Quick Answer: This blog gives instructions for how to file and pay sales tax in Ohio with the UST-1 Sales Tax Return, a return commonly used by out-of-state sellers.

Do You Need to File an Ohio Sales Tax Return?

Once you have an active sales tax permit in Ohio, you will need to begin to file and pay sales tax returns. Not sure if you need a permit in Ohio? No problem. Check out our blog, Do You Need to Get a Sales Tax Permit in Ohio?

Also, If you would rather ask someone else to handle your Ohio filings, our team at TaxValet can handle that for you with our Done-for-You Sales Tax Service. We specialize in eliminating the stress and hassle of sales tax.

Steps for Filling out Ohio’s Sales Tax Return

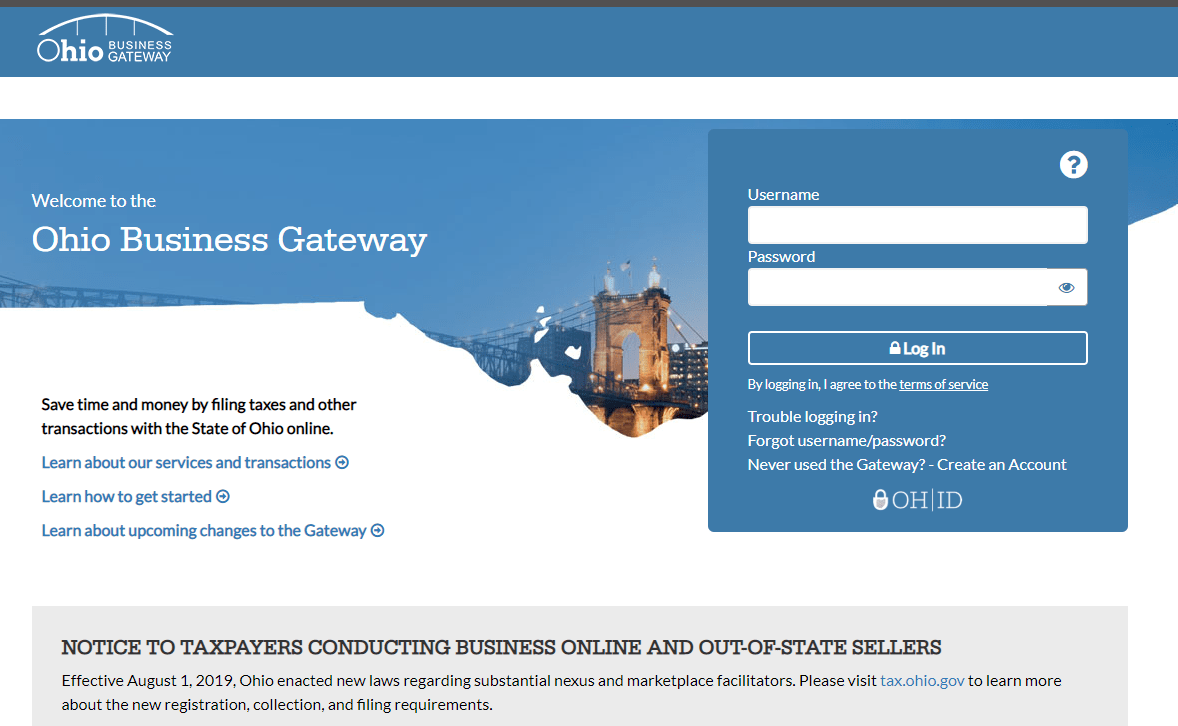

The first step to file and pay your Ohio sales tax return is to log on to the Ohio Gateway here.

If you do not have a username and password you need to click on “Never used the Gateway? Create an Account” and then follow the instructions for signing up.

