Quick Answer: This blog provides instructions for filing sales tax returns using the form TPT-2. This form is for filing periods beginning on or after June 1, 2016. If you are using form TPT-EZ, note that there may be some differences.

Do You Need to File an Arizona Sales Tax Return?

Once you have an active sales tax permit in Arizona you will need to begin filing sales tax returns. Not sure if you need a permit in Arizona? No problem. Check out our blog, Do you need to get a sales tax permit in Arizona. Also, If you would rather ask someone else to handle your Arizona filings, our team at TaxValet can handle that for you with our Done-for-You Sales Tax Service. We specialize in eliminating the stress and hassle of sales tax.

How to Sign-in to Arizona’s Website to File a Return

First, we will start with simple step-by-step instructions for logging on to the website in order to file your sales tax return for Arizona.

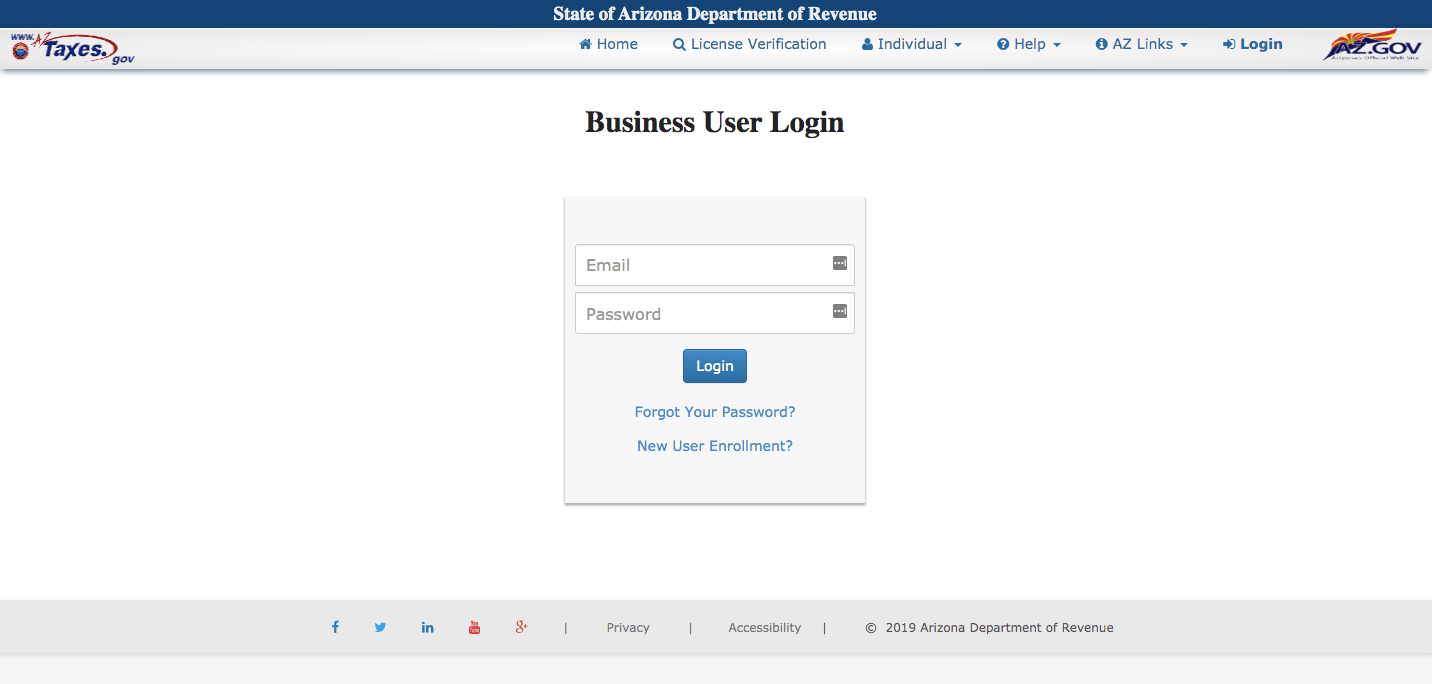

Step 1: Follow this link : https://www.aztaxes.gov/Home/Login to come to this screen.

