In this guide, we’re going to review Shopify’s new sales tax liability dashboard and what your next steps should be to eliminate the hassle and stress of sales tax.

We’re going to answer questions like…

- What is Shopify’s sales tax liability dashboard?

- How do I view and read the dashboard?

- How does Shopify determine where I have economic nexus?

- What steps should I take (and not take) as a Shopify seller?

Wait… what is economic nexus?

Since 2018, every state with a sales tax has passed some economic nexus law in the United States. Before 2018, a business typically had to have a physical presence in a state before the company could be forced to pay sales tax.

States created these economic nexus laws specifically to target online vendors (like Shopify sellers) who did not have a physical presence in a state and were previously not required to collect sales tax from customers.

Economic Nexus is just a fancy way of saying that if you’ve crossed certain sales or transaction count thresholds and need a sales tax permit (or be subject to harsh penalties).

Generally speaking, if you make over $100,000 in sales in a state or have over 200 separate transitions in the current or prior calendar year, you may have economic nexus and be required to get a sales tax permit. You can download a chart with each state’s economic nexus thresholds on this page.

What is Shopify’s Sales Tax Liability Dashboard?

Shopify released a new “sales tax liability” dashboard to help e-commerce sellers determine where they should begin collecting and remitting sales tax. If you are a Shopify seller, you can use this tool to understand better where you might owe sales tax. But the tool has its limitations, and you should only be used as a starting point for determining where you might owe sales tax.

A step in the right direction. We think that Shopify’s sales tax liability dashboard is a step in the right direction because it will help many businesses realize that they owe sales tax outside of their home state. However, business owners need to realize that the liability dashboard may not provide an accurate reflection for your business as a whole.

If you are a business owner that sells on Shopify, you should take special care to ensure that you actually have sales tax nexus in the state before registration. Many factors go into a proper nexus analysis, and our experience with automated nexus tools is that they have the potential to create “false-positives”. This means that they might tell you that you have nexus in more states than you do.

But it has the potential to not tell the full story. In addition, this tool doesn’t take into account your entire physical presence footprint (it will look at where you’ve listed your physical presence in your Shopify settings, but this will typically not be enough for a comprehensive analysis) and other factors (like Notice and Reporting requirements, click-through nexus laws, and more), which play a critical role in determining where you should get permits.

Measure twice, cut once. We’ve seen many business owners who have made the mistake of registering where an automated system told them they had nexus and instantly regretted it once they realized what the downstream effects would be once they registered. You need to take special care to understand where you are registering, what your sales tax permit start date will be, and how much you’d be expected to pay in back taxes upon registration. If you dive head-first into the registration process without proper advisement, you could be setting yourself up for a nasty surprise.