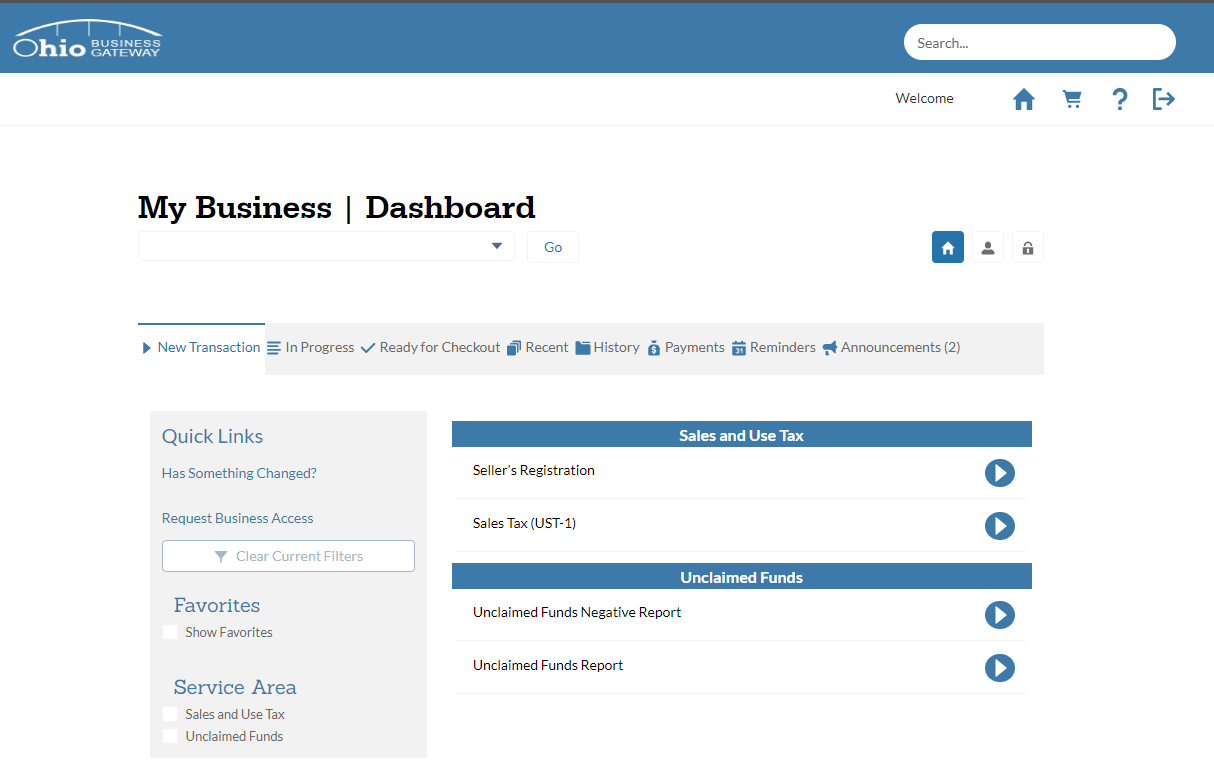

Step 1: After logging on, you should now be on the dashboard. Click on “Sales Tax (UST-1).”