Step 2: Sign in with your username and password.

If you do not have a username & password then your first step is setting that up. Your username and password are generally created when you submit registration paperwork for a sales tax permit. If you are not interested in doing the work of getting the permit or a state login yourself, TaxValet can handle that for you with our Sales Tax Permit Registration Service.

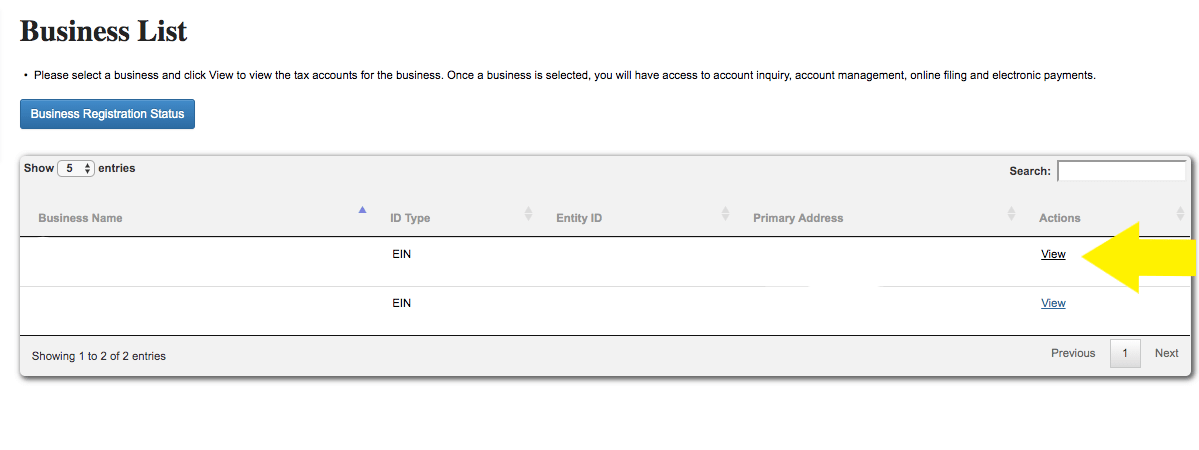

Step 3: You will be directed to your dashboard for that state.

Once you come to the dashboard, select the account for which you want to file a return by clicking the “View” button under the “Actions” header.

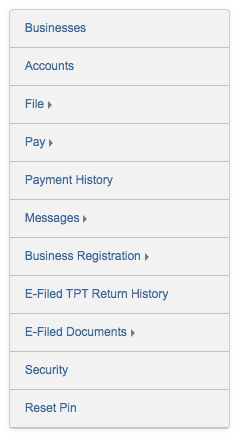

Step 4: Next, you will be directed to a page with a banner on the left side that looks like this.

The third option from the top is what we want. Select “Transaction Privilege and Use Tax Return” from the drop down.

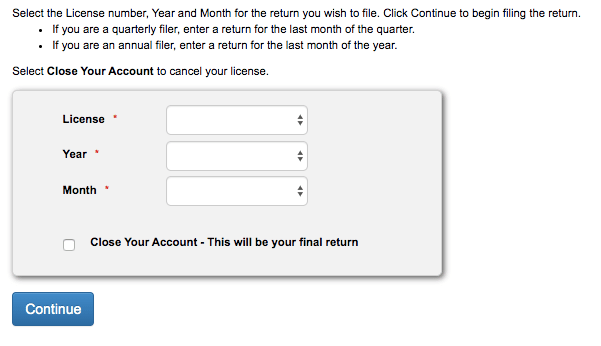

You will now come to a screen with three drop down menus with instructions to follow based on your filing frequency. Just choose the license number (which is your permit number), the year for the return that you wish to file, and the month of the return you wish to file or the last month of the corresponding period if you are a quarterly or annual filer. Next, click “Continue”.

After clicking continue, you will see a few more options come up. If you are amending a prior return or you have no gross sales to report for this period, you will need to check the corresponding box at this time.

Step 5: Now the fun part! You are now at the screen where you need to enter your transaction data. Arizona requires that you report your tax per location. This can be tedious and time consuming depending on how many individual sales you made in the state.