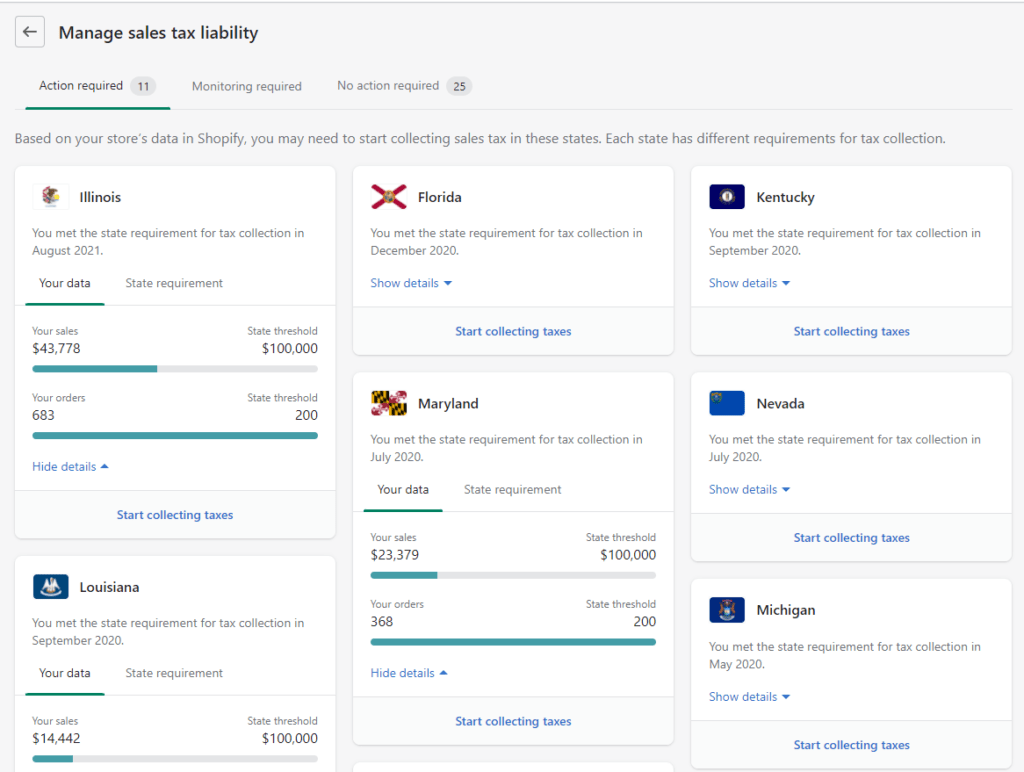

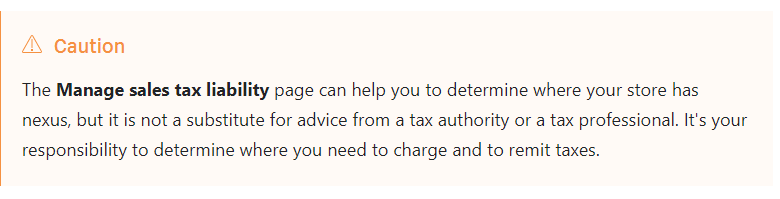

To Shopify’s credit, they do point out that their tool is “not a substitute for advice from a … tax professional,”. Listen to them! If you need help from a sales tax expert, please contact us (this is what we do!).

Please don’t be that guy (or gal) who makes a costly mistake because you decided to “wing it” without the help of a professional and then regretted it after.

How to View Shopify’s Sales Tax Liability Dashboard

Here’s how you can access Shopify’s new sales tax liability dashboard to monitor economic nexus:

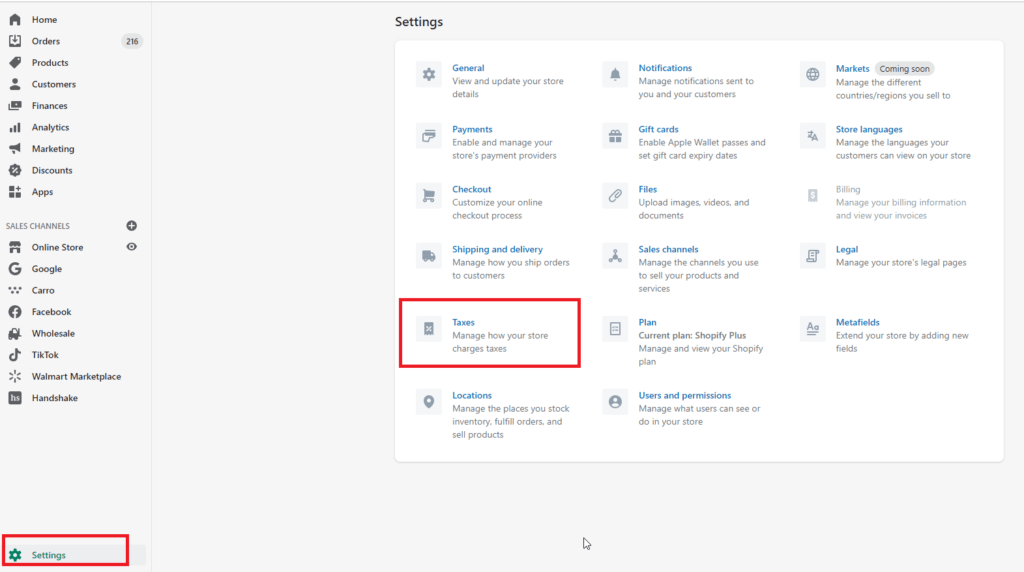

After signing in to your Shopify admin page, click on Settings (on the bottom left) and click Taxes. Next to the United States, click Manage.

