Do You Need to File an Illinois Sales Tax Return?

Once you have an active sales tax permit in Illinois you will need to begin to file and pay sales tax. Not sure if you need a permit in Illinois? No problem. Check out our blog, Do You Need to Get a Sales Tax Permit in Illinois?

Also, if you would rather ask someone else to handle your Illinois filings, our team at TaxValet can handle that for you with our Done-for-You Sales Tax Service. We specialize in eliminating the stress and hassle of sales tax.

How to Sign-in and File a Return on Illinois’s Website

Let’s start with simple, step-by-step instructions for logging on to the website in order to file and pay your sales tax return in Illinois.

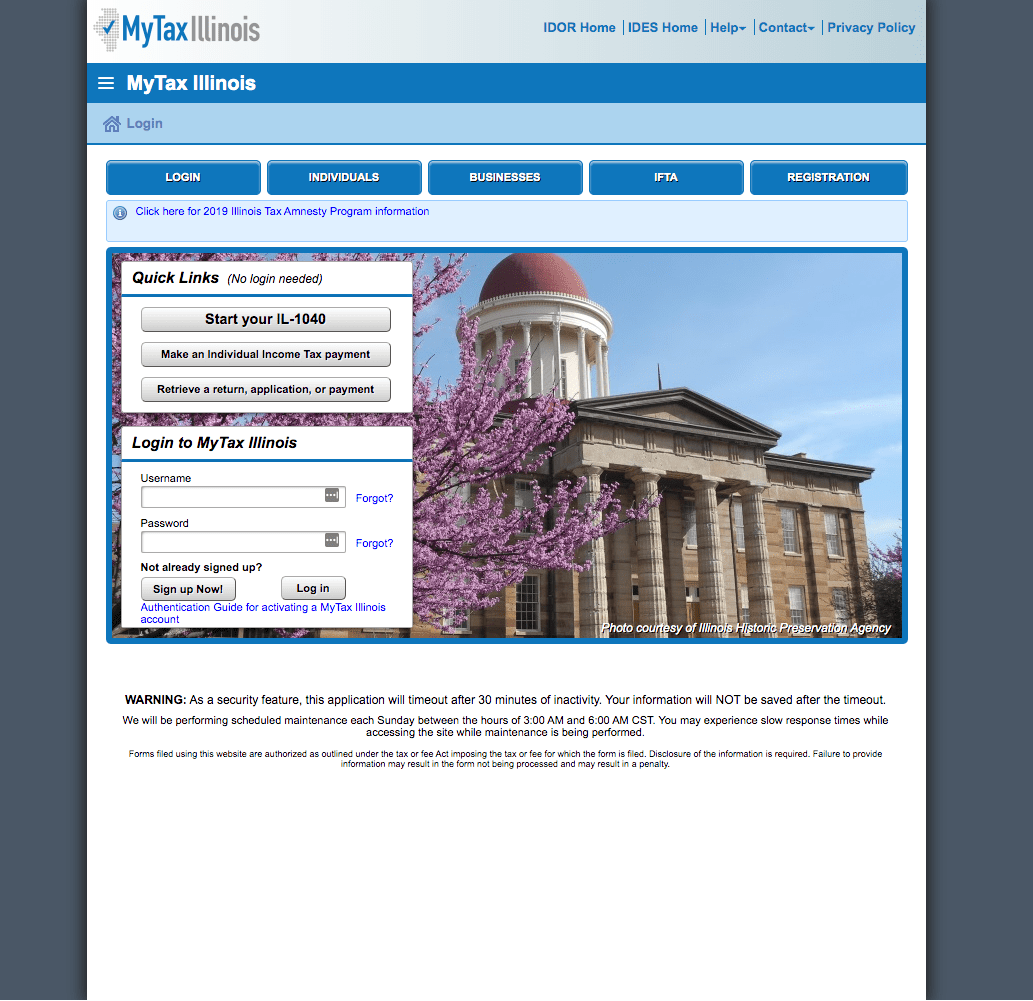

Step 1: Follow this link, https://mytax.illinois.gov/_/, to come to this screen:

If you do not have a username and password, then your first step is getting that all setup. These login credentials are generally created when you submit registration paperwork for a sales tax permit.

