Quick Answer: This blog offers instructions on how to file and pay sales tax in Georgia using form ST-3. Georgia offers a separate form (ST-3 USE) to file use tax only. If you are using that form, note that there may be differences.

For a comprehensive overview of Georgia sales tax, including the latest rules and regulations, visit our Georgia Sales Tax Guide. This resource provides all the information you need to ensure compliance and understand your tax obligations in the state.

Do You Need to File a Georgia Sales Tax Return?

Once you have an active sales tax permit in Georgia you will need to begin filing sales tax returns. Not sure if you need a permit in Georgia? No problem. Check out our blog, Do You Need to Get a Sales Tax Permit in Georgia? Also, If you would rather ask someone else to handle your Georgia filings, our team at TaxValet can handle that for you with our Done-for-You Sales Tax Service. We specialize in eliminating the stress and hassle of sales tax.

How to Sign-in and File a Return on Georgia’s Website

We will begin with simple step-by-step instructions for logging on to the website in order to file and pay your sales tax return for Georgia.

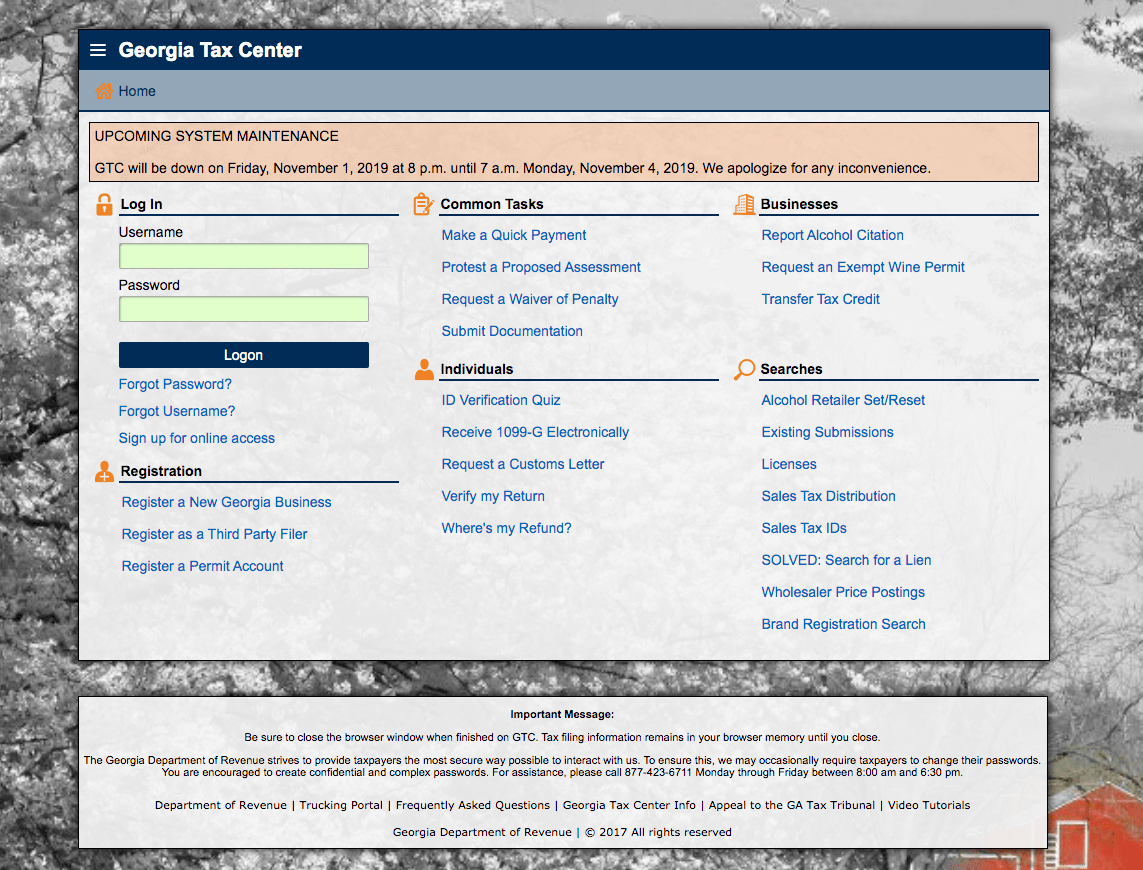

Step 1: Follow this link, https://gtc.dor.ga.gov/_/, to come to this screen:

Step 2: Sign in with your username and password.