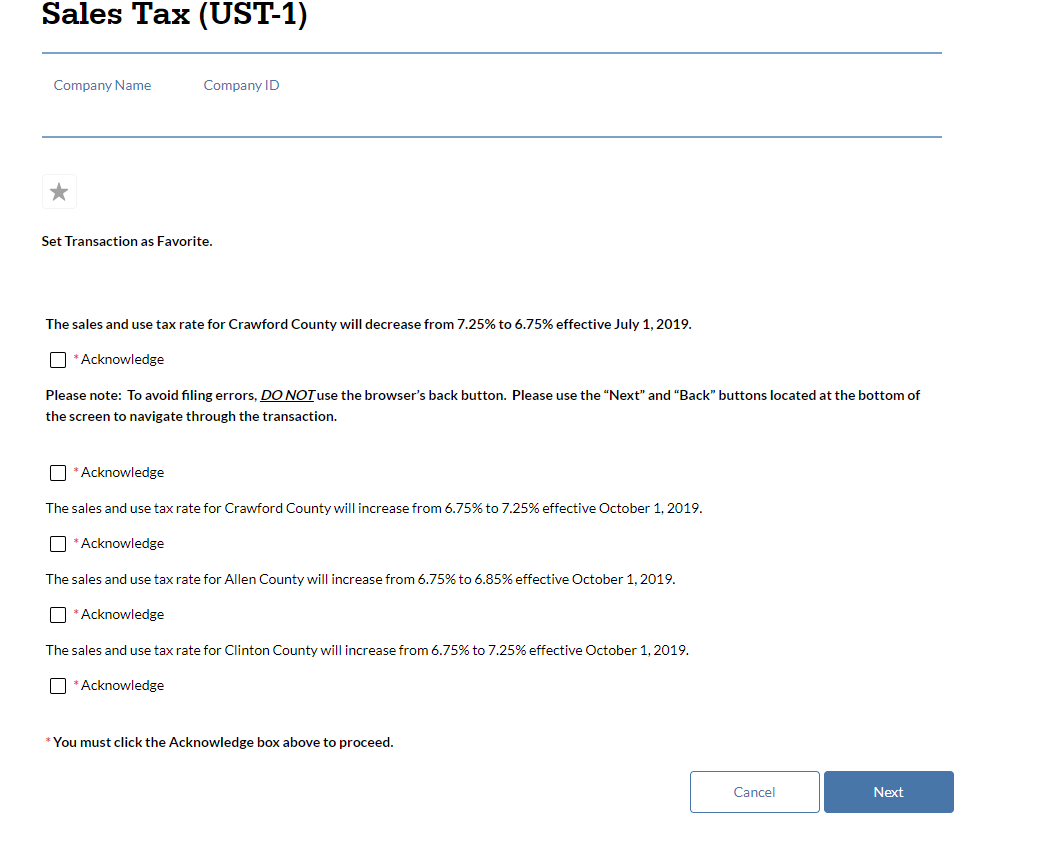

Step 2: Read and acknowledge any new updates in order to proceed. Then click “Next.”

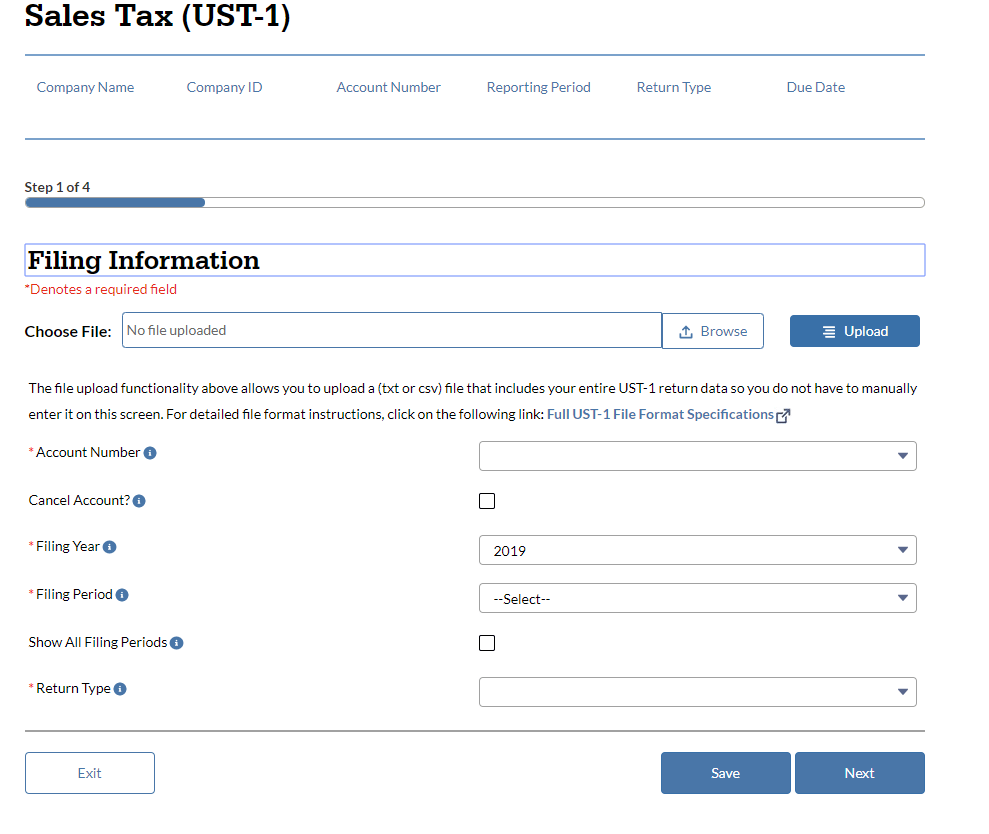

Step 3: Select your filing period. The return type will auto-populate for you if this is an original return. Click “Next.”