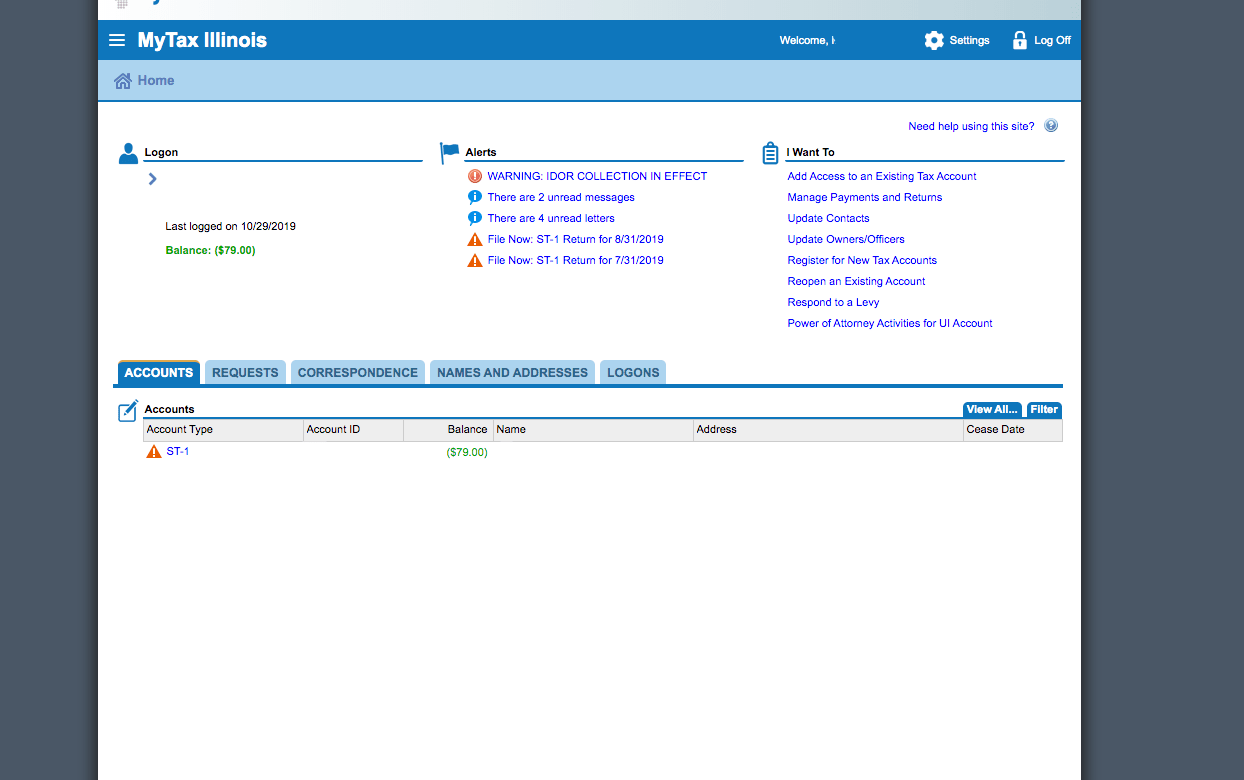

Step 3: You will be directed to the dashboard for the state.

You can also explore the tabs that run across the middle of the page if you would like. The “Correspondence” tab is a good one to look under. You will see any messages or letters received from the state here. If this is your first time in the portal, just familiarize yourself with this page. It will help prevent missing anything in the future.

Once you feel that you have a good understanding of the dashboard, proceed by selecting the “ST-1” button under “Account Type”.

