Quick Answer: This blog provides instructions on how to file and pay sales tax in Missouri using form 53-V. This is the most commonly used form to file and pay sales tax in Missouri. You can reference Missouri’s sales tax form webpage here. There is a search function on this page that will allow you to specifically search for the form that you need.

Do You Need to File a Missouri Sales Tax Return?

Once you have an active sales tax permit in Missouri you will need to begin filing sales tax returns. Not sure if you need a permit in Missouri? No problem. Check out our blog, Do You Need to Get a Sales Tax Permit in Missouri?

Also, If you would rather ask someone else to handle your Missouri filings, our team at TaxValet can handle that for you with our Done-for-You Sales Tax Service. We specialize in eliminating the stress and hassle of sales tax.

How to Sign-in and File a Return on Missouri’s Website

Let’s start with simple step-by-step instructions for logging on to the website in order to file and pay your sales tax return in Missouri.

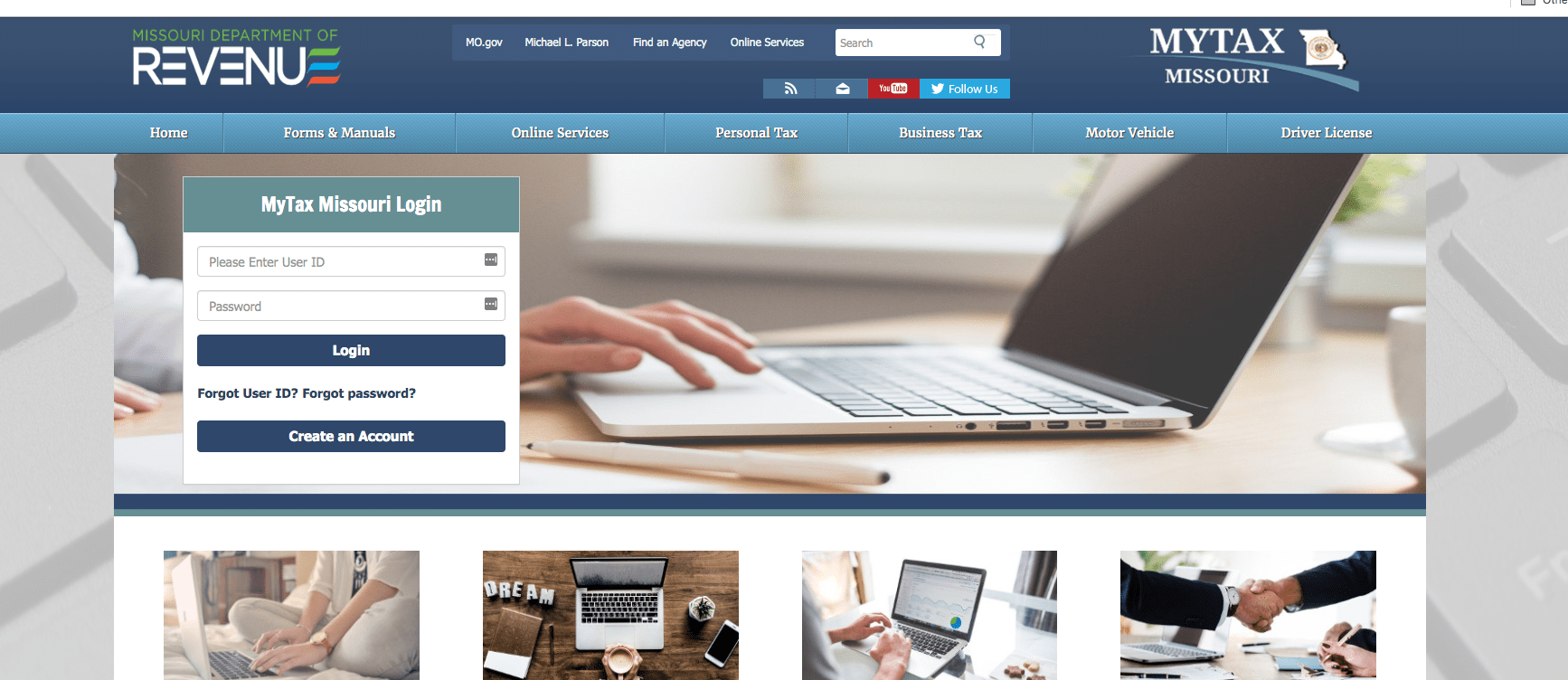

Step 1: Follow this link, https://mytax.mo.gov/rptp/portal/home/, to come to this screen:

Step 2: Sign in with your username and password.

