow this link, https://ritx-fl-sales.bswa.net/, and you will come to this screen:

Step 2: Sign in with your username and password or with your certificate number and business partner number.

If you do not have these login credentials, then your first step is setting that up. They are generally created when you submit registration paperwork for a sales tax permit. If you are not interested in doing the work of getting the permit or a state login yourself, TaxValet can handle that for you with our Sales Tax Permit Registration Service.

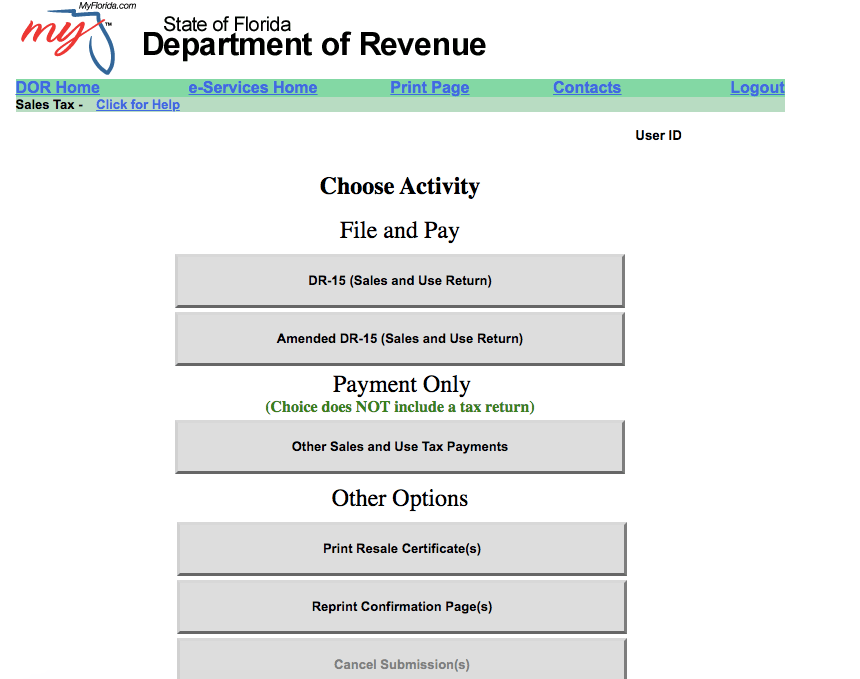

Step 3: You will be directed to this page. Once you come to the dashboard, select the account for which you want to file a return by clicking the “Sales and Use Tax” button directly in the middle of the screen. You can also view the due dates at the top of this page depending on your filing frequency with Florida.

Step 4: You will be directed to your dashboard for that state. This is the main page that you can use to navigate within the Florida portal. Assuming this is the original return for this period, you will need to select the top button “DR-15 (Sales and Use Return).”

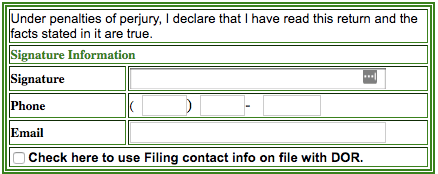

Step 5: Now you should see the page where you can enter your sales data. First, select the period that you wish to file. Second, you can fill out the contact information and signature box outlined in green and shown below.

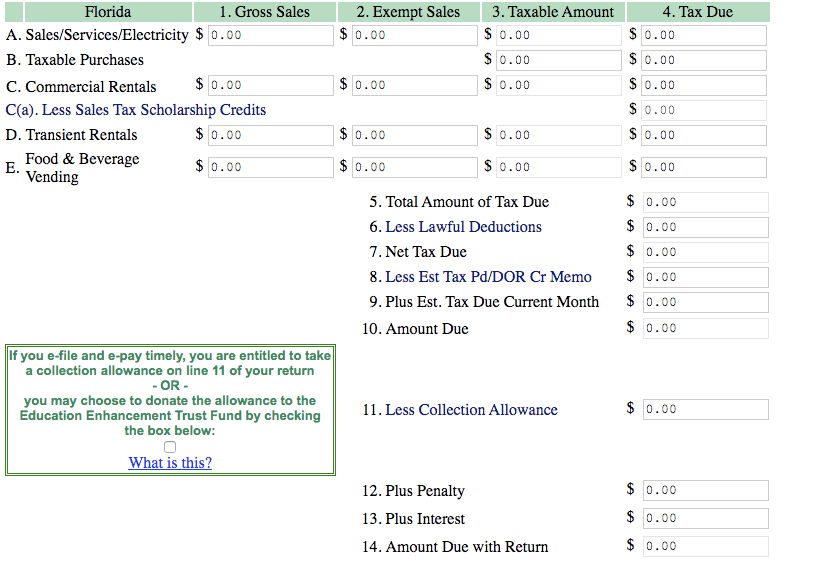

Step 6: At this point, it might be best to take a second and try to understand how the Florida return is set up. It can be a little bit confusing. On #1 A-E, you have your gross sales numbers.