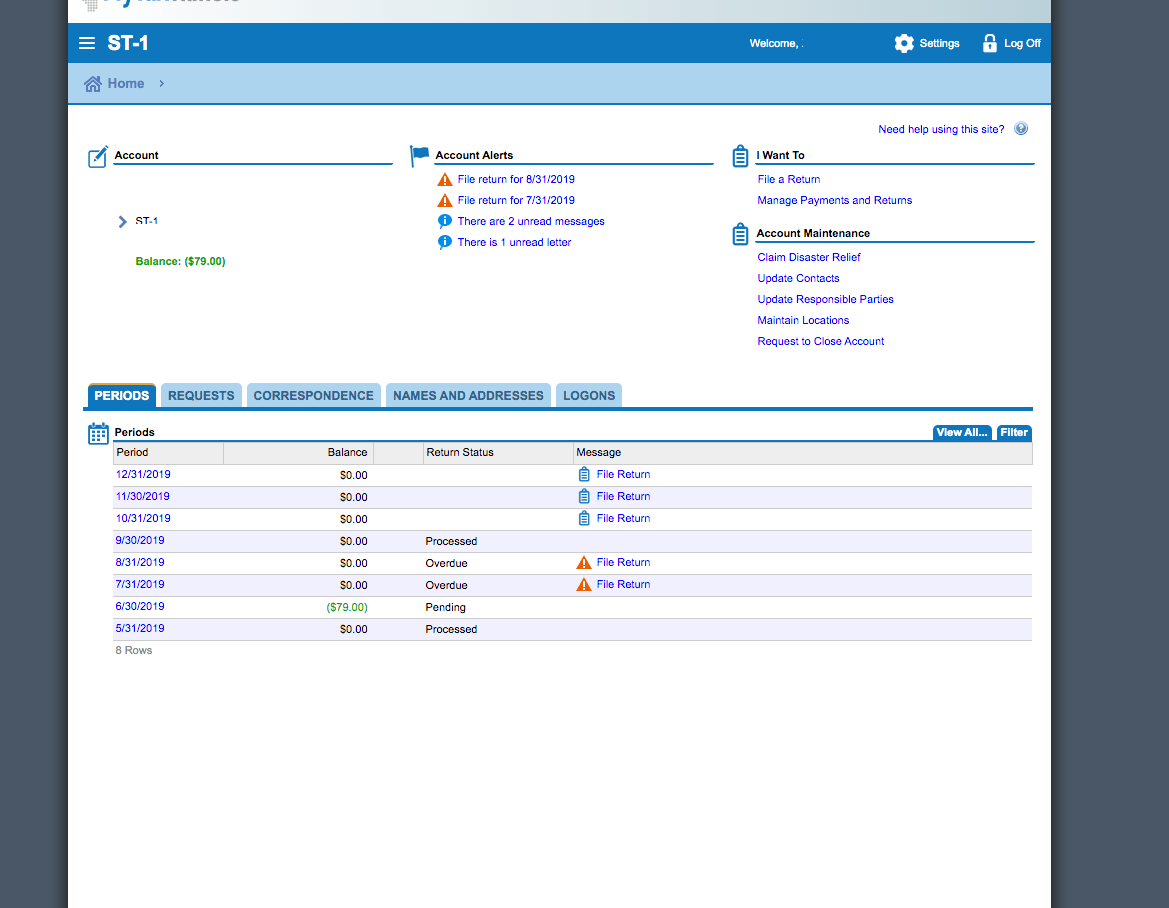

Step 4: You will be directed to this page.

At this page, you should be able to see all of the periods that you have filed and the period that you actively need to file. You can also see the status of any of these previously filed returns.

If you have a return due, you will see the option to file the return to the right of the corresponding period. Select the “File Return” link.