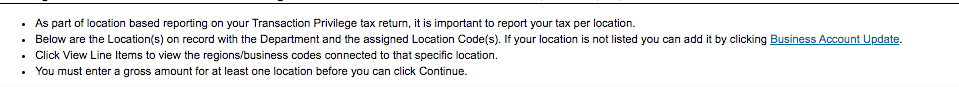

The good news is that at the top of each page, you can find instructions to follow as shown below:

After reading each line, select the location that you have on record. If your location is not listed, just click the link in the second bullet point and follow the instructions. You will also need to enter in the gross sales for that location.

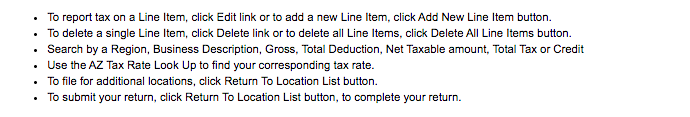

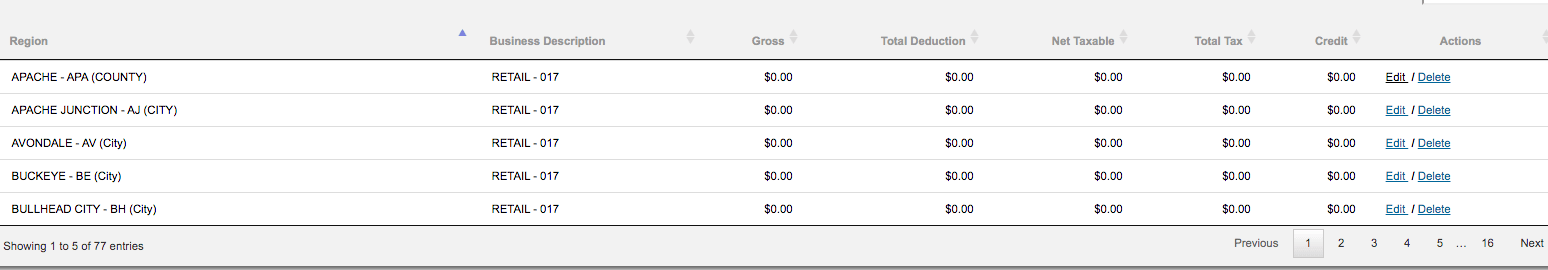

Step 6: Now you should see a new set of instructions at the top of the page as shown below:

This is where you can begin to add each jurisdiction where you made sales. Select “Add New Line Item” at the bottom of the page to add each location that you will need.

After you have all your locations added, you can then go into each location to enter the data.

Click “Edit” on the right side of the screen.