If you do not have a username and password, then your first step is to set that up. These login credentials are generally created when you submit registration paperwork for a sales tax permit with the state. If you are not interested in doing the work of getting the permit or a state login yourself, TaxValet can handle that for you with our Sales Tax Permit Registration Service.

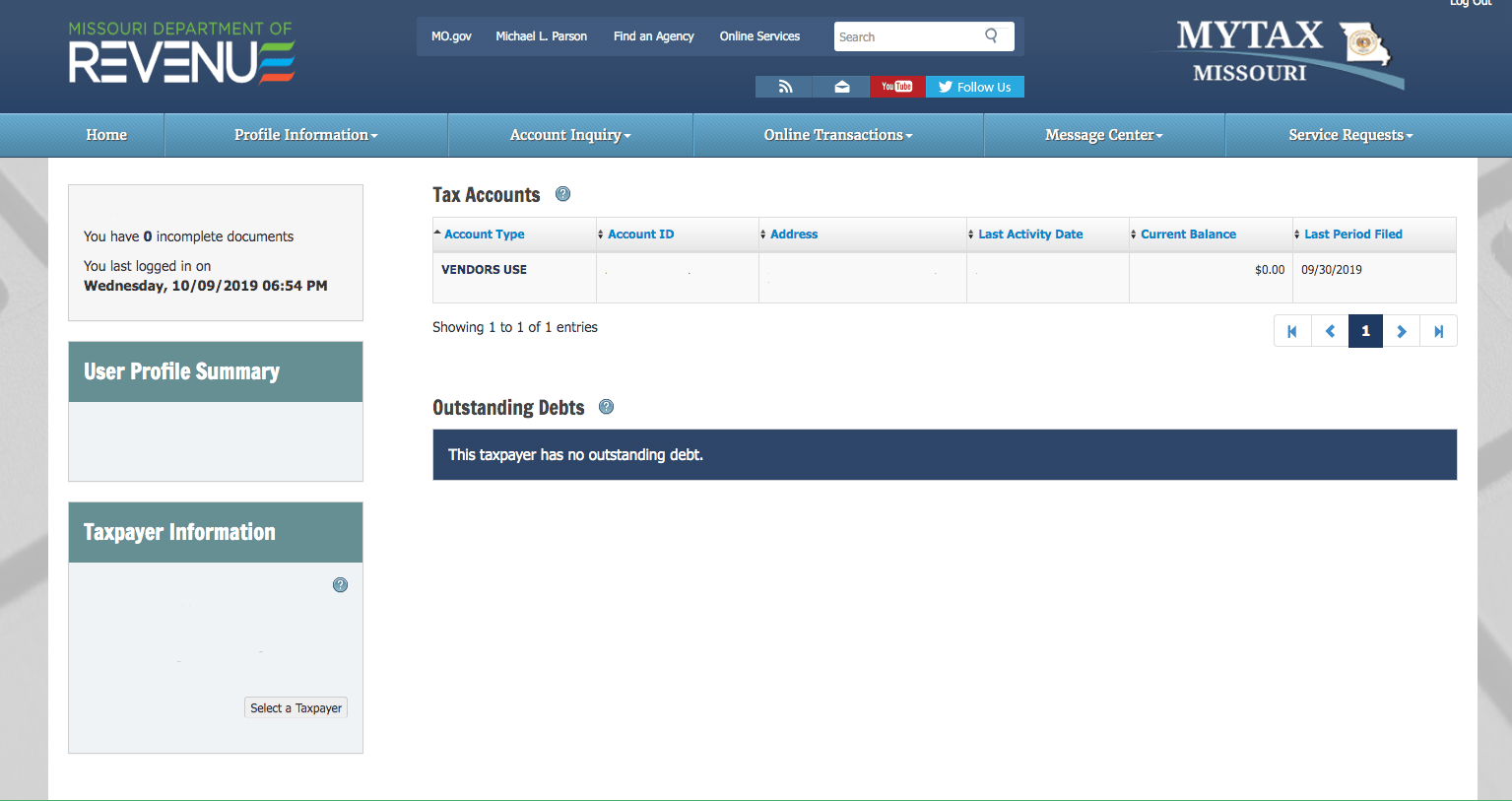

Step 3: You will be directed to the dashboard for the state.

