Quick Answer: Registration for a sales tax permit in Alabama is best completed online via the Alabama Department of Revenue website. More detailed information on how to register for a sales tax permit in Alabama is included below.

Registration Fee: The sales tax permit registration fee in Alabama is free.

Renewal Required?: Sales tax permit renewal is required annually by Nov. 30 in Alabama.

Turnaround Time: The turnaround time in Alabama is 2-4 weeks; verification codes come through mail.

Do You Need to Get a Sales Tax Permit in Alabama?

The first step in registering for a sales tax permit is determining if you even need one. In general, you need a sales tax permit in Alabama if you have physical presence or meet economic nexus requirements. For more detailed information on the necessity of getting a permit, you can learn more at our blog post “Do I Need to Get a Sales Tax Permit in Alabama?”

If you are not sure where you should get sales tax permits, we can help determine that for you with our Done-for-You Sales Tax Service.

Once you’re sure you need a sales tax permit in Alabama, you can proceed with registering.

Types of Sales Tax Permits Available

There are three different types of sales tax permits available in Alabama. Please follow the links to learn more about each one and what applies to your business.

Sales Tax: https://revenue.alabama.gov/sales-use/faq/

Sellers Use Tax: https://revenue.alabama.gov/sales-use/faq/

Simplified Sellers Use Tax (SSUT): https://revenue.alabama.gov/sales-use/simplified-sellers-use-tax-ssut/

Please read the information associated with the permit types carefully to determine which permit is the best choice for your business.

How much does a sales tax permit in Alabama cost? There is currently no charge to apply for an Alabama sales tax permit.

Where to Go If You Need Help Registering for a Sales Tax Permit

If you are stuck or have questions, you can either contact the state of Alabama directly or reach out to us and we can register for a sales tax permit on your behalf.

How to contact the Alabama Department of Revenue if you have questions: You can contact the Alabama Department of Revenue by calling (332) 242-1490 for general information or (866) 576-6531 for paperless filing information.

How to contact TaxValet if you want someone to handle your permit registration for you: You can learn more about our sales tax permit registration service by clicking here.

Information Needed to Register for a Sales Tax Permit in Alabama

Before you begin the process of registering with the state, make sure you have access to the following information:

- Federal tax ID, typically called the EIN, issued by the IRS

- Knowledge of your business entity structure

- Business owner information

- North American Industry Classification System (NAICS) number

- Start date with the state of Alabama

- Your estimated yearly tax liability with Alabama

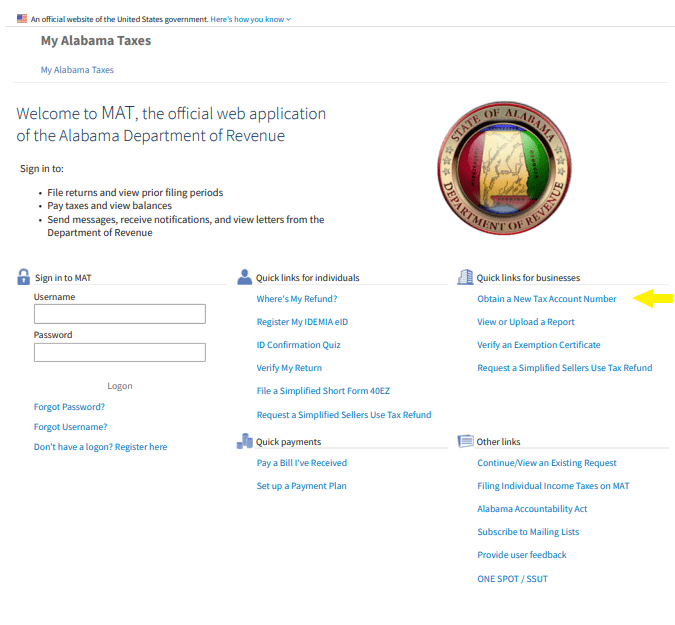

To get started, choose the link titled “Obtain a New Tax Account Number” on the website. This will allow you to start completing the online application.

What Happens after You Apply for a Sales Tax Permit in Alabama?

Once you apply for your sales tax permit with the state of Alabama, it should take around 7-10 business days before your permit comes in the mail. You will receive three pieces of mail from Alabama. The first one will be your sales tax permit. The second one will be your registration letter with the state. Finally, that third one will be a confidential letter that will include confidential information needed to register online.

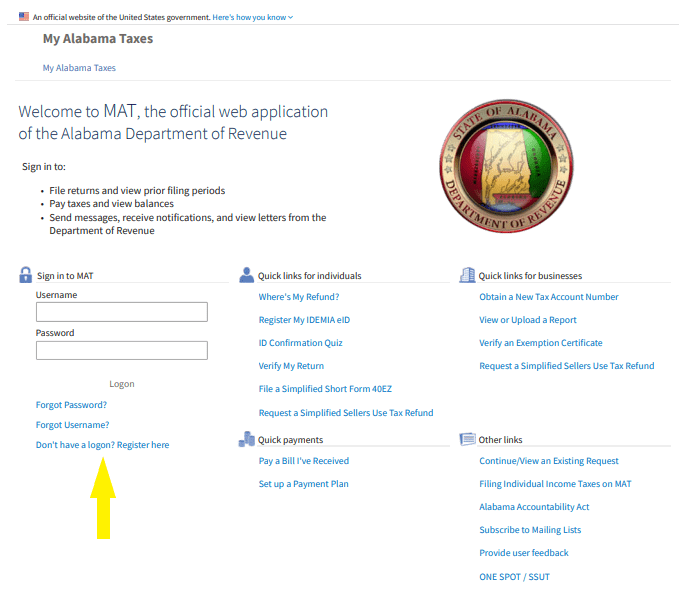

When you receive the confidential letter, return to the Alabama Department of Revenue website to create your online profile.

You will select “Don’t have a login? Register here” After changing the account type, follow the directions to create your online login information.

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.