Quick Answer: This blog provides instructions on how to file and pay sales tax returns in Arkansas using form ET-1. This is the only form used by Arkansas to report sales tax.

Do You Need to File an Arkansas Sales Tax Return?

Once you have an active sales tax permit in Arkansas you will need to begin filing sales tax returns. Not sure if you need a permit in Arkansas? No problem. Check out our blog, Do You Need to Get a Sales Tax Permit in Arkansas?

Also, If you would rather ask someone else to handle your Arkansas filings, our team at TaxValet can handle that for you with our Done-for-You Sales Tax Service. We specialize in eliminating the stress and hassle of sales tax.

How to Sign in to Arkansas’s Website to File a Return

We will begin with simple step-by-step instructions for logging on to the website in order to file your sales tax return for Arkansas.

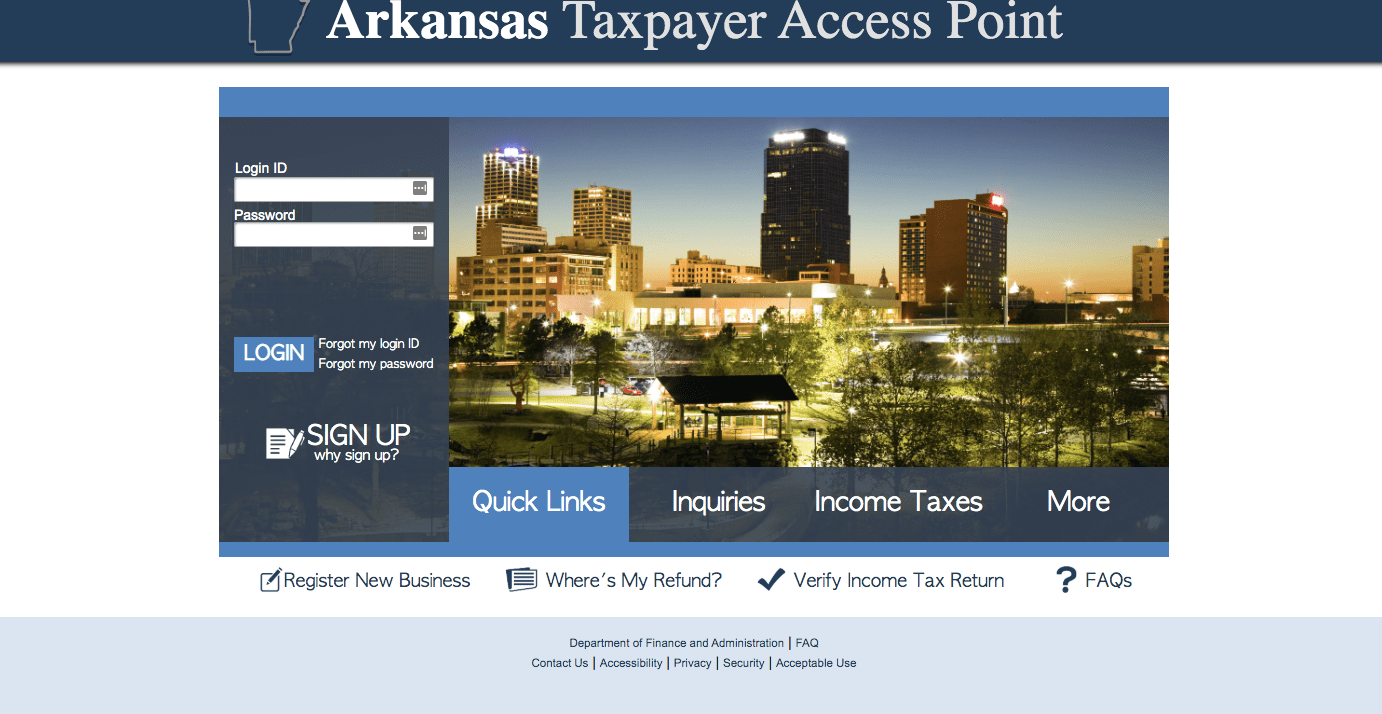

Step 1: Follow this link, https://www.atap.arkansas.gov/_/, and you will come to this screen:

Step 2: Sign in with your username and password.

If you do not have a username & password then your first step is setting that up. Your username and password are generally created when you submit registration paperwork for a sales tax permit. If you are not interested in doing the work of getting the sales tax permit or a state login yourself, TaxValet can handle that for you with our Sales Tax Permit Registration Service.