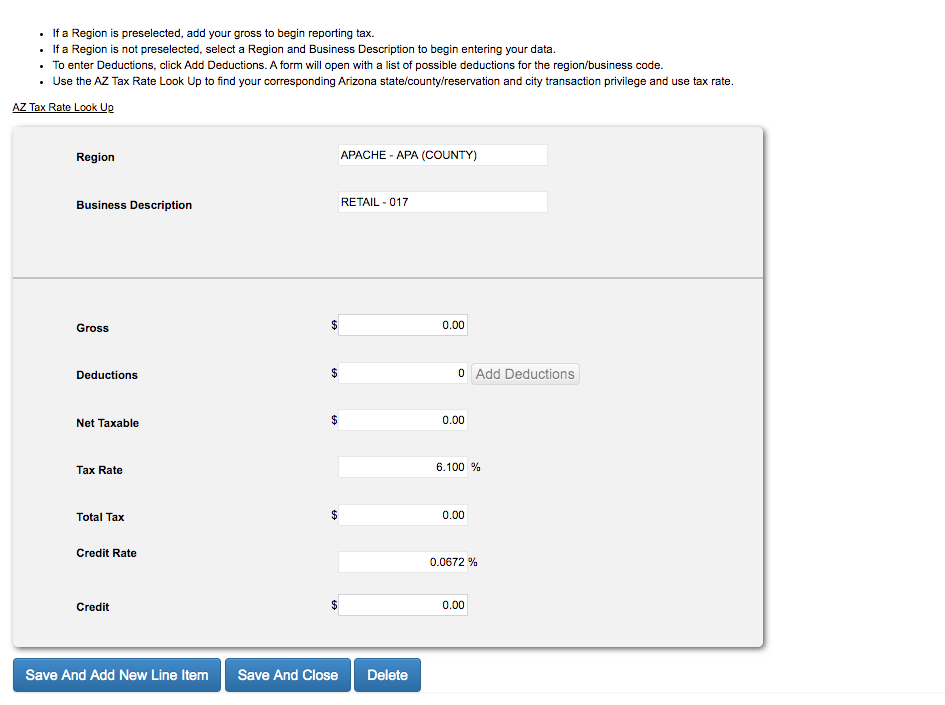

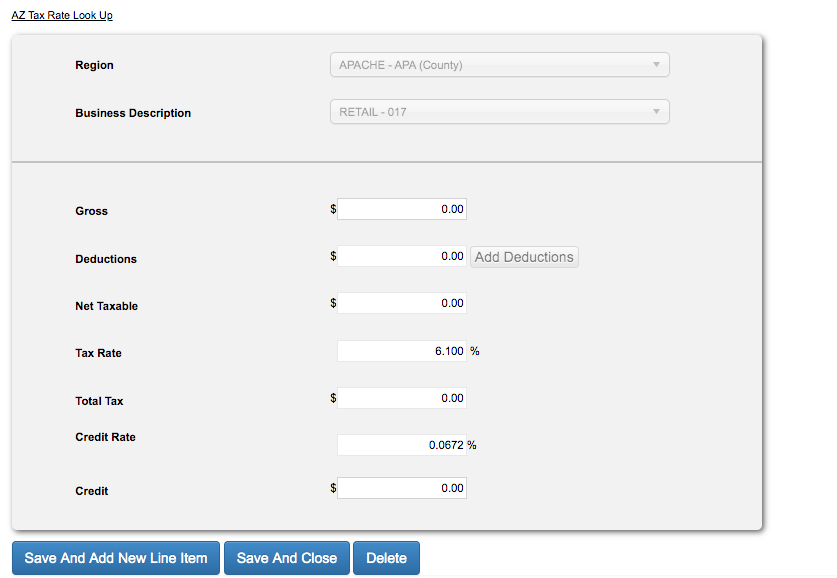

First enter in gross sales for that location. For AZ the total gross including tax is included in gross sales. To factor in tax for the sale, you have to add it as a deduction. This is an important point.

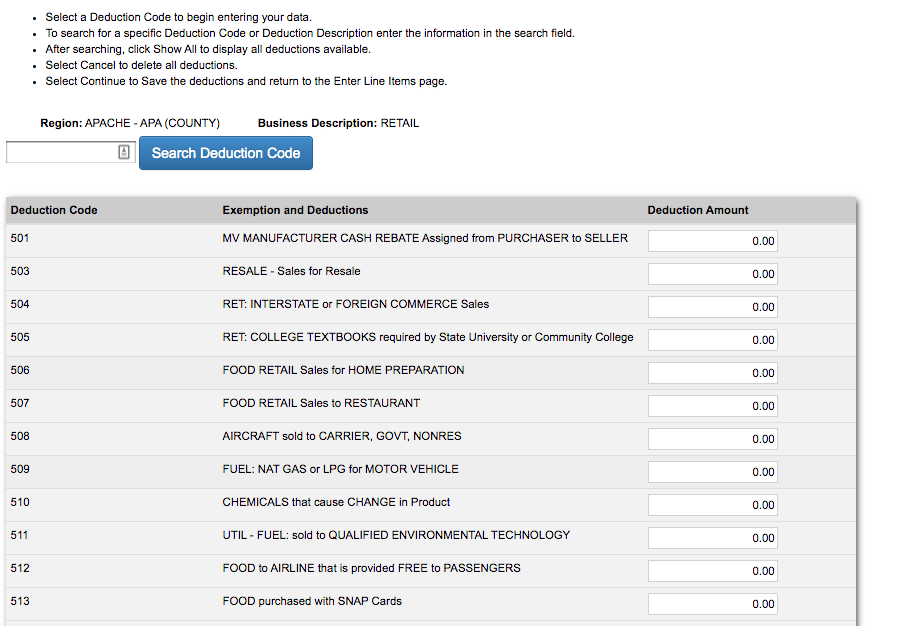

Next, select “add deductions”. You will come to this screen.