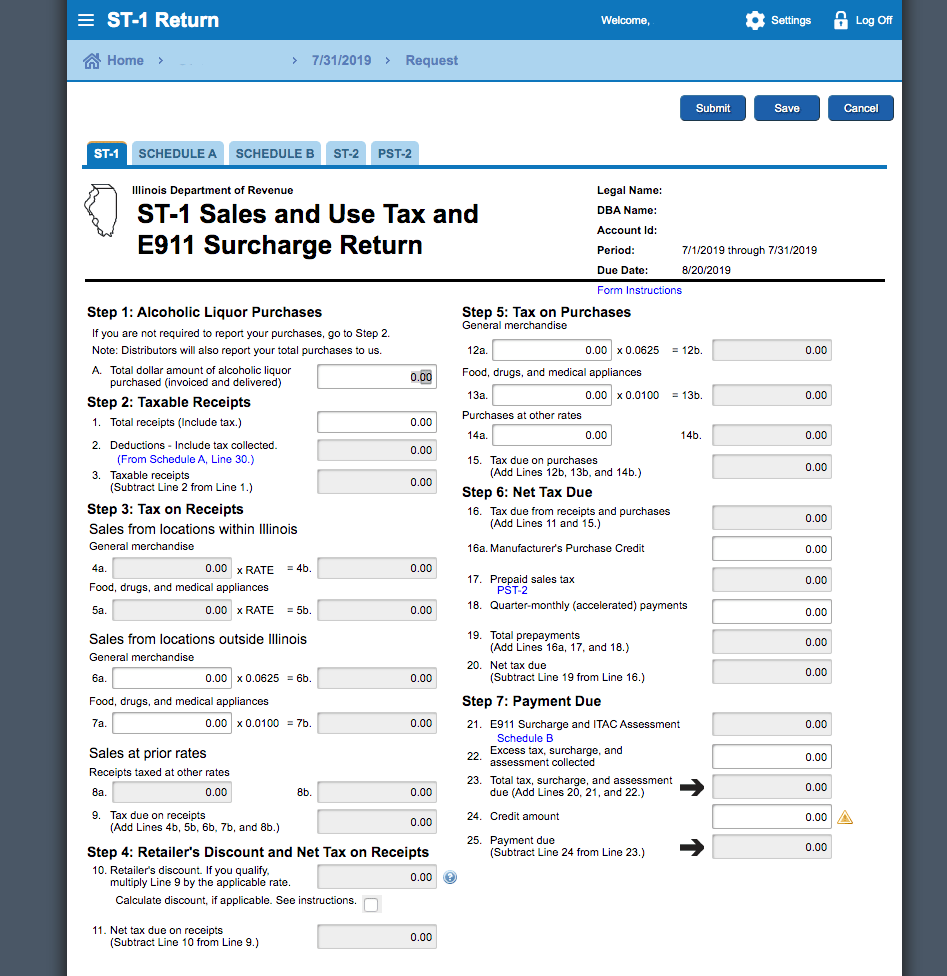

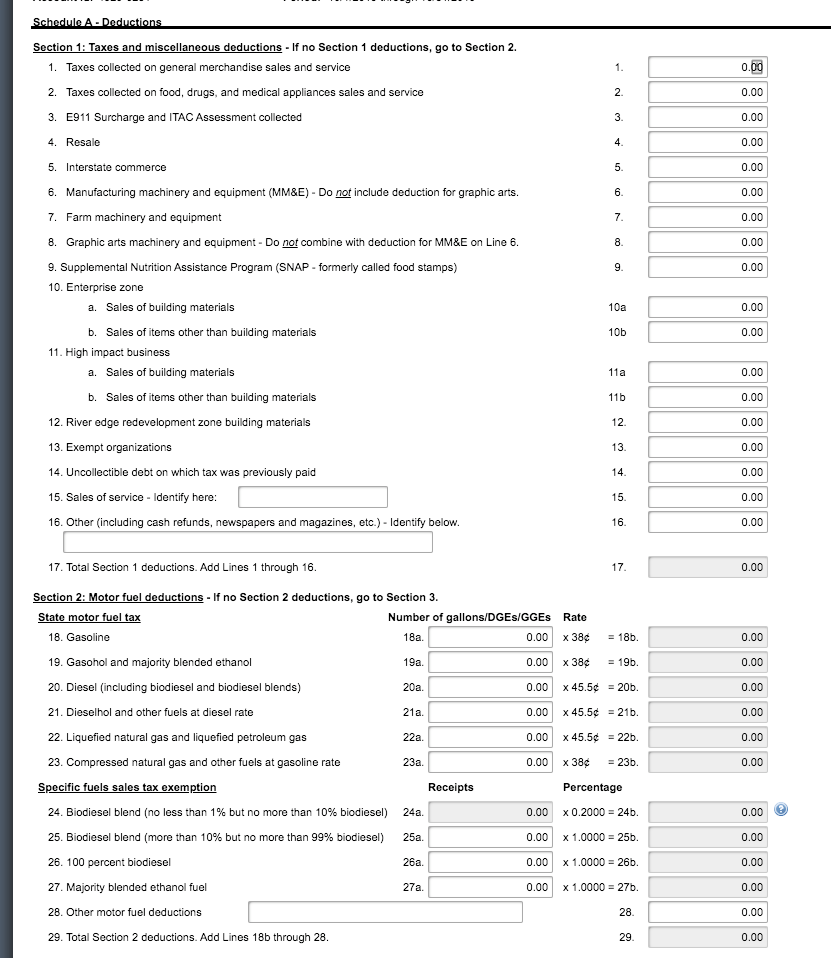

Step 5: Understanding ST-1, Schedule A, Schedule B, ST-2, and PST-2

The Illinois return is not as complicated as some others, but it could take a minute to fully understand. So take a deep breath and read over this page thoroughly.