On #2 A-E, you have your exemptions related to your gross sales data. On #3, the taxable amount should auto-calculate.

For #4, you actually have to manually enter in the amount of tax due based on the state rate and any county surtax due. The state rate for Florida is 6% and the surtax rates range from 0.50% to 1.50%. Again, be sure that you include the state and county tax in column #4, “Tax Due.”

At this point, you should have everything completed down to #5. Of note, #5, #7, and #10 will all auto-calculate for you. If you had any lawful deductions, include them here. According to the Florida Department of Revenue website, a lawful deduction is defined as “… tax refunded by you to your customers for returned goods or allowances for damaged merchandise, tax paid by you on purchases of goods intended for use or consumption but sold by you instead, Hope Scholarship Credits, and any other deductions allowed by law.”

If you are filing this return on time, then you are allowed a timely filing discount called a “collection allowance”. The collection allowance is noted on line 11. To calculate your collection allowance, multiply line 10 by 2.5%. The maximum collection allowance is $30.

Your amount due with the return (#14) would not automatically calculate. Don’t worry, when you click the next button, it will calculate in the next page. However, before clicking that next button, do step 7 first.

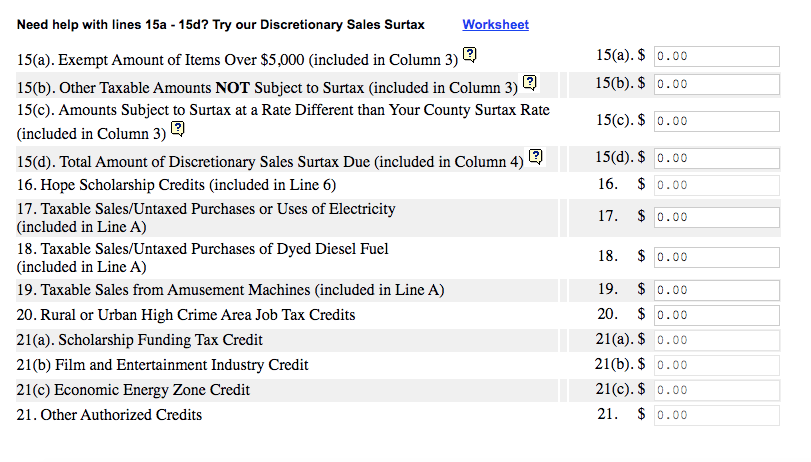

Step 7: Shift your eyes down to the remainder of the return. The most commonly used lines are 15(a) – 15(d). The rest are for special circumstances. Read them carefully to be sure that they do not apply to you.

If you have any sales that are not subject to the additional surtax, put this value in box 15(b). Keep in mind that these sales should be included in the column 3 above.

Now, take the taxable sales included in column 3 and subtract line 15(b). This will be the amount for line 15(c). 15(d) should be the actual discretionary tax due not including the sales tax.

Line 15(a) is where you put the amount of exemptions over $5,000 if you had that much exempt.

Lines 16-21 are more unique lines that you may or may not need to use to file your return. Be sure to read them carefully and determine if they apply to you.

You should now be finished with entering data for this return. Double-check all your numbers and click “next” at the bottom.

How to Pay Florida Sales Tax

You will now be given the option of submitting the return by itself or submitting payment with the return. Assuming you want to submit an electronic payment with the return, select the button on the right.