If you do not have a username and password, then your first step is setting that up. They are generally created when you submit registration paperwork for a sales tax permit. If you are not interested in doing the work of getting the permit or a state login yourself, TaxValet can handle that for you with our Sales Tax Permit Registration Service.

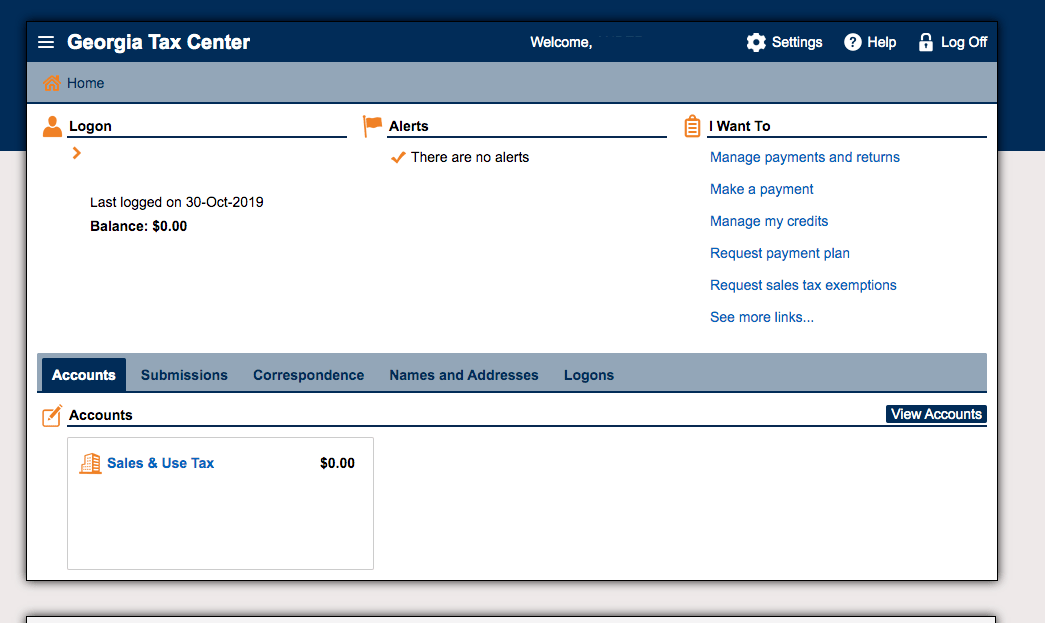

Step 3: You will be directed to the dashboard for the state.

Once you come to the dashboard, you can also take a minute here to see if there are any alerts that need your attention. It is a good practice to get into the habit of checking this page thoroughly. After that, you can proceed by clicking the “Sales and Use Tax” account.

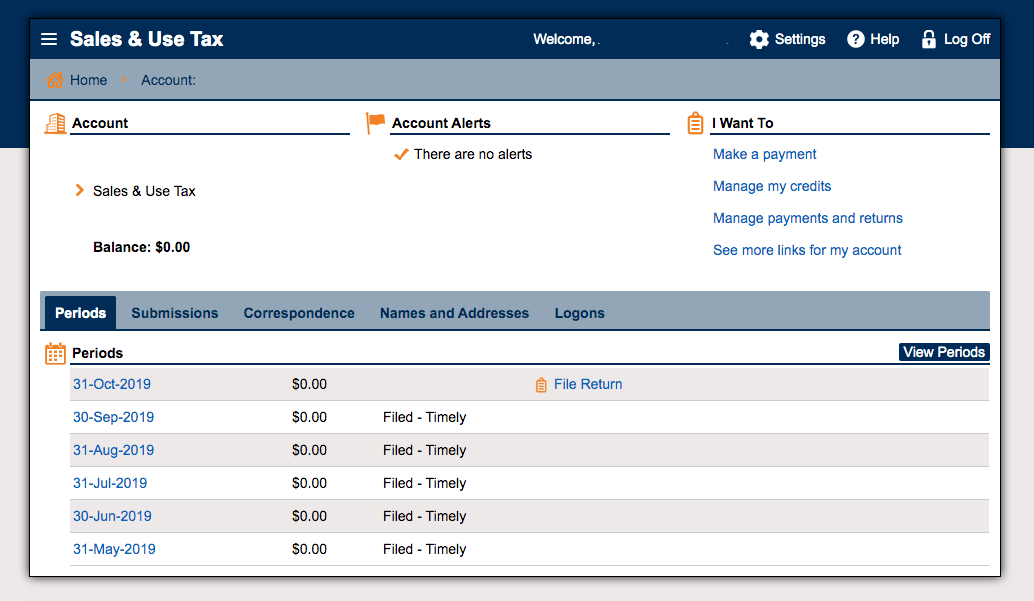

Step 4: You will be directed to this page.