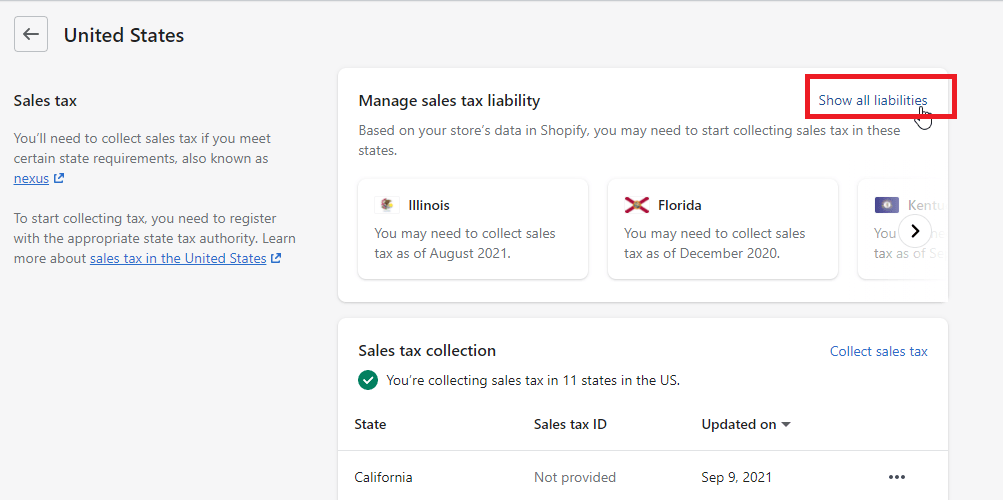

At the top of the screen, you should see a section that says Manage sales tax liability. To the right of that, click Show all liabilities.

Now you are on the sales tax liability dashboard and can click show details to see Shopify’s calculation on how close you are to hitting the threshold.

How Shopify Calculates Economic Nexus Thresholds

Let’s break down how Shopify calculates where you have economic nexus, and why this might not be the best methodology for most sellers. Shopify uses a unique formula for calculating total sales (which doesn’t match with the state’s definisions) combiend with incomplete data.

Shopify’s Economic Nexus Tool May Use Incomplete Data

Economic nexus needs to be determined based on your entire entity’s transaction data. If you sell on multiple sales channels, we need to use all of those transactions to determine where you have nexus. For example, if you sell on Amazon and Shopify and to some resellers, you will need to include all of the transactions in your calculations.

The issue with Shopify’s economic nexus calculator is that it only considers transactions running directly through the Shopify platform. So if you only sell on Shopify, then this tool could be great (assuming you don’t sell products that have state exemptions). But on the other hand, if you sell on multiple sales channels (and many people do), then Shopify will not have all of your transaction data in order to make an accurate assessment.

If you are selling on multiple platforms, there is a good chance that Shopify is missing transaction data that could lead to them not including the transactions in their analysis.

If you answer “yes” to ANY of these questions, then Shopify’s economic nexus dashboard may be inaccurate:

- Do you sell products that could be exempt in certain states (such as clothing, food, dietary supplements, or digital products – see more examples here)?

- Do you sell on any other sales channel besides Shopify?

- Do you sell on marketplaces like Amazon?

- Do you sell to resellers outside of Shopify and invoice them in another tool like Xero or Quickbooks?

If so, then you may benefit from having a free sales tax consultation with one of our experts.

Shopify’s Economic Nexus Calculations Don’t Use The Right Formulas

Economic nexus thresholds are, admittedly, complex. I wish it were simpler for sellers (and software providers) to determine where businesses have sales tax nexus. Shopify’s economic nexus threshold tool has the potential to provide inaccurate advice because it doesn’t consider all of the necessary details that states look at.

Here are a few examples of potential issues with Shopify’s calculations:

Net sales. Shopify determines where you might have sales tax nexus based on your net sales, which is not how states want us to calculate economic nexus. Most states want us to calculate where you have crossed the economic nexus threshold based on your gross, retail, or taxable sales. Shopify is looking at your total sales less refunds or credits. This means that Shopify might tell you that you owe sales tax in more forms than you do.

