California’s Annual LLC Fee

| Question | Answer | ||||||||||

|

Who has to file/pay California’s LLC Fee? |

If your LLC meets one or more of the following conditions:

Then your LLC must pay California’s $800 annual tax plus an annual LLC fee based on gross income attributable to California. |

||||||||||

|

How do you register for California’s LLC Fee? |

Registration to pay California’s LLC Fee is not required. Simply complete the forms listed below and mail them in. Web payment options are available at https://ftb.ca.gov/pay. | ||||||||||

|

How is California’s LLC Fee calculated? |

Your annual California LLC Fee is based on your total California income rounded to the nearest whole dollar. An updated chart can be found on California’s website. This amount is in addition to California’s $800 annual tax.

|

||||||||||

|

Where is the form for California’s LLC Fee? |

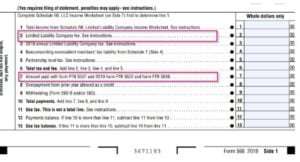

For California’s Annual LLC Fee(s), there are three forms you need to keep in mind:

You can pay the $800 annual tax with Limited Liability Company Tax Voucher (FTB 3522) by the 15th day of the 4th month after the beginning of the current tax year. You can estimate and pay the LLC fee with Estimated Fee for LLCs (FTB 3536) by the 15th day of the 6th month after the beginning of the current tax year. You can then deduct the amount of tax paid through the above forms (FTB 3536 and FTB 3522) from your California Limited Liability Company Return of Income (Form 568) from line item 7 on the first page.

|

||||||||||

|

When is California’s LLC Fee due? |

LLCs must estimate and pay the annual fee by the 15th day of the 6th month of the current tax year (so, generally June 15th) with form FTB 3536.

However the annual $800 tax is due by the 15th day of the 4th month after the beginning of the current tax year (so typically April 15th) with form FTB 3522. If the LLC’s tax year ends prior to the 15th day of the 6th month, the LLC must pay the fee by the due date for filing its Form 568, Limited Liability Company Return of Income. |

||||||||||

|

Where can I go for more information on California’s LLC Fee? |

You can learn more about California’s LLC Fee on FTB 3556 LLC MEO and on California’s Limited Liability Company information page. | ||||||||||

|

Does TaxValet handle California’s LLC Fee? |

TaxValet will not file and pay your California LLC Fee and will depend on your CPA to handle this. |

Get Help with Your Gross Receipts Tax Filings

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.