Quick Answer: This blog provides instructions on how to file and pay sales tax in Connecticut using form OS-114. This is the only form used by out-of-state sellers reporting sales tax to the state of Connecticut.

Do You Need to File a Connecticut Sales Tax Return?

Once you have an active sales tax permit in Connecticut you will need to begin to file and pay sales tax returns. Not sure if you need a permit in Connecticut? No problem. Check out our blog, Do You Need to Get a Sales Tax Permit in Connecticut? Also, If you would rather ask someone else to handle your Connecticut filings, our team at TaxValet can handle that for you with our Done-for-You Sales Tax Service. We specialize in eliminating the stress and hassle of sales tax.

How to Sign in to Connecticut’s Website to File a Return

First, we will begin with simple step-by-step instructions for logging on to the website in order to file and pay your sales tax return for Connecticut.

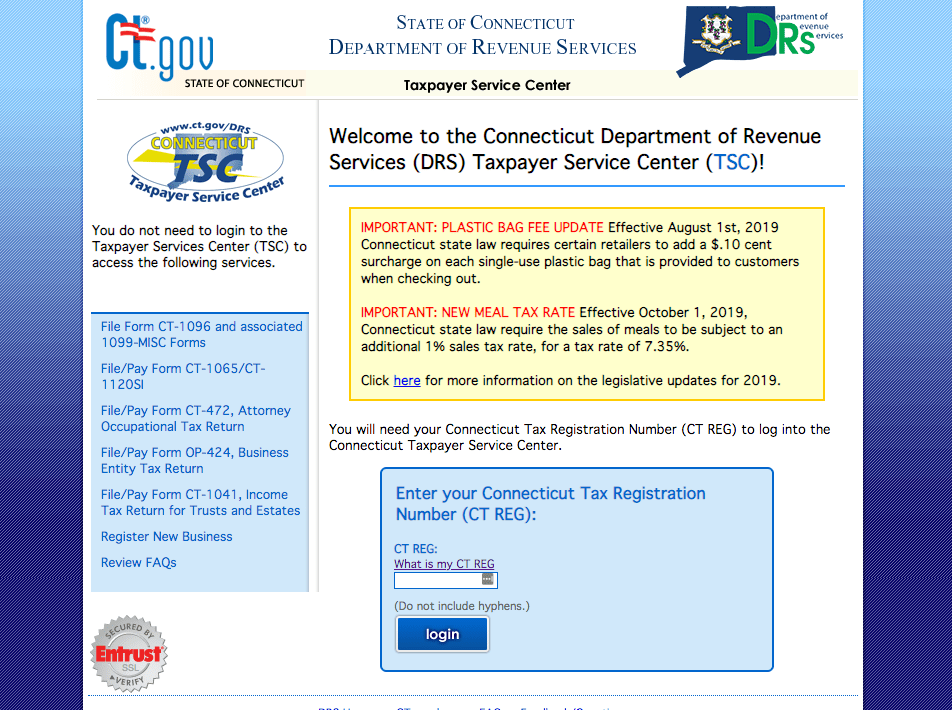

Step 1: Follow this link, https://drsbustax.ct.gov/AUT/welcomebusiness.aspx, and you will arrive at this screen:

Step 2: Sign in with your CT REG, username, and password. Your CT-REG is the number assigned to you by the Department of Revenue Services. It can be located on all returns and correspondence from this department.

If you do not have a CT REG, username, and password then your first step is setting that up. These login credentials are generally created when you submit registration paperwork for a sales tax permit. If you are not interested in doing the work of getting the permit or a state login yourself, TaxValet can handle that for you with our Sales Tax Permit Registration Service.