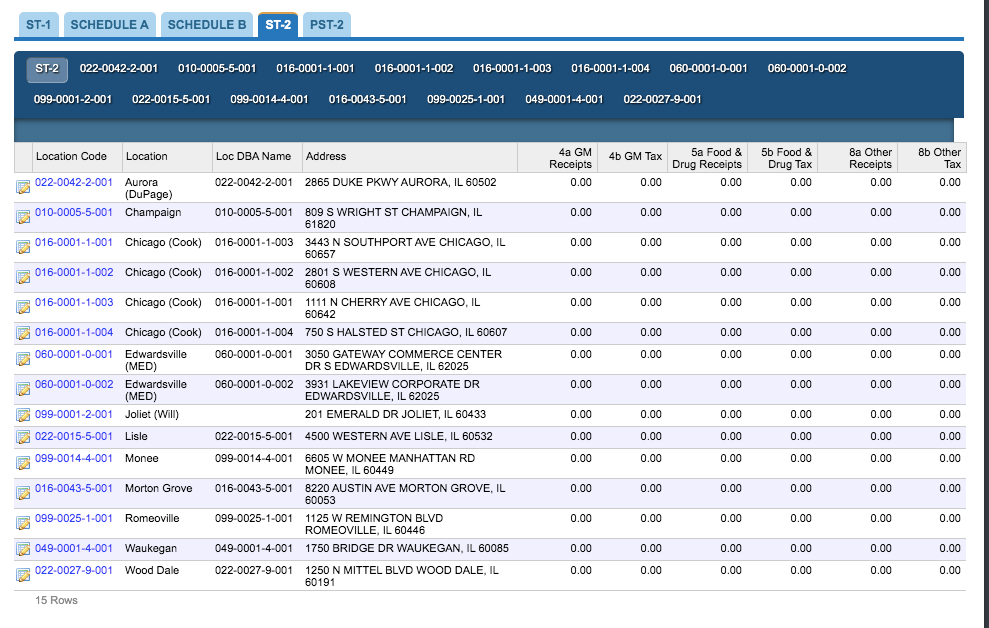

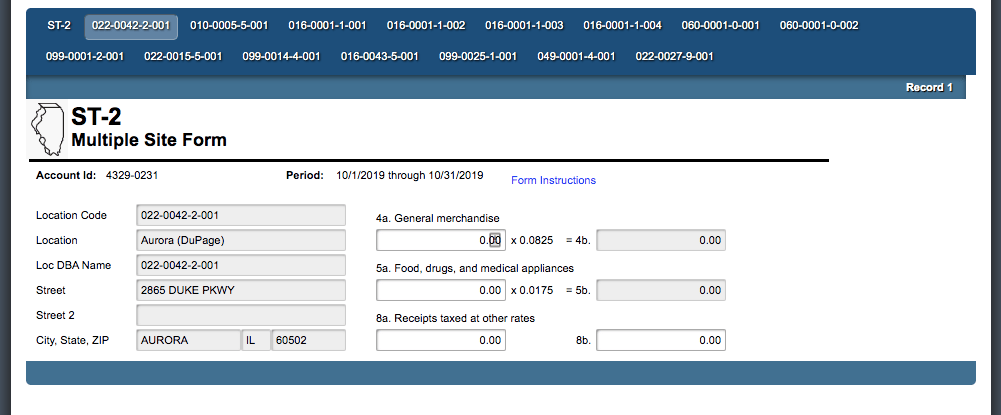

This form relates back to form ST-1 number 4a (sales from locations within Illinois). Any sales data that you put into form ST-2 will automatically carry over to 4a in form ST-1. If this is your first time filing an Illinois sales tax return and you make sales from within the state, you may not see these locations added. My recommendation is to call the Illinois department of revenue and have them add these for you. You can go back to the main screen under “Account Maintenance” and select “Maintain Locations” if you wish to add these yourself. Either way, be sure that you get the proper locations added so that you see locations on form ST-2.

Finally, PST-2 (and PST-1 if you are selling motor fuel to resellers) is related to reseller accounts. According to the IL DOR, “Form PST-2 is a four-part form, which allows the department to verify that the information reported by retailers and resellers matches. The retailer is required to file Copy A with Form ST-1 and keep Copy B as a file copy. The reseller is required to file Copy C with Form PST-1 and keep Copy D as a file copy.” If this applies to you, click “Add a record” and fill out this form properly.