Each deduction has a related deduction code. For tax collected that you included in the gross sales, the code is 551. The code for shipping is 549.

After you enter all of the deductions for that jurisdiction, click “continue” at the bottom of the page. This will bring you back the tab where you can see the actual tax calculated for this period. If your filing is timely, be sure that the proper credit that you should get for that jurisdiction is factored into that total.

Now select “Save and Close”.

From here, go into each of the jurisdictions in which you made sales and enter the data. Make sure that if you have more than one physical location, you do not enter sales data from the wrong location.

An important point to make is that you can add the sales data in as you add each jurisdiction if you like. When adding the jurisdiction, it gives you the option of adding the sales data at that time.

Do whatever is easiest for you.

The final step is to select the “Return to Location List” button and submit your return.

How to Pay Arizona Sales Tax

After you have reviewed and submitted your return, be sure to sure to proceed with electronic payment. You can select the “Pay” tab on the left and then “TPT Payment.”

Key in the period that you are filing and the payment amount. Be sure to enter the correct payment date as well. Nobody wants to pay late fees!

Once you have processed your return and payment, be sure to save all documentation.

Now you are done! You have officially filed your Arizona sales tax return.

As a final step, it is always a good idea to verify that the correct amount of funds were withdrawn from your bank account on the correct day.

Things to Consider After Filing a Sales Tax Return in Arizona

If you forgot to print or save a copy of your sales tax return, don’t fret. You can easily go back into the period to view and/or print the return that you just filed. Just go back to the dashboard, click into the period you would like to view by navigating to that panel on the left side of the screen.

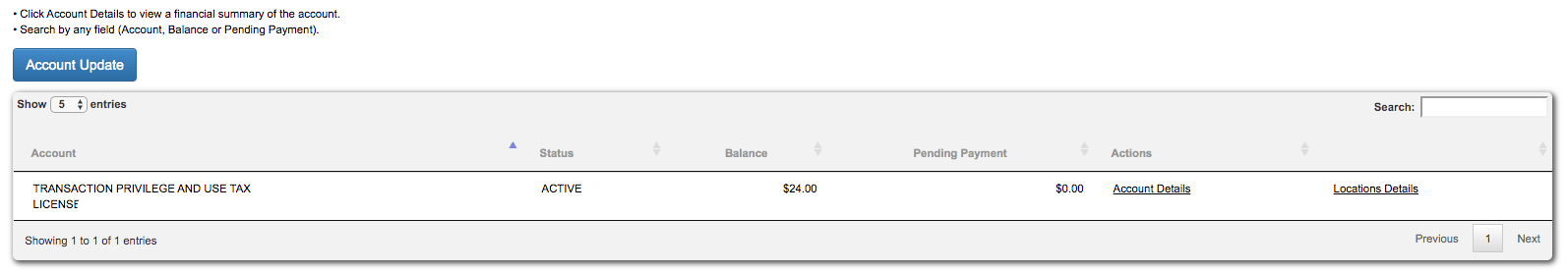

One more thing to note, Arizona charges a special fee in order to have the privilege of making sales into their state. The next time you go into the Arizona portal, you may find that you have an outstanding payment.

This is what it looks like:

If you see this, don’t worry. Arizona adds this fee for everyone.

How to Get Help Filing an Arizona Sales Tax Return

If you are stuck or have questions, you can contact the state of Arizona directly at (602) 255-3381 between 8:00 A.M. and 5:00 P.M. MST. You can also find additional resources at the Arizona Department of Revenue (DOR) website, https://azdor.gov/

But if you are looking for a team of experts to handle your sales tax returns for you each month, you should check out our Done-for-You Sales Tax Service. Feel free to contact us if you’re interested in becoming a client!

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.