This is an easy step. Just find the period that you wish to file and select it. Also, be sure that all of the previous returns filed (if you have any) show that they have been processed.

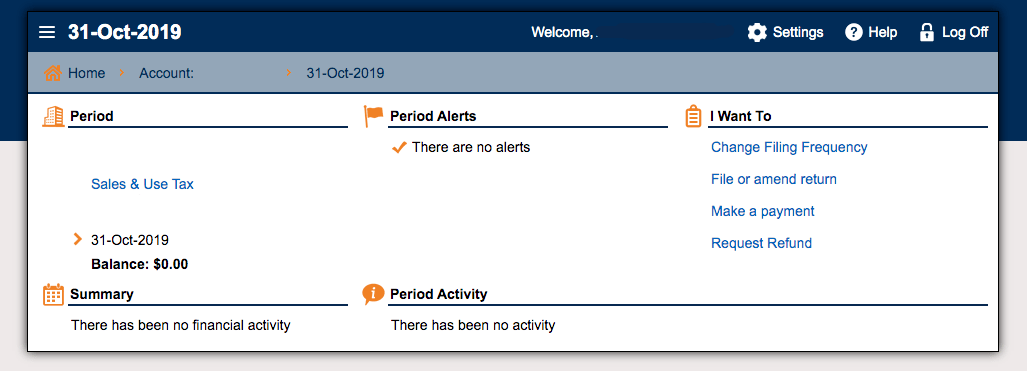

Step 5: Navigate to the right side of the page. Under “I Want To” select “File or amend return.”

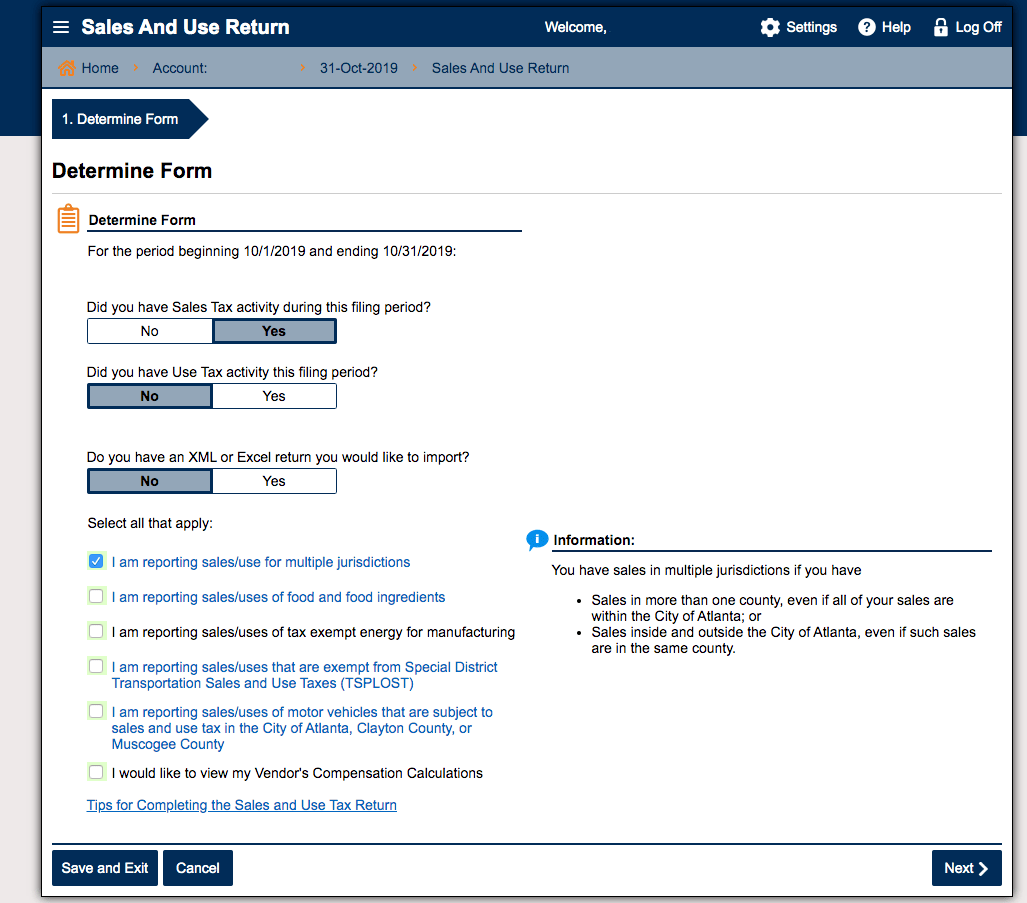

Step 6: You will now see a page that looks something like the one below. This is where Georgia determines what kind of form will be used to file the sales and use tax return. Be sure that you read each line carefully and fill this section out accurately.