Think of this page as your home base. You can always come back to this page if you get lost.

Take a minute here to explore. Missouri has a unique dashboard compared to other states. On the left side, you can see if you have any incomplete documents, your user profile summary, as well as your business name and address.

Click through the tabs that run across the top. Visiting the message center is generally a good idea. If the state needs you to know something, they will likely send it here.

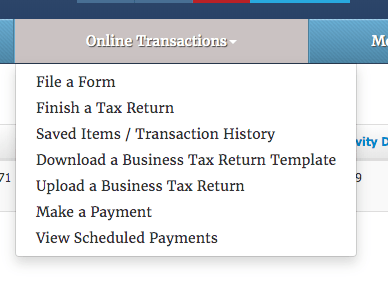

Once you feel that you have a good understanding of the dashboard, proceed by clicking “File a Form” under the “Online Transactions” tab.

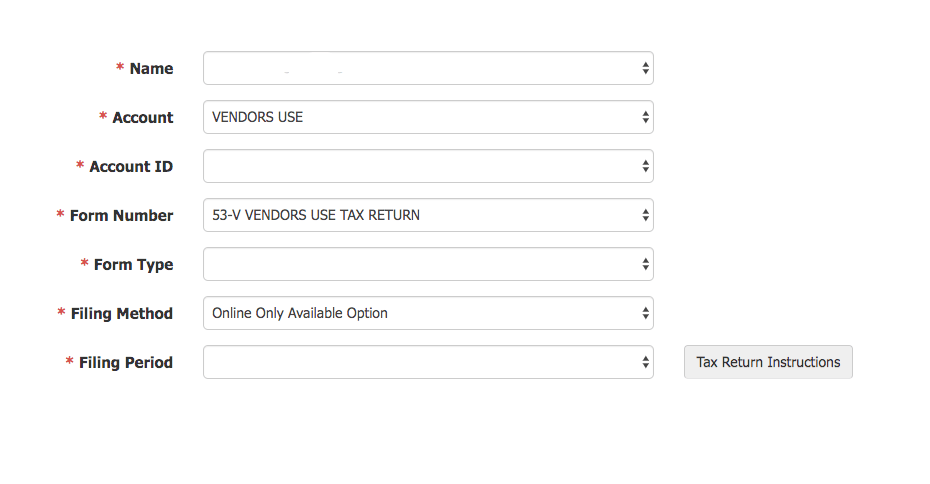

Step 4: You will be directed to this page.

On this page, you need to select the form type and the filing period. I also strongly recommend downloading the “Tax Return Instructions”. It breaks down how to file the Missouri return and is very helpful. After downloading this, proceed to the next page.