Product exemptions. Suppose you sell exempt products in certain states (dietary supplements, food, clothing, and other product types). In that case, Shopify will include these transactions in their net sales calculation for states that allow us to exclude nontaxable sales. This means that Shopify might tell you that you owe sales tax in more forms than you do.

Marketplace sales. Suppose you sell on a marketplace like Amazon, and you route the marketplace transactions through Shopify for fulfillment purposes. In that case, there is a chance that Shopify will not be able to “read” that the transaction initially took place on a marketplace. This is important because many states allow us to deduct marketplace sales from your economic nexus calculation. If your marketplace sales are included in Shopify as regular retail sales, it could lead to Shopify telling you that you owe sales tax in more states than you do. Shopify does support taking this into account for some, but not all, marketpalces.

Worst still is that the vast majority of e-commerce businesses that sell on marketplaces do not route their transactions through Shopify. Therefore, all of the marketplace sales won’t be included in the economic nexus thresholds. Please also remember that storing inventory in third-party marketplace warehouses (like Amazon FBA warehouses) will create sales tax nexus in the vast majority of states (there are a few exceptions to this general rule).

Here are some other things to keep in mind when reviewing Shopify’s economic nexus report:

- If you have a physical presence in a state (such as having people, property, or inventory, then you may need to get a permit REGARDLESS of your sales volumes

- Certain states still have Notice and Reporting Requirements with thresholds that are substantially lower than the economic nexus threshold. Click here for a list of states where Notice and Reporting requirements still matter.

- If you sell on more sales channels than only Shopify, then Shopify will not include all of your transactions in the economic nexus tool.

- If you sell exempt products in certain states (such as dietary supplements, food, clothing, or digital products), these may not be deducted appropriately from Shopify’s calculations.

- Colorado and Alaska both have home-rule localities that have individual filing requirements. This tool does not take these locations into account.

Next Steps That Shopify Sellers Should (and Should NOT) Take

Any time you are making financial decisions for your business, there’s an opportunity to make the right decision and set yourself up for success. However, there’s also an opportunity to do a lot of damage if you make ill-informed decisions quickly. Here’s our advice when it comes to what steps Shopify sellers should (and shouldn’t) take next:

Please DO the following once you’ve seen Shopify’s sales tax dashboard:

- Reach out to a sales tax expert (we can help) to talk about if the results of your Shopify analysis are accurate, and if you could benefit from a more thorough analysis.

- Determine if all of your transaction data is within Shopify. If it isn’t, then begin downloading and organizing transaction data from all of your sales channels.

- Begin gathering a list of where you might have a physical presence. This includes where you store inventory, have offices, employees, or contractors.

Please do NOT do the following once you’ve seen Shopify’s sales tax dashboard:

- Do NOT turn on tax settings for the states because you’re panicking and think you need to begin collecting tax right away. It is illegal to collect tax without a permit and could be considered tax fraud. You are also “locked-in” to getting a permit once when you begin collecting sales tax. It is complicated and difficult to “undo” collecting tax.

- Do NOT begin registering for sales tax permits based on Shopify’s dashboard alone. As we explained, the tool is likely inaccurate and will lead you to decide where to get a license based on incomplete or erroneous information. It would help if you also had a thorough understanding of the implications of registering for a sales tax permit before you start.

- If you do register for a sales tax permit, do NOT use the date suggested on the dashboard without speaking with a sales tax expert first to help you understand if you’re using the right date.

I want to repeat that I think this economic nexus tool is overall “good” in that it brings awareness to sales tax. However, you need to be particularly careful taking tax advice from an automated system.

Shameless plug – we can eliminate the hassle and stress of sales tax for you. And if you’re a Shopify (or other e-commerce sellers) looking for sales tax advice, please schedule an initial consultation with us. We’d be happy to help.

Please note that this guide was written in September 2021 and may be out-of-date if Shopify has enhanced its tool since its launch.

Get in Touch

Company

Disclaimer: Nothing on this page should be considered tax or legal advice. Information provided on this page is general in nature and is provided without warranty.

Copyright TaxValet 2023 | Privacy Policy | Site Map

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.