After you are finished, click “Next.”

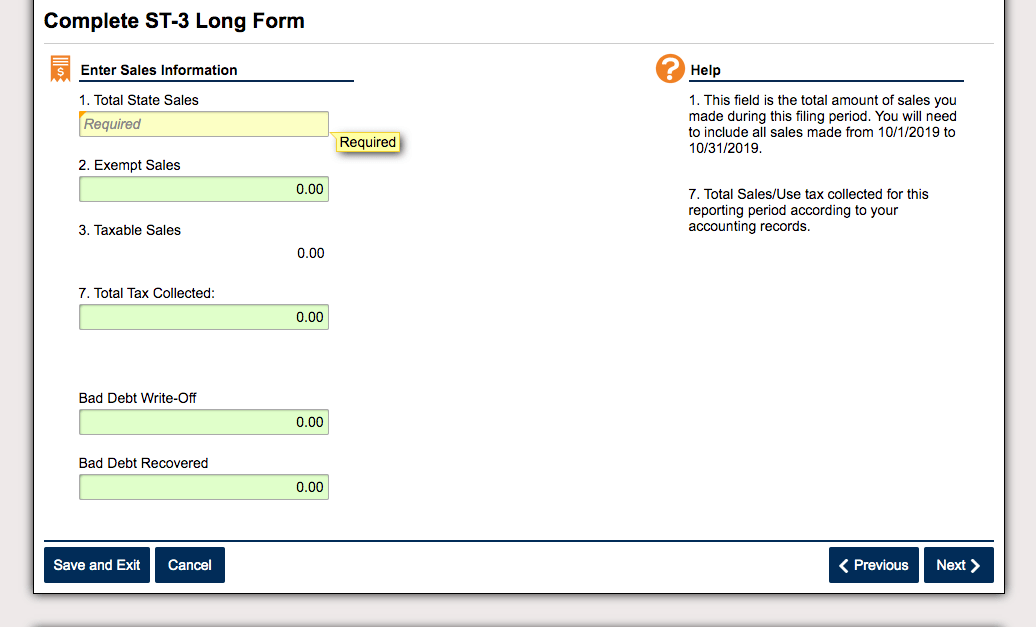

Step 7: This is where you enter your total sales, exempt sales (if any), and total tax collected. I like to think of this as the place to enter the total sales data. In the next steps, you will enter in your sales by jurisdiction and then come back to these numbers.

Once you have filled in this screen, select “Next.”