Step 6: Key in Sales Data

Now that you have an understanding of how all of the forms are connected, let’s key in your sales data. Start at Step 1 of form ST-1. If you made alcohol purchases and are required to report those purchases, enter in that amount in A. Otherwise, proceed to Step 2.

Step 2 is where you will key in your total receipts including tax in number 1. If you properly filled out Schedule A, you will see your deductions in number 2. Number 3 should display your taxable receipts (total receipts less your deductions from Schedule A).

Step 3 deals with reporting sales made from within Illinois and from outside the state. As referenced earlier, 4a and 5a are connected to ST-2. If you have properly filled out ST-2, then these numbers should be displayed as a total in those two boxes. After you have added your locations on form ST-2, select the link to click into each of them. You should see a screen that looks like this:

Now you can report your sales from locations outside of Illinois as a lump sum on lines 6a and 7a.

Step 5 has to do with use tax that you need to pay to Illinois for purchases made. Reference this form if you have questions about whether or not you need to fill out section 5.

One other important line that we need to take note of is line 22. This is the place where you need to report any excess tax collected. This means that if you collected too much tax, you need to include it on this line. Be sure that you remit all tax collected regardless of what is due. Collecting sales tax and not remitting all of it is illegal.

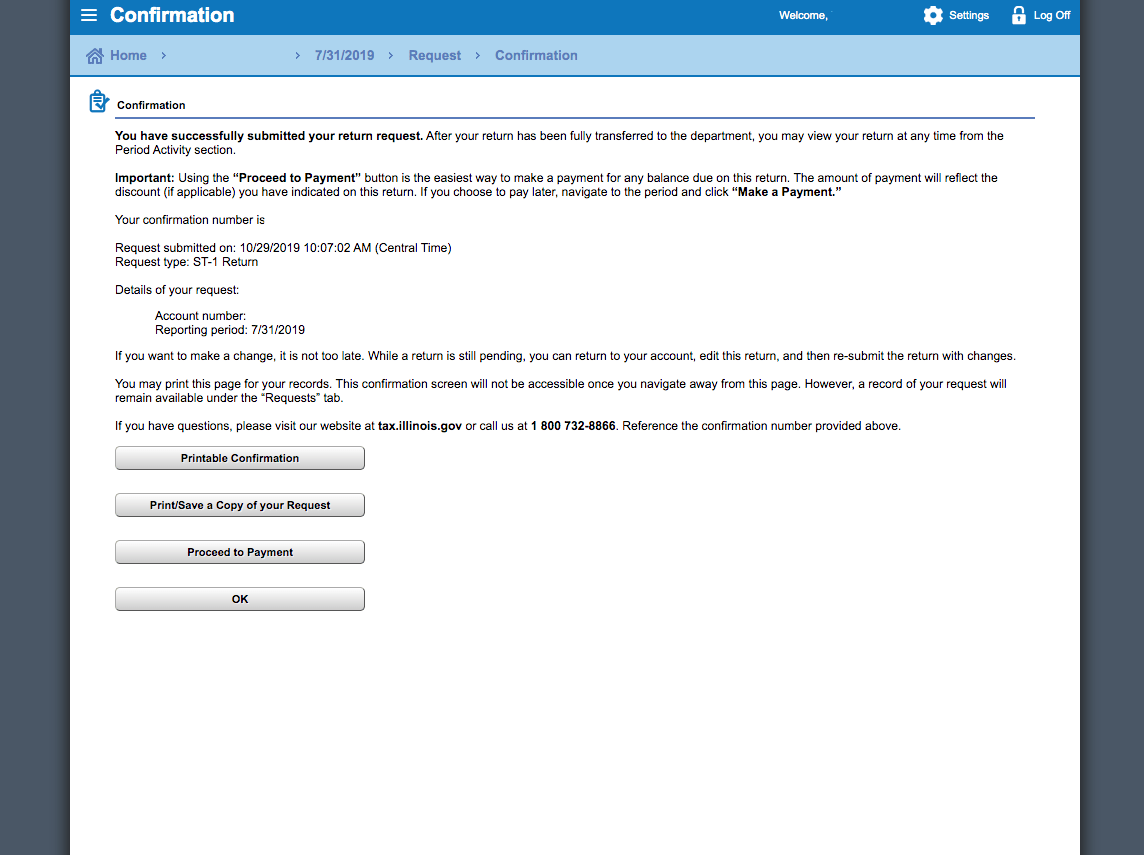

You are done! At this point review all data that you have entered. Make sure that all of your data matches. Now go back to form ST-1 and find the submit button in the upper right corner. It will ask you to re-enter your password. Now you should see the confirmation screen.