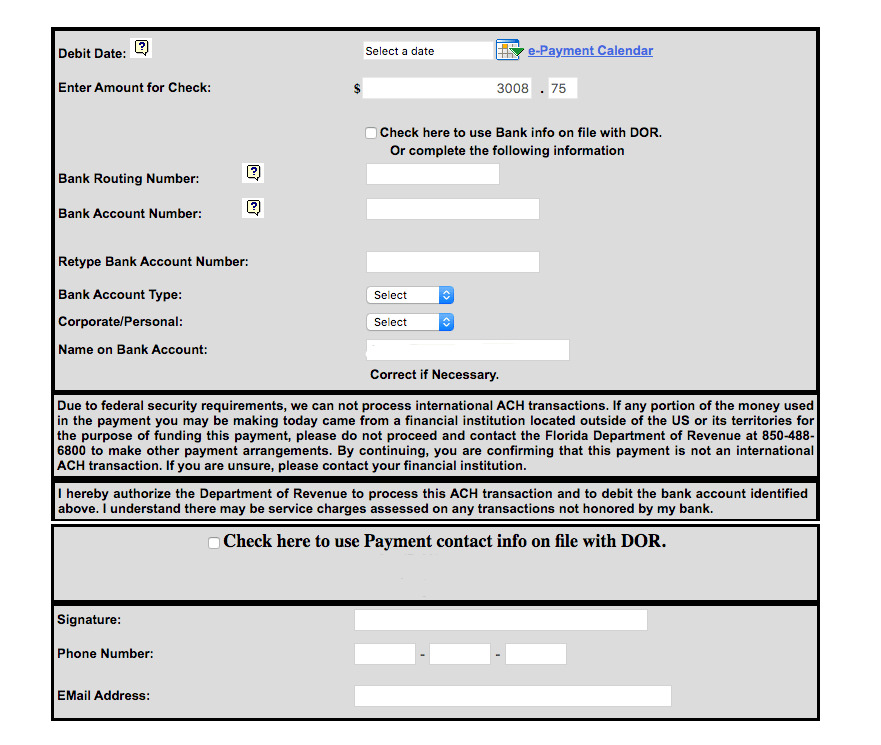

You should see the screen below.

Carefully fill in this screen. Be sure that you select the appropriate date and enter the account and routing number. Florida requires you to type in your name, phone number, and email address as a signature. Now follow the buttons at the bottom to submit your return and payment at the same time.

You have now successfully filed and paid your Florida sales tax return! How fun was that?

Things to Consider After Filing a Sales Tax Return in Florida

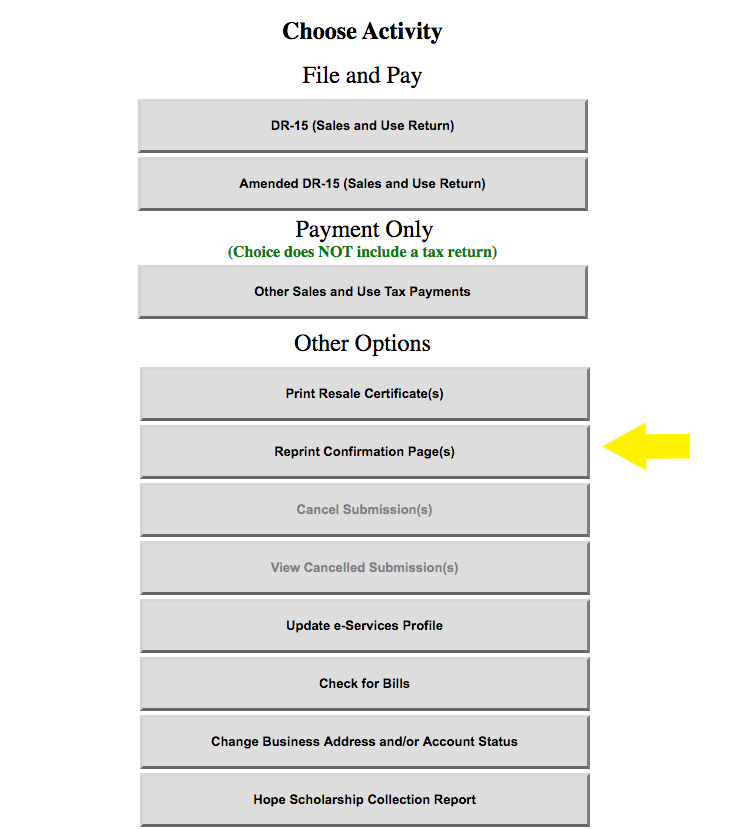

If you forgot to print or save a copy of your sales tax return, no need to worry. You can easily go back into the period to view and/or print the return that you just filed. Go back to the dashboard and click into the “Reprint Confirmation Page(s)” button. Then select the return that you wish to print.

How to Get Help Filing a Florida Sales Tax Return

If you are stuck or have questions, you can contact the state of Florida directly at (850) 488-6800 between 8:00 am and 5:00 pm EST. You can also find additional resources at the Florida Department of Revenue (DOR) website.

Sales tax laws are constantly changing and it can be challenging to keep up with complicated nexus requirements, especially if your business operates in multiple states. If the hassle and headache of filing and paying sales tax is a chore you’d rather hand off, check out our Done for You Sales Tax Service and let our team of experts take sales tax off your plate.

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.