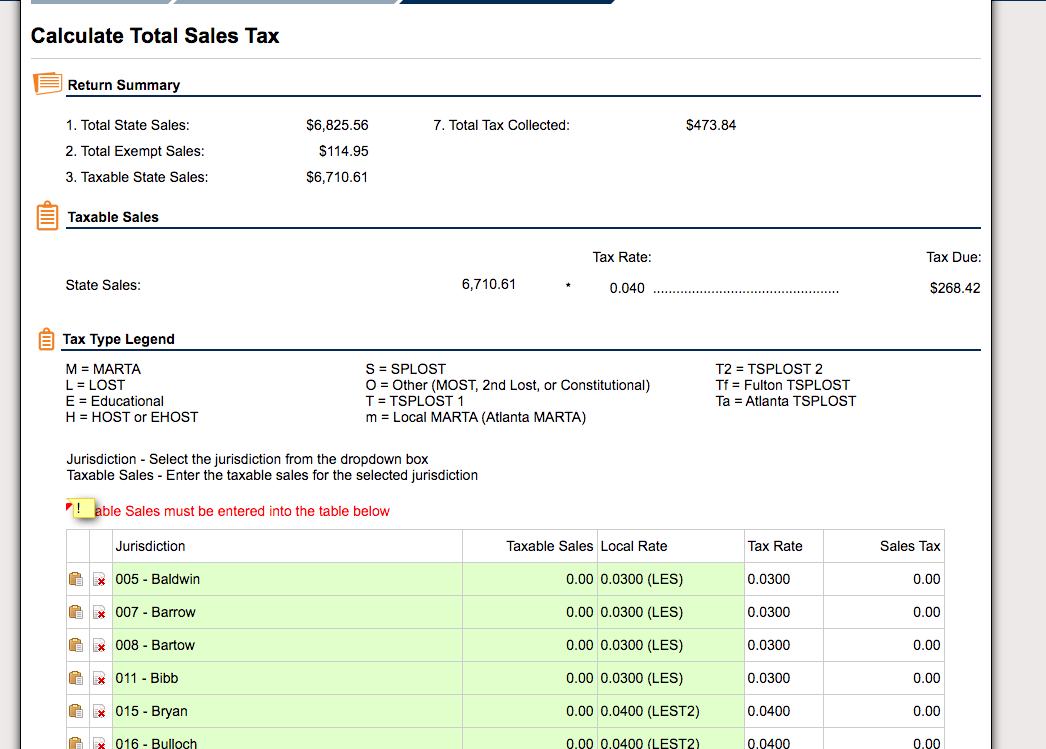

Step 8: Enter sales data by jurisdiction.

Let’s break down what we are looking at on this screen. At the top, you have the data that you just keyed in on the prior step. Below that, under “Taxable Sales,” you have the taxable sales multiplied by the state rate of 4%.

Below that, you have all of the jurisdictions in which you made sales. Notice that these are listed at varying rates. These rates are in addition to the state rate.

Now that you understand what is going on, it is simple data entry. Enter the jurisdictions and the corresponding taxable sales for each one. This can be time-consuming. I know it is tempting to rush this step but don’t. It is better to key in the data accurately the first time.

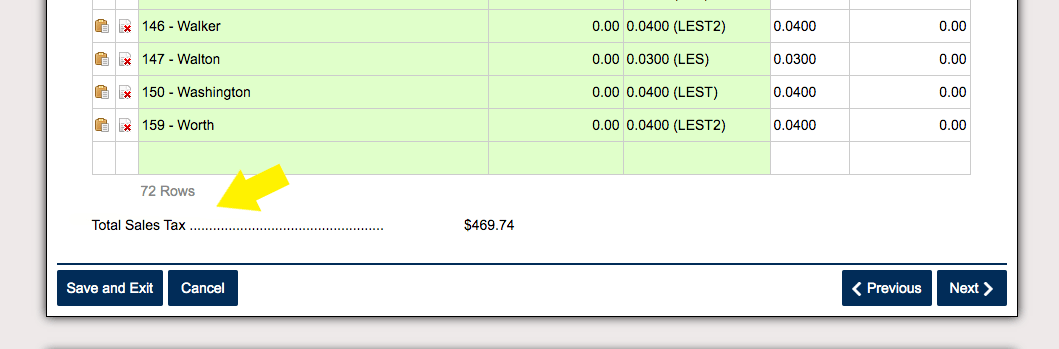

After you have accurately entered in the sales data, scroll all the way to the bottom of the page. Here is the “total sales tax” due, including both state and local taxes. If this looks correct, you can proceed to the next step. If it does not look right, go back through each line and verify that you have accurately entered in your data.

