Quick Answer: In this blog, you will learn how to register for a sales tax permit in Florida. The registration process is best completed online via the Florida Department of Revenue website. More detailed information is included below.

Registration Fee: The online permit application in Florida is free. It costs $5.00 to register via paper application.

Renewal Required?: Sales tax permit renewal is required annually in Florida.

Turnaround Time: In Florida, you can usually verify after 24-48 hours. You need to get the BP number and account number and verify them (those numbers can be found on the permit application screen).

Looking to register for a sales tax permit in Florida? You’ve come to the right place. We’ll walk you through how to get up and running in no time with our step-by-step guide below.

For a comprehensive overview of Florida sales tax, including the latest rules and regulations, visit our Florida Sales Tax Guide. This resource provides all the information you need to ensure compliance and understand your tax obligations in the state.

Do You Need to Get a Sales Tax Permit in Florida?

The first step in registering for a sales tax permit is determining if you even need one. In general, you need a sales tax permit in Florida if you have a physical presence or meet economic nexus requirements. For more detailed information on the necessity of getting a permit, you can learn more at our blog post “Do You Need to Get a Sales Tax Permit in Florida?”

If you are not sure where you should get sales tax permits, we can help determine that for you with our Done-for-You Sales Tax Service.

Once you’re sure you need a sales tax permit in Florida, you can proceed with registering.

Done dealing with sales tax on your own? Meet with an expert and get sales tax off your plate forever. Schedule a Free Sales Tax Plan.

Types of Sales Tax Permits Available

Florida only has one type of permit, a Sales and Use Tax Permit. There is no fee to register for this permit with the state of Florida.

Where to Register for a Florida Sales Tax Permit

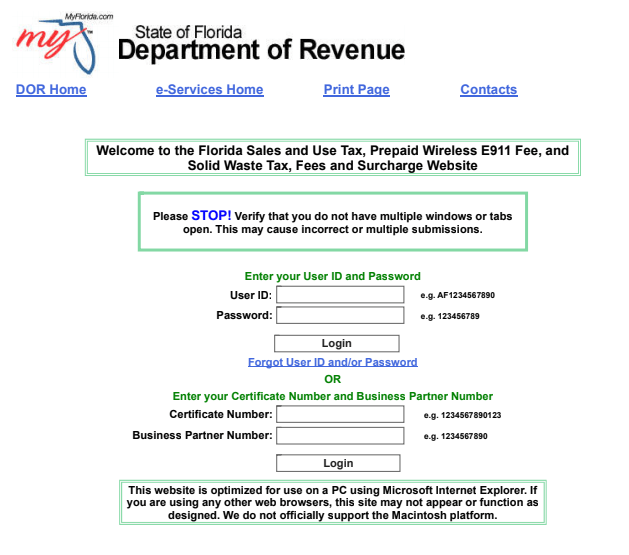

There are two ways to register for a sales tax permit in Florida, either by paper application or via the online website. We recommend submitting the application via the online website as it will generally be processed faster and you will receive confirmation upon submission. Having a submission confirmation will help if your application is not processed on time, or if it is not processed at all (which unfortunately can happen every now and again).

Online Application Location:

The best place to register for a sales tax permit in Florida is on its website.

Paper Application Location:

If you want to apply by paper, the Florida sales tax permit paper application can be found here.

Where to Go if You Need Help Registering for a Sales Tax Permit in Florida

If you are stuck or have questions, you can either contact the state of Florida directly or reach out to us and we can register for a sales tax permit on your behalf.

How to contact the Florida Department of Revenue if you have questions: You can contact the Florida Department of Revenue by calling 850-488-6800.

How to contact TaxValet if you want someone to handle your permit registration for you: You can learn more about our sales tax service by clicking here.

Information Needed to Register for a Sales Tax Permit in Florida

Before you begin the process of registering with the state, make sure you have access to the following information:

- Federal tax ID, typically called the EIN – issued by the IRS

- Knowledge of your business entity structure

- Business owner information

- North American Industry Classification System (NAICS) number

- Start date with the state of Florida

To get started, choose the link titled “CREATE USER PROFILE” on the website.

Answer the questions and follow the prompts that walk you through the process of registering with the state of Florida.

What Happens After You Apply for a Sales Tax Permit in Florida?

Keep in mind, once you have an active sales tax permit in Florida, you will need to begin filing sales tax returns. Our team can handle your sales tax returns for you with our Done-for-You Sales Tax Service. You can also learn more about how to file and pay a sales tax return in Florida by clicking here.

Florida will send your Certificate of Registration and Business Partner Number to your mailing address within 7-10 business days.

Once you receive your Business Partner (BP) Number and Certificate of Registration number from the state of Florida, you can access your account online here https://ritx-fl-sales.bswa.net. You must enter your registration number and business partner number to get started.

All Florida sales tax permits are issued for one calendar year. As long as you are registered to collect sales tax and continue to conduct business in the state of Florida, you will be issued a new certificate each year.

Sales tax laws change frequently, making it difficult to stay abreast of shifting nexus requirements particularly if your company operates across several states. What’s more, mistakes can be costly and trigger audits. It’s a lot for busy entrepreneurs and start-up founders to keep up with, especially when their plates are already full.

If you'd rather hand off the stress and responsibility associated with filing and remitting sales tax, explore our Done for You Sales Tax Service. Let our team of experts handle sales tax for you, and enjoy 360-degree sales tax compliance and total peace of mind.

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.