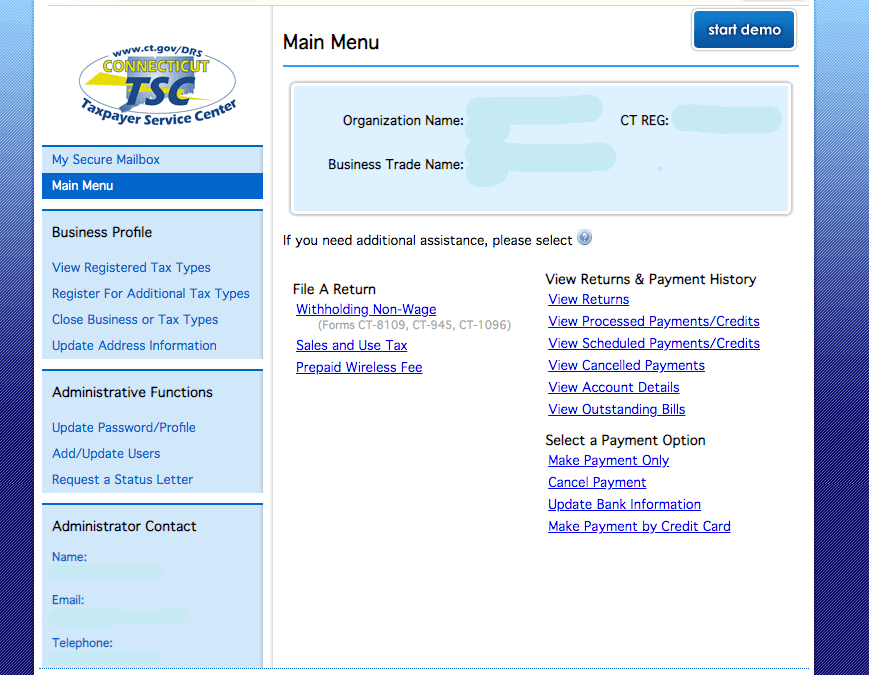

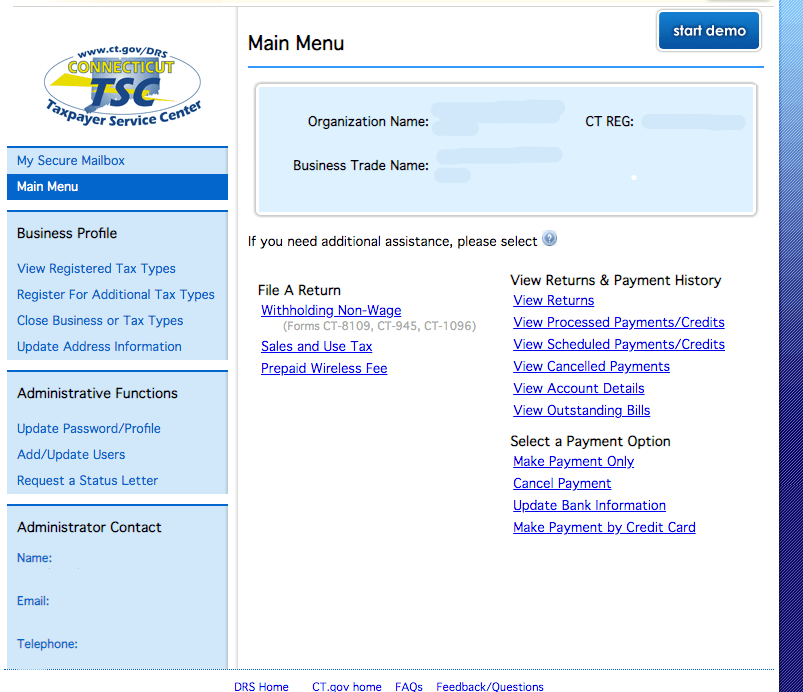

Step 3: You will be directed to your dashboard for the state. Once you come to the dashboard, select the “Sales and Use Tax” link under “File a Return”.