The file upload functionality allows you to upload a txt or csv file that includes your county sales data so you do not have to manually enter it on this screen. For detailed file format instructions, click on this link that provides county data file format specifications.

Step 4: Either upload or enter manually your taxable sales and tax liability in each county that you have. Note, there are MANY counties. You can add counties by clicking the “Add Counties” button at the top. You can toggle between pages of counties using these buttons:

Once you are finished adding all the counties, click “Next.”

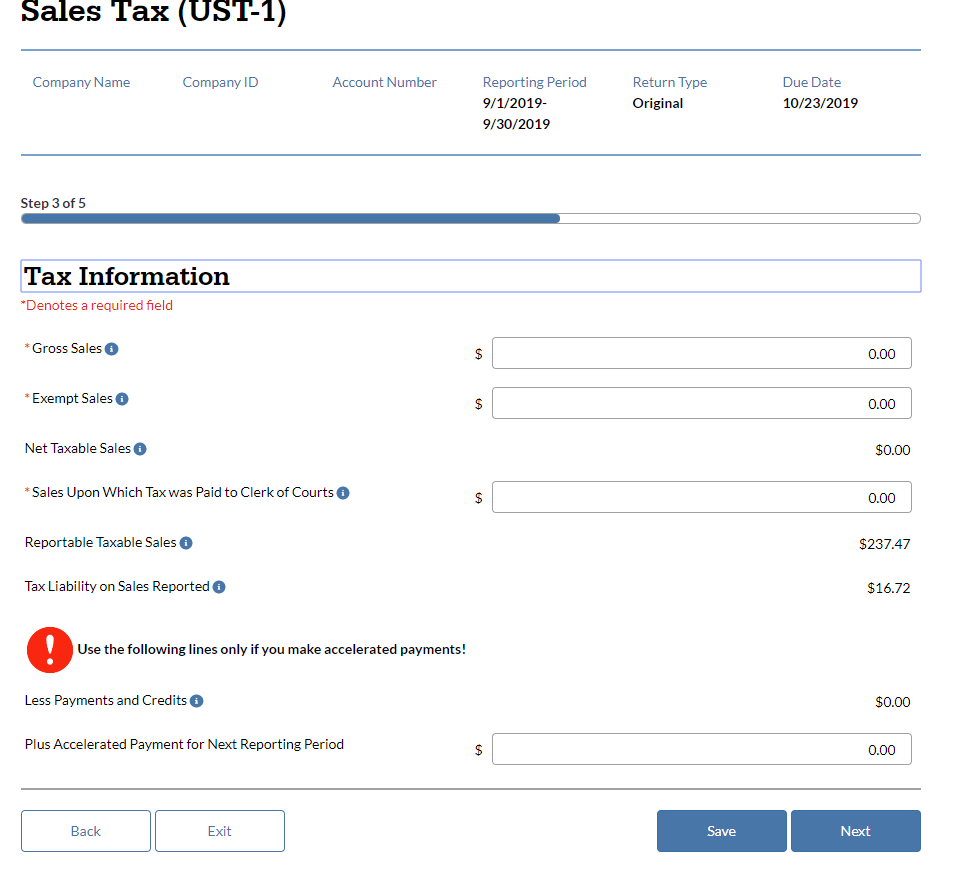

Step 5: Enter your gross sales, exempt sales, and sales upon which tax was paid to the Clerk of Courts. Then, click “Next.”

Note: If you have marketplace sales you would include those sales in your gross sales numbers then enter the marketplace sales in the exempt line.

