Sales tax compliance is simple enough when a business is small. With a few products and sales channels limited to a couple of states, software like Shopify or QuickBooks can efficiently manage rate updates and monthly state filings.

But that changes fast once growth kicks in. Expanding into new markets, selling through Amazon or wholesalers, and opening fulfillment centers in new states adds complexity.

At this point, Shopify and QuickBooks might not align on rates, product tax codes can clash between channels, and Amazon FBA shipments create nexus in states you’ve never registered.

It only takes one overlooked registration or untracked channel to create a serious liability. And when that notice arrives, the software won’t be the one paying for it.

That’s when you need real people who can interpret state rules, track how your platforms interact, and fill the gaps technology simply can’t see.

In this article, you’ll learn how the hybrid approach combines the speed of automation with the judgment of real experts to keep growing businesses compliant.

The Growing Risk (and Cost) of Being Audited

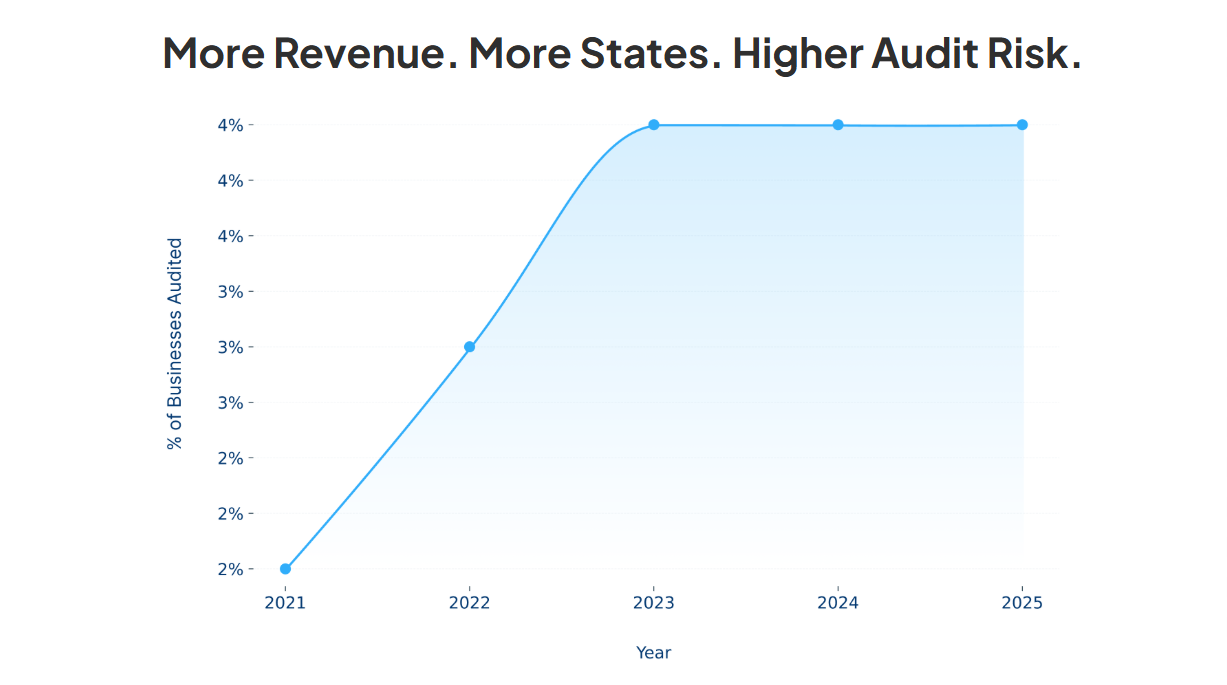

We've recently noticed something concerning: an increase in the number of audits over the last few years.

Between 2021 and 2025, we’ve seen audit rates rise from 2% to 4%. The graphs below show the upward trend and how states are tightening their oversight year after year.