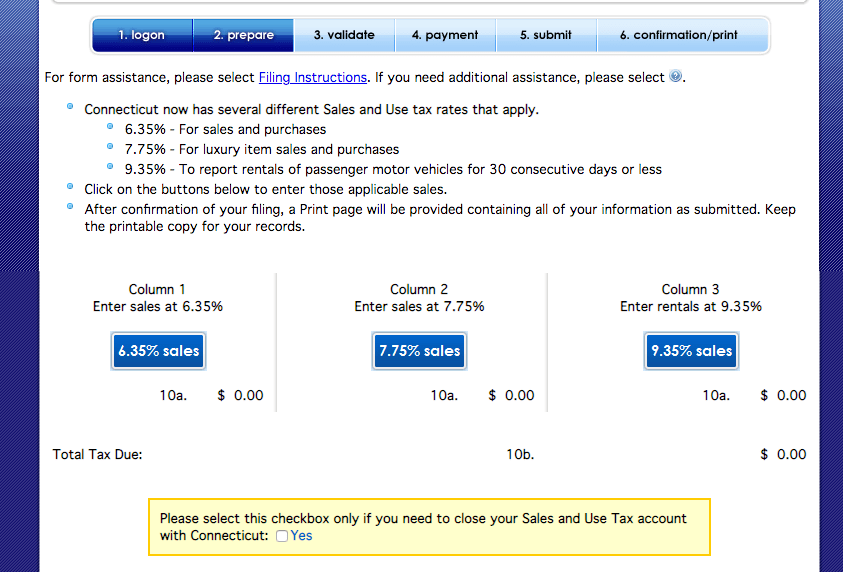

Step 4: On the next page, select the correct period from the offered drop-down menu. Then, click “Next”. Now you will see the page where you will prepare the return.

You will see instructions that reference different sales tax rates in Connecticut. Of note, 6.35% is the standard rate. However, be sure that you submit the correct rate based on the instructions provided and your business. To begin, click on the rate button that most applies to you.

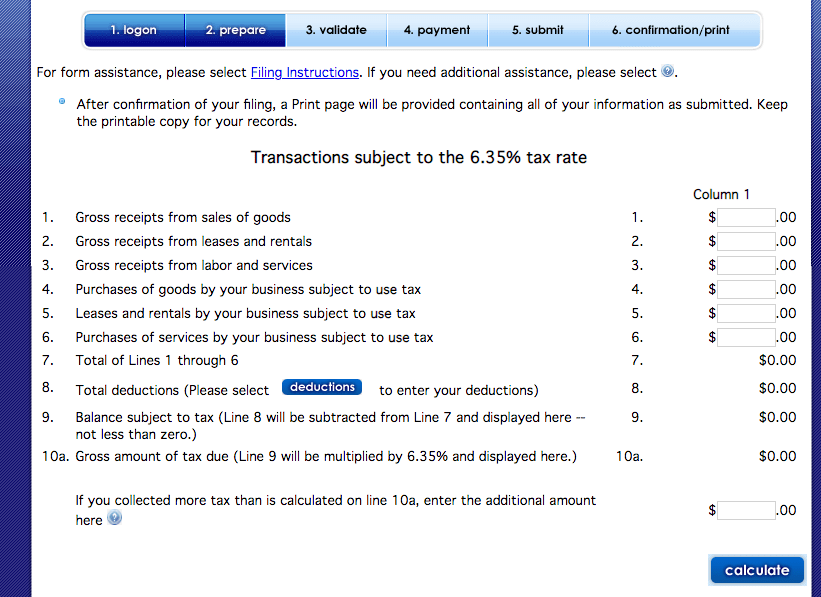

Step 5: Lucky for you, Connecticut has a reasonably easy return to fill out. At this step, all you need to do is enter in your gross receipts and your deductions. Click the blue “deductions” button if you have any deductions to key in.

This will take you to a new screen where you will need to choose the appropriate deduction from the drop-down menu. You will also be asked for the amount of that deduction.

Next, select “Enter deduction”. It will populate on a line directly where you keyed in the amounts. Now navigate back to the previous menu. Here you should see both your gross receipts and deductions.

Press “Calculate”.

Now you should see the total tax due. Be sure to repeat this process at both 7.75% and 9.35% rates if you have any sales that fall in those categories.

After that is complete, click “next” at the bottom of the page.