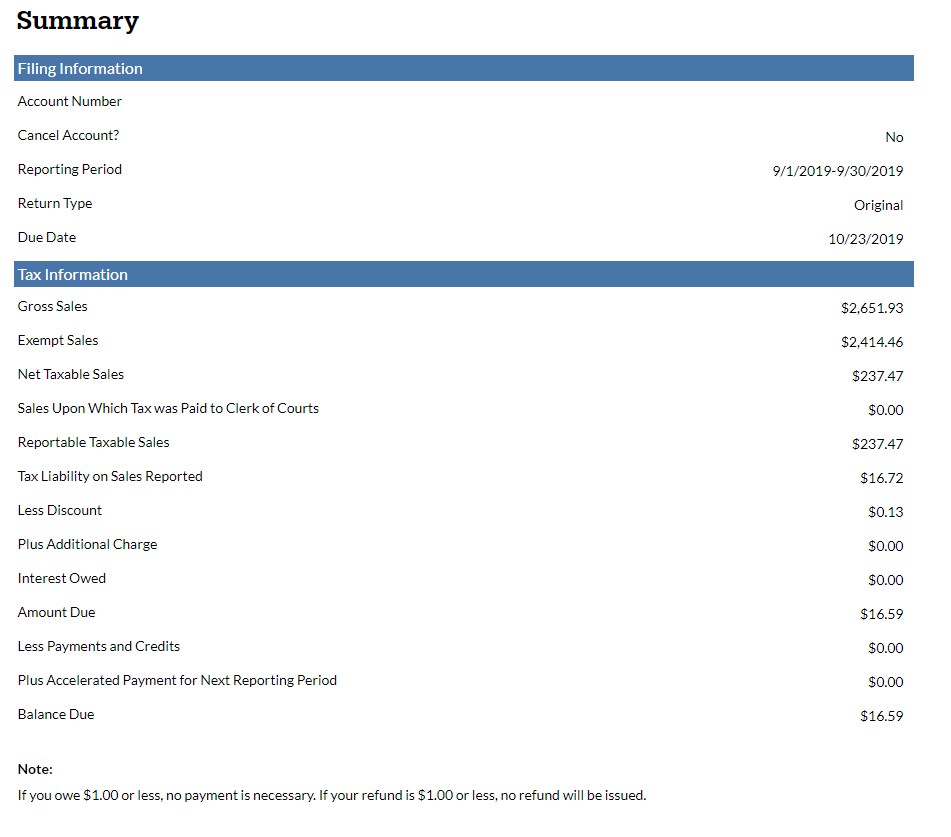

Step 6: You are now ready to review your UST-1 Sales Tax Return. If everything looks correct check the box and click “Accept.”

How to Pay Ohio Sales Tax

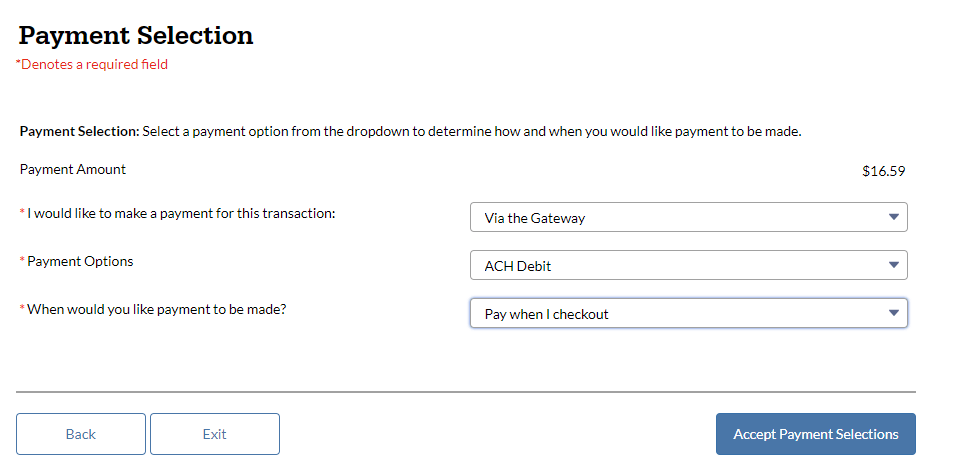

Ohio will not let you file a return without payment.