Step 5: Key in Sales Data

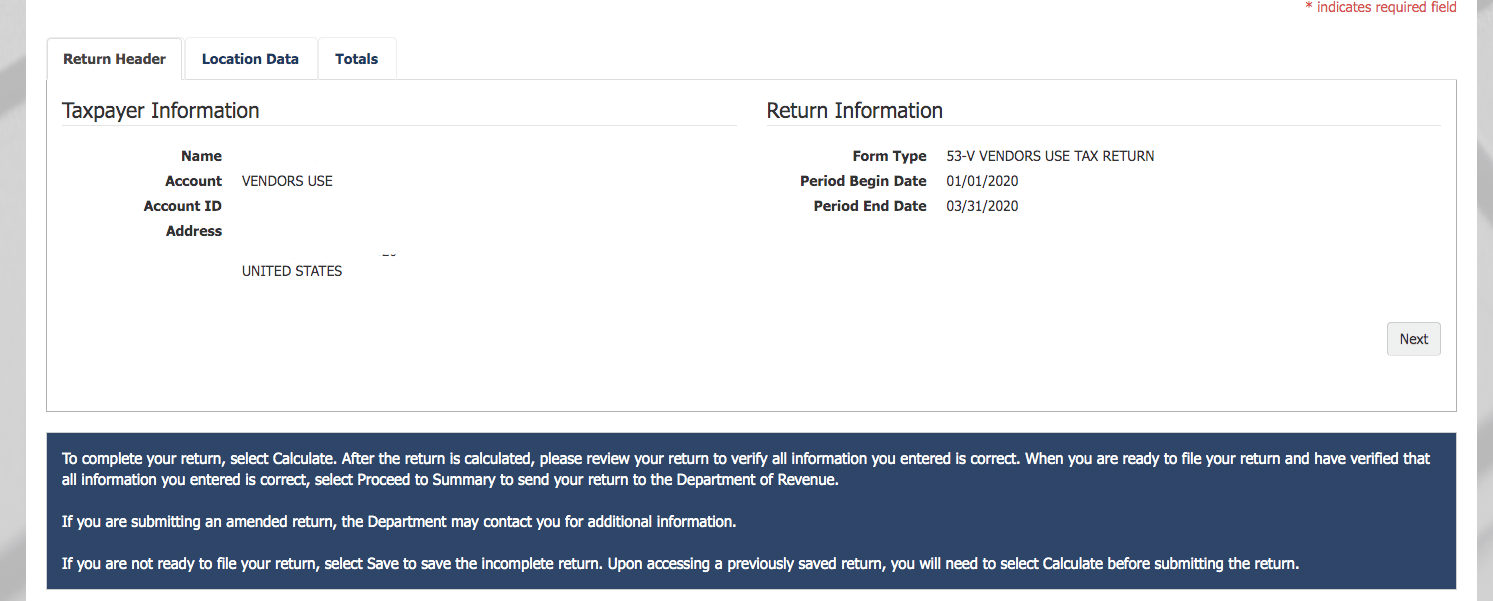

You are now faced with a screen that looks something like this:

Notice the three tabs at the top of the page. The “Return Header” tab is where you will go to verify your business information. The “Location Data” tab is where you will enter your data by locality. Be sure to also include the “MISSOURI STATE ONLY” location code to properly calculate the state tax. The “Totals” tab will be where you can review the summary of the “Location Data” tab.

The first step is to enter your sales data under the “Locations Data” tab. Once you have entered in all of your sales data by jurisdiction correctly, you need to go back to the “Return Header” tab and press “Calculate.” This will calculate the tax that you owe.

