Summary: This blog post will provide you with the information and access to the tools you need to comply with Puerto Rico’s Notice and Reporting requirements.

Does Puerto Rico Have Economic Nexus Requirements?

As of the publication of this blog, Puerto Rico does not have economic nexus regulations. They do, however, have Notice and Reporting requirements. At the end of this blog, we provide you with the tools you need to comply with Puerto Rico’s Notice and Reporting requirements.

If you read our blog, States Where Notice and Reporting Requirements Still Matter, you know that the sales threshold for Puerto Rico’s Notice and Reporting requirement is $0. That means that a single sale into Puerto Rico can create a notice and reporting obligation.

In other states, many companies have opted to get a sales tax permit in lieu of dealing with notice and reporting requirements. You can do this as well in Puerto Rico.

Can a Remote Seller Get a Sales Tax Permit in Puerto Rico?

Puerto Rico will issue a sales tax permit upon application. You should note, however, that registering for a sales tax permit in Puerto Rico triggers the opening of a corporate income tax account.

Corporate income tax in Puerto Rico is the equivalent of paying income tax to the IRS in the United States. You can learn more about this requirement on our blog, Should Your E-Commerce Business Get a Sales Tax Permit in Puerto Rico?

A Summary of Puerto Rico’s Notice and Reporting Requirements

To comply with Puerto Rico’s Notice and Reporting Requirements, you must do the following:

(1) notify the buyer on their invoice or receipt that they need to pay tax directly to the government

(2) provide a quarterly report to Puerto Rico with a list of all purchases made by residents

(3) provide an annual notice to purchasers each year

(4) provide the Treasury with a copy of each notice

The penalty for not complying with Puerto Rico’s Notice and Reporting Requirements is $100 for each transaction. Failure to file a quarterly report is $5,000 for each failure. And failure to file the annual report is $500 for each failure.

How to File Reports with Puerto Rico to Comply with Notice and Reporting Requirements

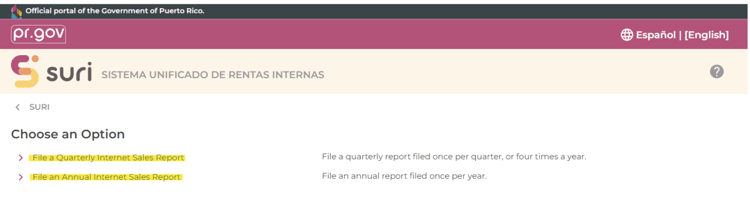

Puerto Rico’s Quarterly and Annual Reports can be filed electronically through their “SURI” system. You can find detailed instructions on the Puerto Rico website here.

You do not need to establish a username and password to submit the reports.

- Access the SURI site at https://suri.hacienda.pr.gov/

- Select “File an Internet Sales Report” listed Under “Non-Merchant Declarations”

3. File your Quarterly or Annual Sales Report.

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.