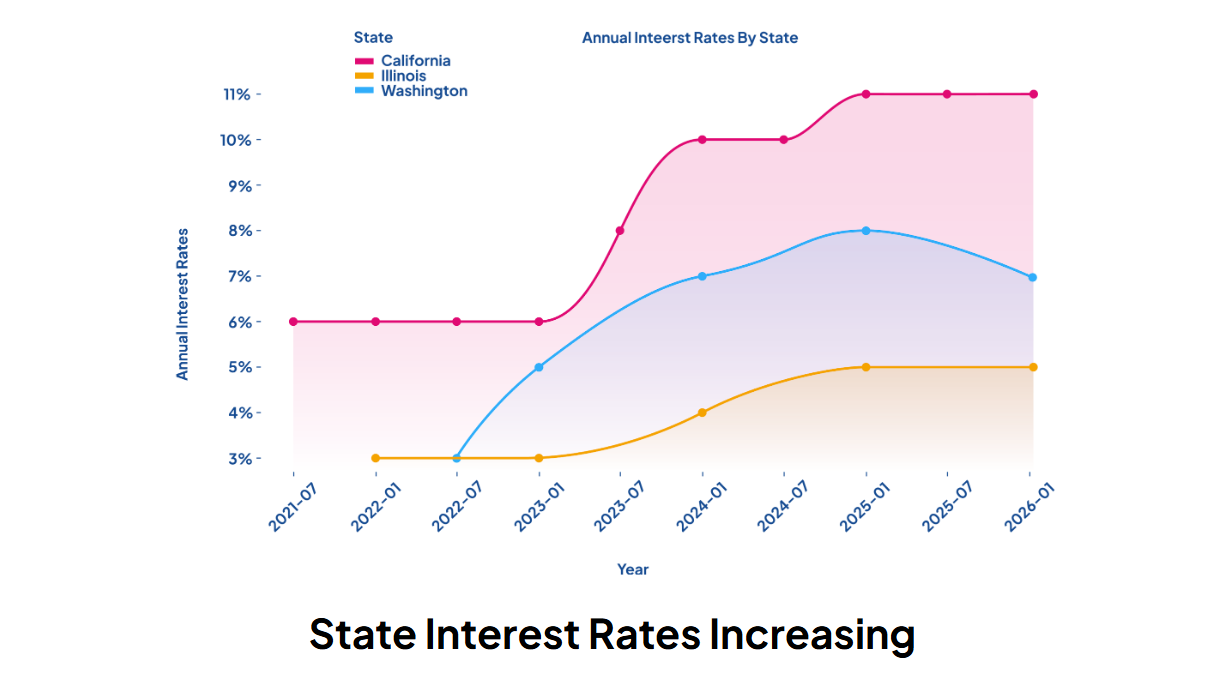

In addition to a higher chance of being audited, the cost of those audits is going up, too:

- In California, interest on unpaid liabilities jumped from 6% in 2021 to 11% in 2025.

- Illinois rose from 3% to as high as 8%.

- Washington climbed from 3% to 5%.

Why Software Alone Isn’t Enough

Sales tax software does exactly what it’s told. It can calculate thousands of transactions in seconds, but it can’t think critically about what those numbers mean, or how you should adjust your settings so you’re pulling the right numbers. It also can’t see what you’re selling on other platforms.

Take a business that sells through Shopify, Amazon, and wholesale invoices. Shopify might show the company is safely below every state’s economic nexus threshold. But that only reflects Shopify’s sales. Add in Amazon and wholesale orders, and the true total might have passed the threshold in several states months ago.

|

Even with the best setup and ongoing maintenance, software alone can leave serious gaps in compliance. Learn about the six most common—and costly—sales tax mistakes most businesses overlook. |

Furthermore, sales tax software often:

- Can create a false sense of security. Business owners assume it can do everything required, then are horrified when they get a big notice.

- Has a steep learning curve. You need to set up and maintain the software correctly, understand the tax rules behind the numbers, and stay updated on rate changes and filing requirements.

Many business owners prefer to hand this work off to a professional or bring in guidance for their in-house team.

The Hidden Costs of Manual-Only Approaches

Some businesses lean heavily on internal staff or accountants to manage sales tax by hand, which might feel safer than trusting software.

In practice, though, manual compliance can also create pressure that builds as the business expands:

- Filing deadlines pile up across multiple states, forcing teams into reactive fire drills.

- Thousands of rule changes every year make it nearly impossible to keep rates current.

- Human error becomes inevitable when juggling spreadsheets and portal logins at scale.

- Payroll costs balloon — adding headcount to keep up with compliance often costs more than investing in the right tools.

- Scalability is limited — a team that can handle filings in three states today will struggle once the footprint expands to ten or twenty.

The Hybrid Framework Explained

A true hybrid sales tax strategy blends automation with expertise. Software captures and calculates data at scale. Human sales tax experts analyze that data through multi-channel tracking, taxability testing, and return reviews to catch what automation can’t see.

Even then, software only performs as well as it’s set up. Getting it to work properly means understanding how each state taxes products, services, and transactions differently.

Without expert oversight, even the best systems can produce incorrect results.

Here’s a look at each approach’s strengths:

Automation Strengths |

“The Sweet Spot” – Humans + Tech |

Human Expertise |

|

Real-time tax rate calculation across all U.S. jurisdictions |

Automated calculations with human oversight for accuracy |

Strategic guidance on where and when to register |

|

Automated jurisdictional logic and rooftop-level accuracy |

Fast onboarding + personalized setup and configuration |

In-depth nexus analysis (including Amazon FBA, wholesale, and use tax) |

|

Scalable processing for high-volume sellers |

Variance monitoring: real-time flags + expert investigation |

Handling physical and economic nexus triggers across all states |

|

Seamless integrations with platforms like Shopify, QuickBooks, NetSuite |

Strategic nexus decisions powered by comprehensive data |

Legal referrals and voluntary disclosure assistance |

|

API flexibility for custom tech stacks |

Full coverage of sales tax + use tax liabilities |

Sales tax mail management + state portal monitoring |

|

Automatically updated tax rules and rates |

Reduced audit risk through collaboration |

Variance resolution + manual data review |

|

Data normalization across multiple channels |

Human interpretation of ambiguous tax rules + AI-driven alerts |

Setup validation, testing, and peer-reviewed configurations |

|

Intelligent alerts and configuration diagnostics |

Ongoing compliance evolution through automated tracking + expert reviews |

Representing clients in audits and resolving state notices |

When Does Your Business Need the Hybrid Approach?

Every business moves through stages of sales tax maturity. It starts with managing a few filings in one state and grows into complex, multi-state compliance across several channels.

TaxValet’s upcoming webinar, How to Future-Proof Your Sales Tax Setup in 2026, will walk through the hybrid framework and share the maturity model you can use to determine when it’s time to adapt your sales tax strategy.

You’ll also hear real-world stories of businesses that avoided six-figure mistakes and gain insights from a live panel with experts from TaxValet, CereTax, and the legal firm, Bennet Thrasher.

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.