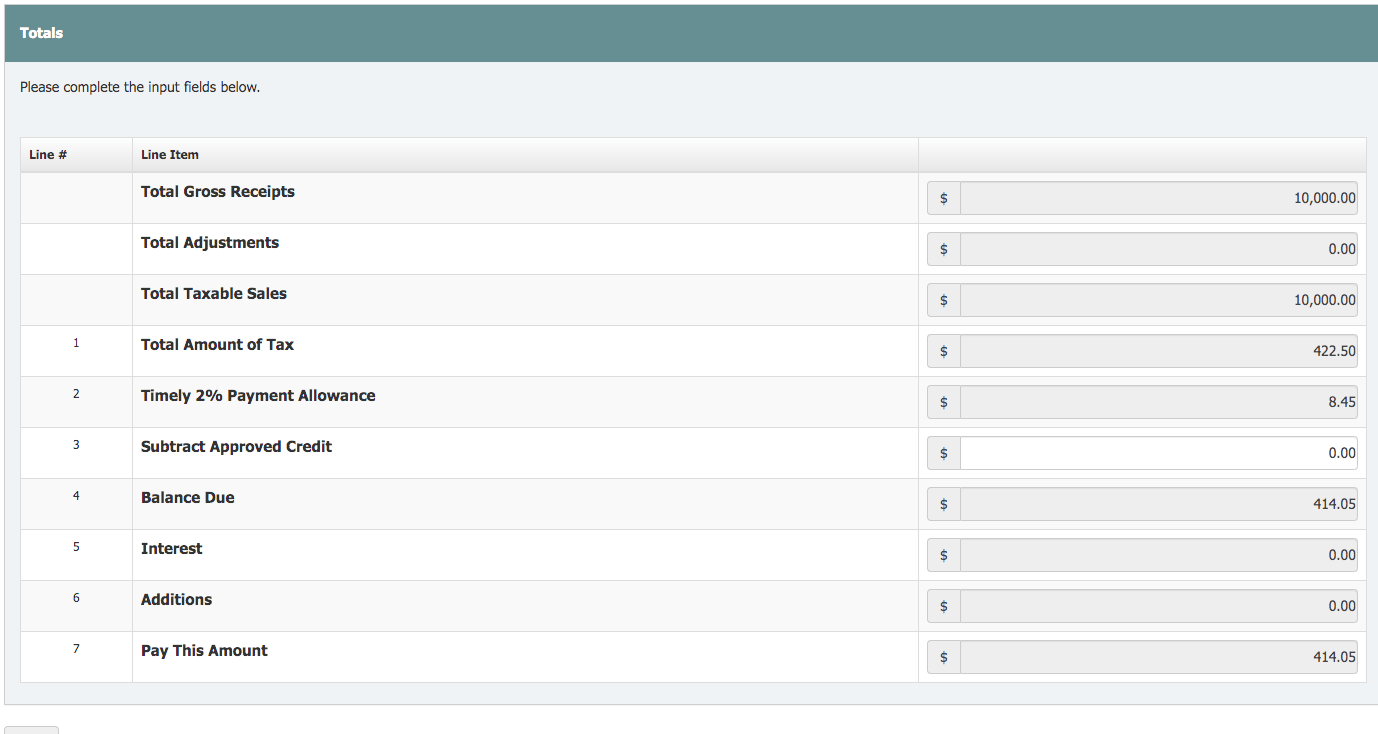

Now go back to the “Totals” tab and check your results.

You should now see all of the lines (besides line 3) auto-populate. Line 3 only applies to you if you have a credit from a prior return.

Assuming all of the numbers look correct, scroll to the bottom and select “Proceed to Summary”.