Step 7: You have two options for making a payment via the Gateway (this website). Recommended is using ACH debit. As another option, you can also use a credit card for an extra fee. Once you have made your selections, click “Accept Payment Selections.”

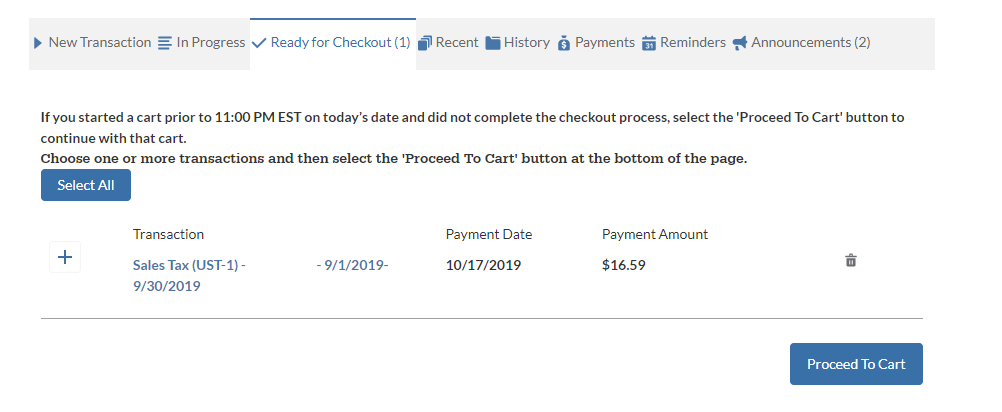

Step 8: You now should be back at the dashboard, At the top of your dashboard you should see a number “(1)” next to “Ready to Checkout.” Click here and your transaction should come up on the screen. Next, click on the “+” sign and then proceed to your cart.

Step 9: Review your payment and select your payment method. Here we will select “ACH Account.” Then, click “Next.” Now, you made it to the last step! Click the “Acknowledge” box and click “Complete Checkout.” You now have a receipt with a confirmation number. Make sure to save the confirmation number and a copy of your return for your records.

Things to Consider After Filing a Sales Tax Return in Ohio

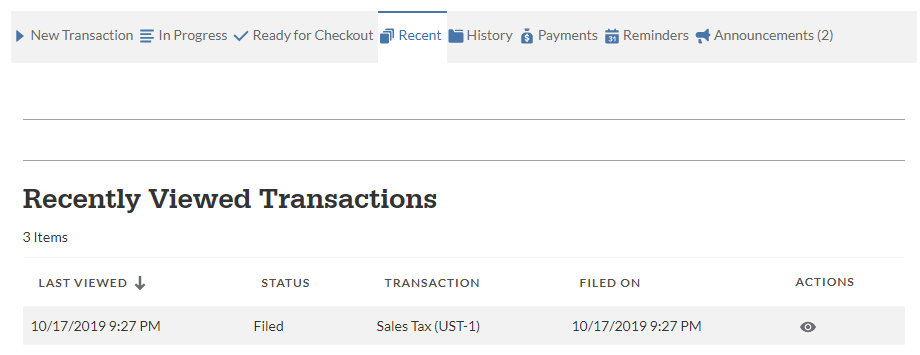

You should make a copy of your return for your records. To do this go back to the Dashboard/Homepage. Click on the “Recent” tab.

You should then see a listing with the return you just filed. Click on the eyeball. This will bring up your payment receipt. At the bottom of your receipt will be a link to a pdf of your UST-1 Summary. Click on this to print your return.

How to Get Help Filing an Ohio Sales Tax Return

Lastly, here is the contact information for the state if case you end up needing help:

Gateway Help Desk: Available at 866-OHIO-GOV (866-644-6468) for help with filing a return, answering general questions, or assistance with logging in to the website.

The Help Desk is available Monday through Friday 8 a.m. – 5 p.m., excluding state holidays.

Instead, if you are looking for a team of experts to handle your sales tax returns for you each month, you should check out our Done-for-You Sales Tax Service. Feel free to contact us if you’re interested in becoming a client!

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.