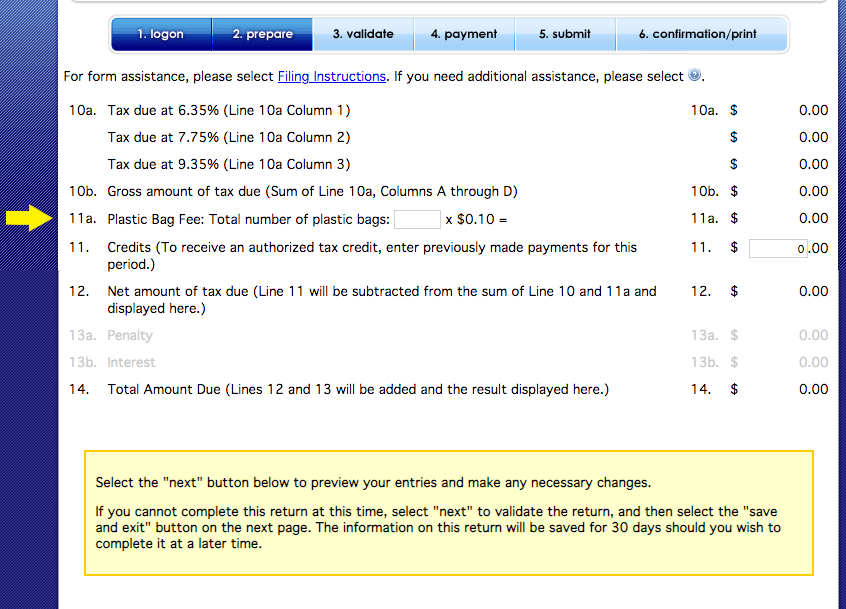

Step 6: You will see where you need to tell Connecticut if you used any plastic bags in sales made to your customers. Connecticut taxes $0.10 per bag used. If you did not use any bags, enter 0. Now, click “Next”.

Step 7: You will be directed to a summary screen where you can check the accuracy of the information you just entered.

How to Pay Connecticut Sales Tax

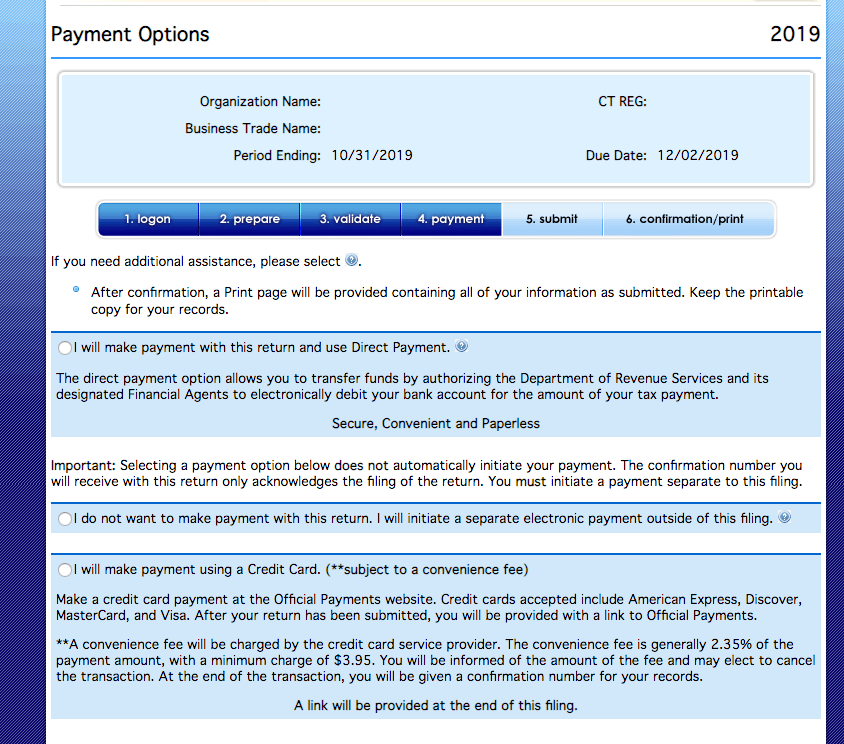

The subsequent page is where you can submit payment with your return. Connecticut lets you submit both your return and payment at the same time.