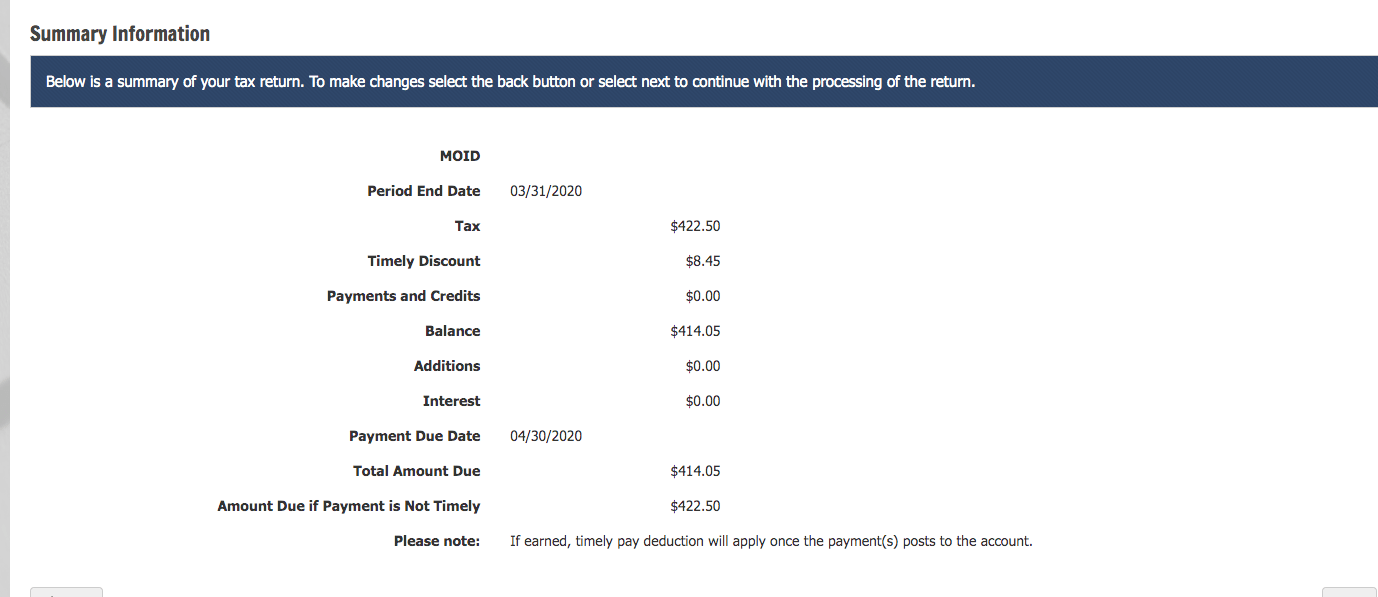

Now you will be able to review everything again on the summary information page.

Select “Next” after reviewing this page thoroughly.

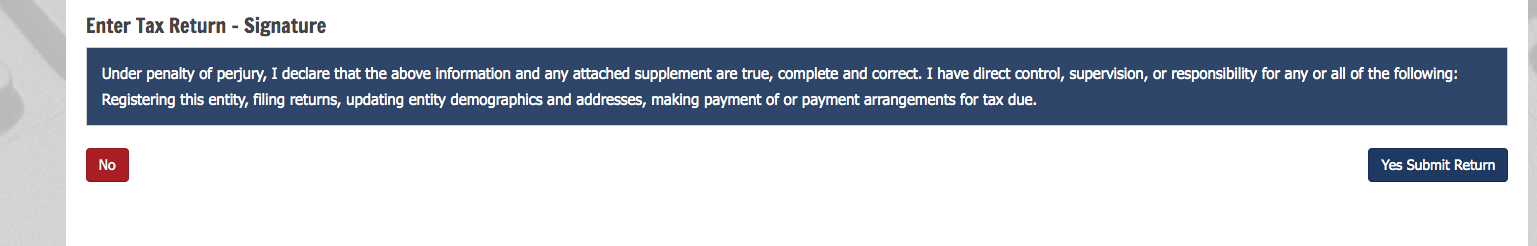

Step 6: Submit your return.

If you agree to the perjury statement, then select “Yes Submit Return” and now you are officially finished with your Missouri sales tax return.

How to Pay Missouri Sales Tax

If you wish to pay your sales tax due while submitting the sales tax return, select that option after filing your return. You can also make a payment by navigating back to the dashboard and selecting “Make a Payment” in the drop-down menu under “Online Transactions.”

You will now need to choose the type of payment. Once you do that, your account information will auto-populate. You will need to select the appropriate filing period and select “Next”. Key in the amount that you need to pay to the state of Missouri and select your desired payment method.