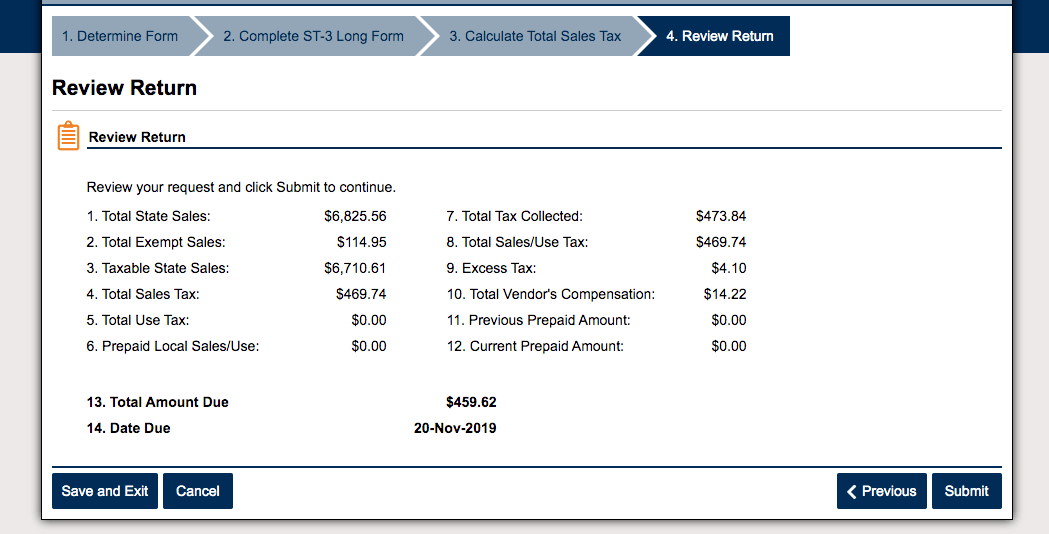

Step 9: Review the return

You will now be able to look over the entire return and verify that everything is correct.

You can see here that the tax collected is greater than the actual tax due. You must remit that difference as excess tax collected. In this example, the difference is $4.10. Hypothetically, if the amounts were reversed and we had collected less tax than was due, you would still have to pay the higher of the two amounts.

In order to properly file this return and abide by the law, you have to pay the greater of the actual tax collected and the tax due. You can use this as a good motivator to make sure that your tax collecting settings are correct in all of your sales channels.

Another point to note is that in Georgia, the vendor’s compensation is automatically calculated. If you don’t know, the vendor’s compensation amount is a discount offered by Georgia for filing on-time. Every state calls it something different, and some states don’t have it at all.

Now you should be all set. Just click the “Submit” button on the bottom right of the screen and your Georgia sales tax return is filed. Time to celebrate!

How to Pay Georgia Sales Tax

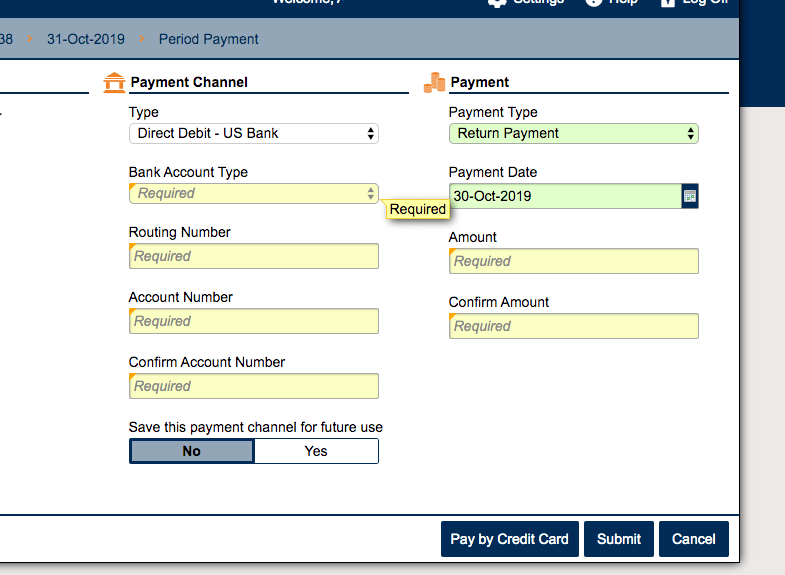

Now that you have filed your Georgia return, you need to pay the sales tax owed to the state. In order to pay the amount due, just follow the screen that came up after you submitted your return.

You should come to a screen that looks something like this:

As you can see, you have the option of paying by U.S. bank or credit card. If you can avoid using a credit card, you will avoid the extra fees associated with that type of payment.

Carefully enter your bank info, payment amount, and payment date accurately. I like to schedule the payment for the day before the return is due, just to be safe. Nobody likes late fees!

It is also a good practice to make sure that you see the payment drafted from your account on the scheduled payment date, especially if this is your first time filing a Georgia return. Now submit your payment and you are ready to go.

Things to Consider After Filing a Sales Tax Return in Georgia

If you forgot to print or save a copy of your sales tax return, no need to worry. You can easily go back into the period to view and/or print the return that you just filed. Go back to the dashboard and select the period that you wish to reprint. Now look under “I Want To.” Select “File or amend a return”. Select “Print Return”. Now save or print the return for your records.

How to Get Help Filing a Georgia Sales Tax Return

If you are stuck or have questions, you can contact the state of Georgia directly at (877) 423-6711 between 8:00 am and 6:30 pm EST. You can also find additional resources at the Georgia Department of Revenue (DOR) website.

But, if you are looking for a team of experts to handle your sales tax returns for you each month, you should check out our Done-for-You Sales Tax Service. Feel free to contact us if you’re interested in becoming a client!

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.