Select the option that applies to you. The top “Direct Payment” option is the method to use for electronic payment.

At this stage, make sure that your bank information is correct. Also, check that the payment date you select is on or before the due date of the return. Nobody likes late fees!

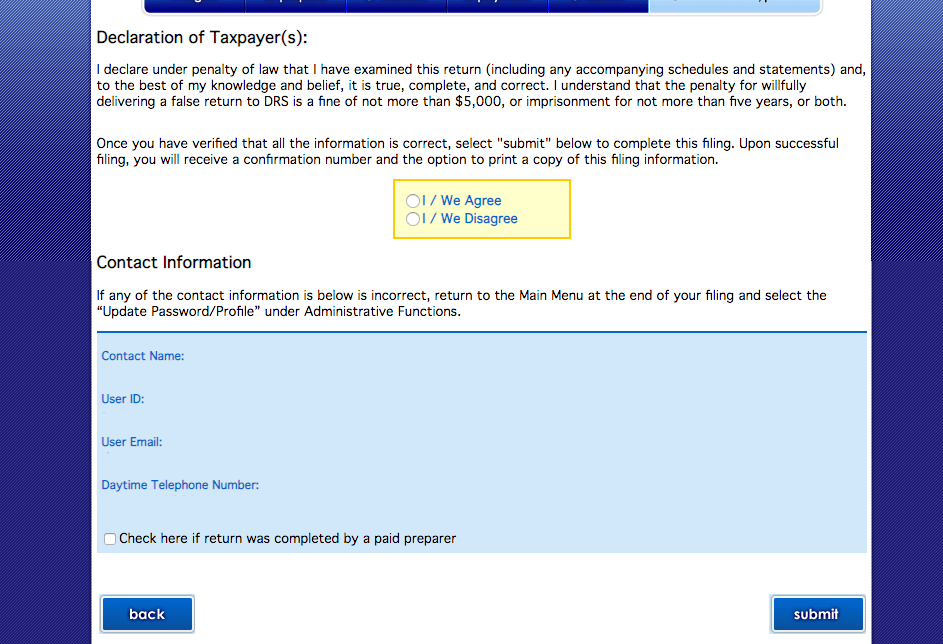

Now simply check the box that you wish at the Declaration of Taxpayer page and press the “submit” button at the bottom right corner. (Hint: To electronically file your return, you do have to agree here.)

As an additional note, it is never a good idea to press the back arrow on the browser to navigate around any state sales tax portal. Always be sure you use the appropriate navigation buttons provided on the site.

At this step, you are done! That wasn’t so bad, was it?

Things to Consider After Filing a Sales Tax Return in Connecticut

If you forgot to print or save a copy of your sales tax return, don’t sweat it. You can easily go back into the period to view and/or print the return that you just filed. Go back to the dashboard and click on the period that you just filed. Under “View Returns & Payment History” click “View Returns”.

Follow that link to the search function that Connecticut has for finding returns that you wish to print.

It is pretty easy to use. Just search for the correct date range, and then select the confirmation number. Also, remember that your payment for this return was submitted concurrently with the return. You can view that in a similar way by following the “View Processed Payments/Credits” or “View Scheduled Payments/Credits” links directly under the “View Returns” link.

How to Get Help Filing a Connecticut Sales Tax Return

If you are stuck or have questions, you can contact the state of Connecticut directly at (860) 297-5962 between 8:30 am and 4:30 pm CST. You can also find additional resources at the Connecticut Department of Revenue (DOR) website, https://portal.ct.gov/.

If instead, you are looking for a team of experts to handle your sales tax returns for you each month, you should check out our Done-for-You Sales Tax Service. Feel free to contact us if you’re interested in becoming a client!

More from TaxValet:

Do You Need to Get a Sales Tax Permit in Connecticut

by Jenniffer Oxford

How to Register for a Sales Tax Permit in Connecticut

by Tara Johnston

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.