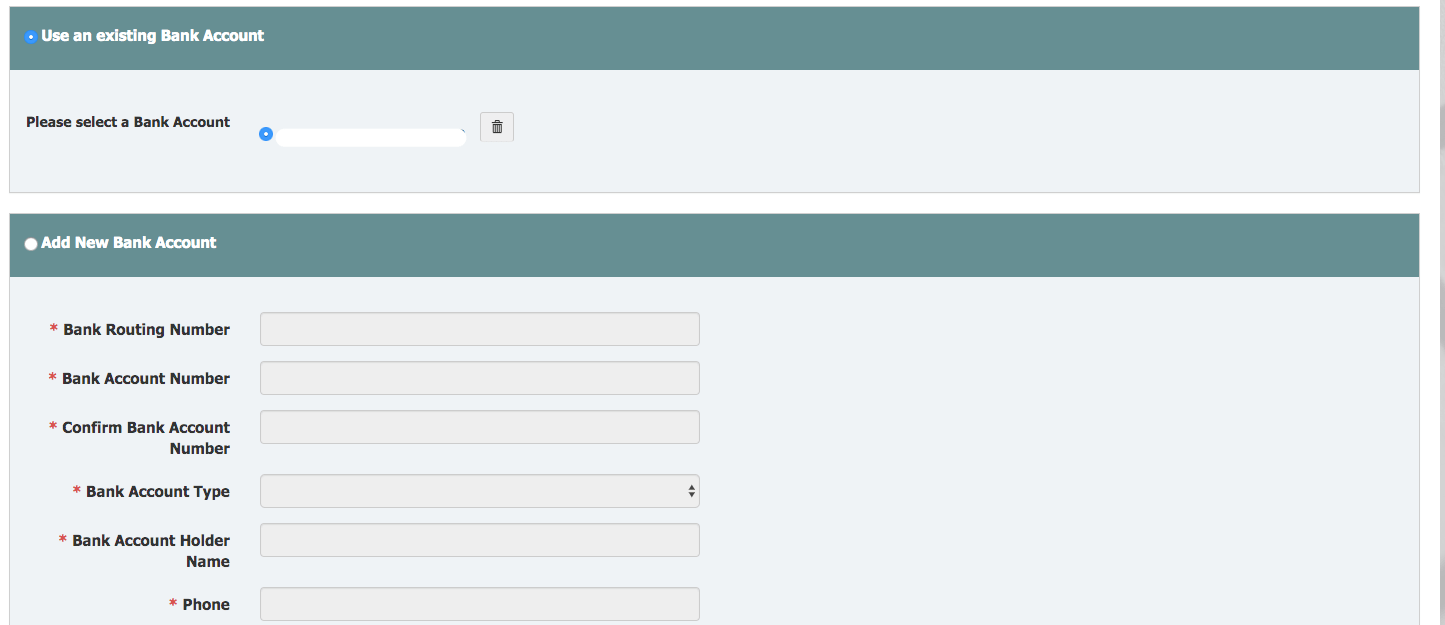

You can now either use a bank account already on file or add a new account.

Select the appropriate payment option and scroll to the bottom of the page. Be sure to schedule the payment at least by the due date of the return, if not before. If your payment is late, you will likely incur late fees.

Once you are sure that everything is correct, hit “Submit”. That’s it! You are officially finished filing and paying your Missouri sales and use tax return.

Things to Consider After Filing a Sales Tax Return in Missouri

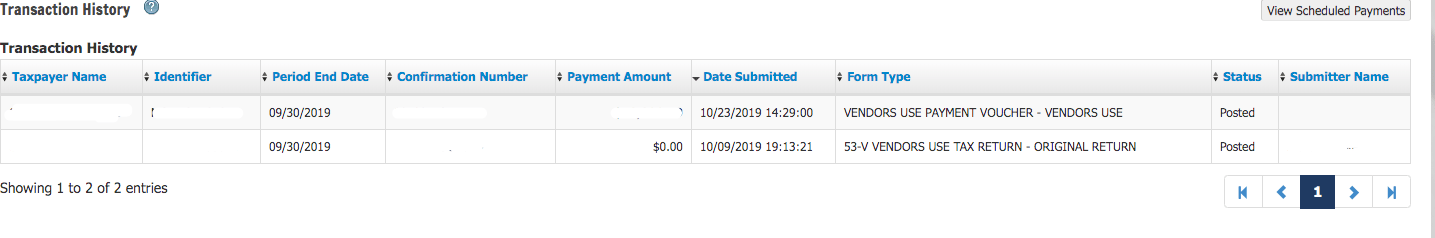

If you forgot to print or save a copy of your sales tax return, don’t sweat it. You can easily go back into the period to view and/or print the return that you just filed. Go back to the dashboard and select the “Saved Items / Transaction History” from the “Online Transactions” drop-down menu. You will now see something like this:

Now just select the confirmation number link if you wish to view the return, or the payment amount link if you wish to view the payment. You will now be able to save/print these documents for your records.

How to Get Help Filing a Missouri Sales Tax Return

If you are stuck or have questions, you can contact the state of Missouri directly at (573) 751-4450 between 8:00 a.m. and 5:00 p.m. CST. You can also find additional resources at the Missouri Department of Revenue (DOR) website.

Instead, if you are looking for a team of experts to handle your sales tax returns for you each month, you should check out our Done-for-You Sales Tax Service. Feel free to contact us if you’re interested in becoming a client!

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.