Now you are done and ready to save all of your documents.

How to Pay Illinois’s Sales Tax

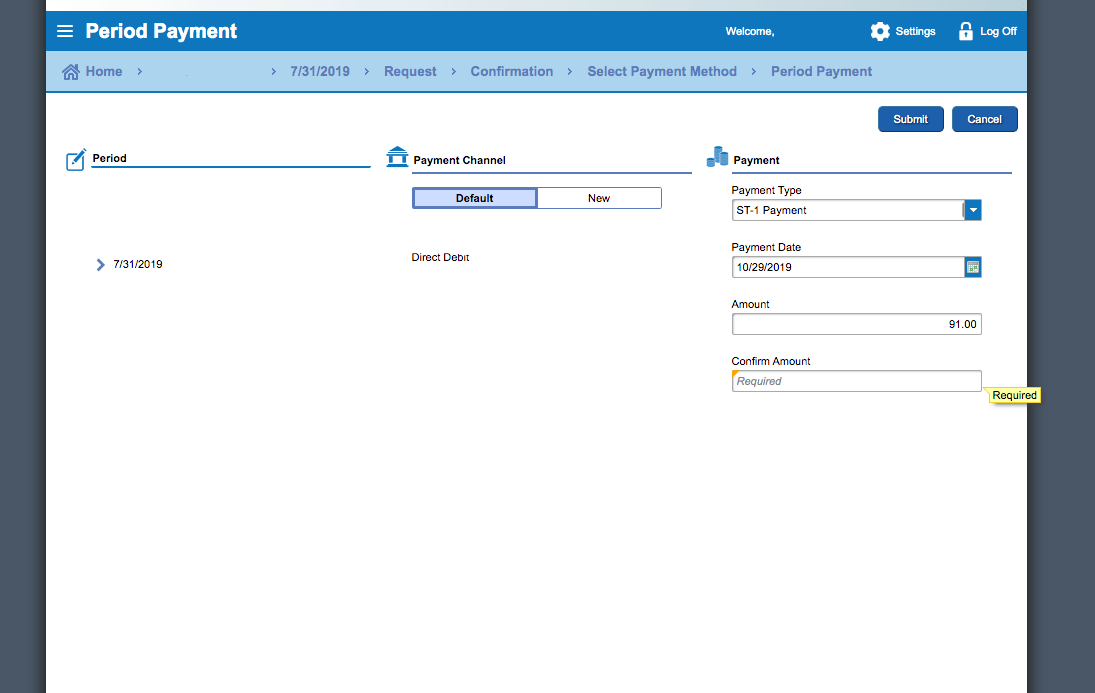

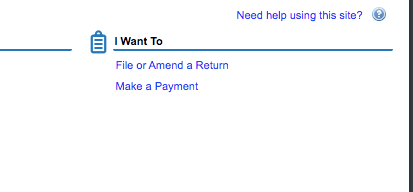

If you wish to pay your sales tax due while submitting the sales tax return, select that option after filing your return on this screen:

You will now have the option of choosing how you would like to pay. If you would like to pay online, select the “Bank Account Debit” option.

Now you will see the screen below.

Once you are sure that everything is entered correctly, hit “Submit”.

Things to Consider After Filing a Sales Tax Return in Illinois

If you forgot to print or save a copy of your sales tax return, no need to worry. You can easily go back into the period to view and/or print the return that you just filed. Go back to the dashboard and select the “ST-1” account. Select the period that you need. Now, look under “Periods”. You should see something that looks like this in the upper right portion of the screen:

How to Get Help Filing an Illinois Sales Tax Return

If you are stuck or have questions, you can contact the state of Illinois directly at (800) 732-8866 between 8:00 a.m. and 5:00 p.m. CST. You can also find additional resources at the Illinois Department of Revenue (DOR) website.

Instead, if you are looking for a team of experts to handle your sales tax returns for you each month, you should check out our Done-for-You Sales Tax Service. Feel free to contact us if you’re interested in becoming a client!

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.