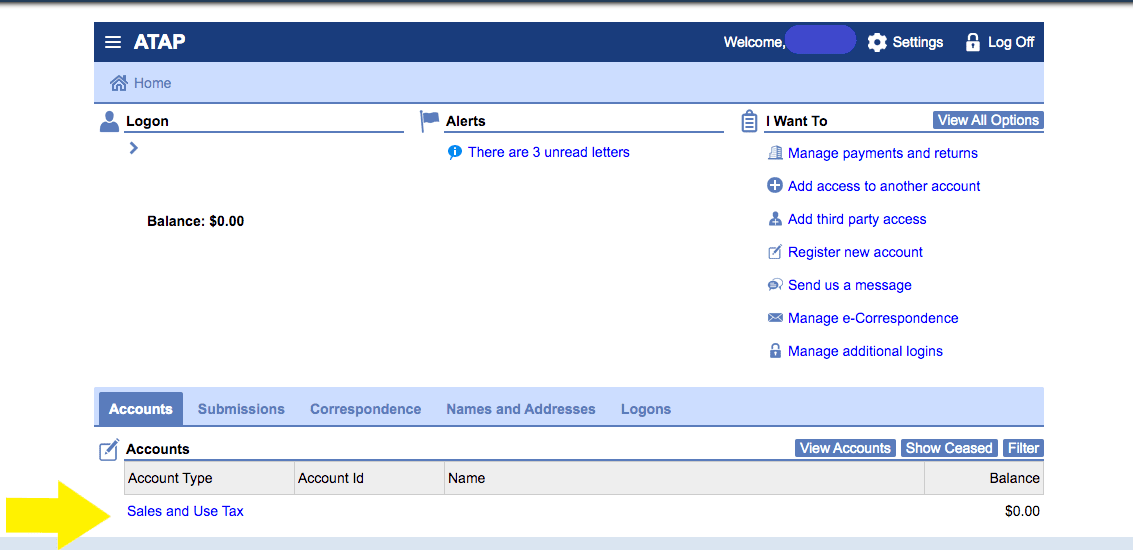

Step 3: You will be directed to your dashboard for that state. Once you come to the dashboard, select the account for which you want to file a return by clicking the “Sales and Use Tax” button to the left of the proper account type.

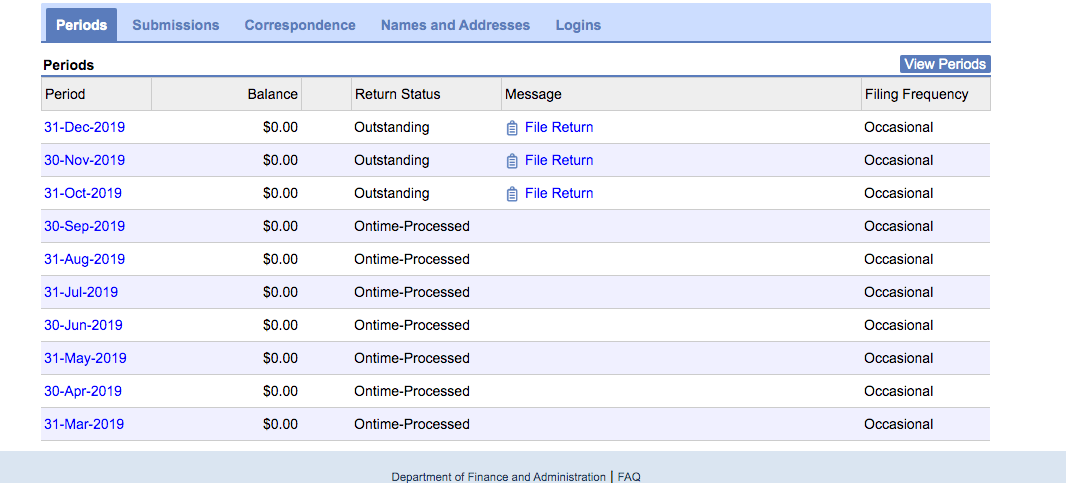

Step 4: Next, you will be directed to this page. As you can see by the filing periods listed, this business files sales tax returns monthly. Click into the correct period. Then, navigate to the right side of screen and select “File or amend a return”.

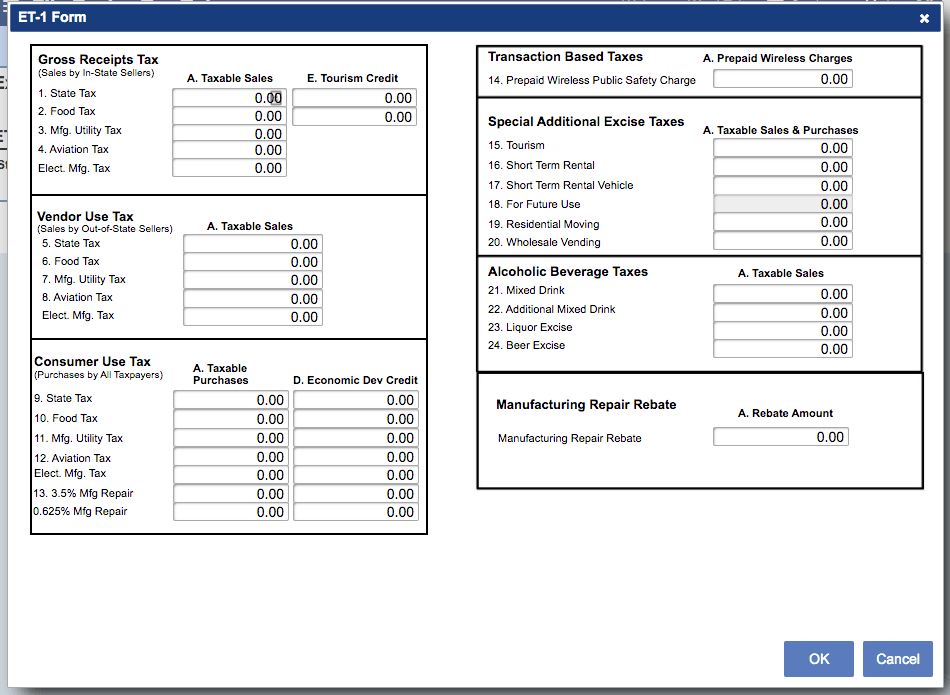

Step 5: This is the step where it starts to get interesting. You will see a screen with “Step 1: Enter Tax Information”. Click that link. Next, you will see the screen below.

If you are an In-State Seller, use the “Gross Receipts Tax” table to report your sales. If you are an Out-Of-State Seller, use the “Vendor Use Tax” table to report your sales.

Key in your gross sales data on this page and then click “OK”. Now you should be given the option of moving on to the next step. Next, click the “Local Sales and Use Selection” and you should see this screen:

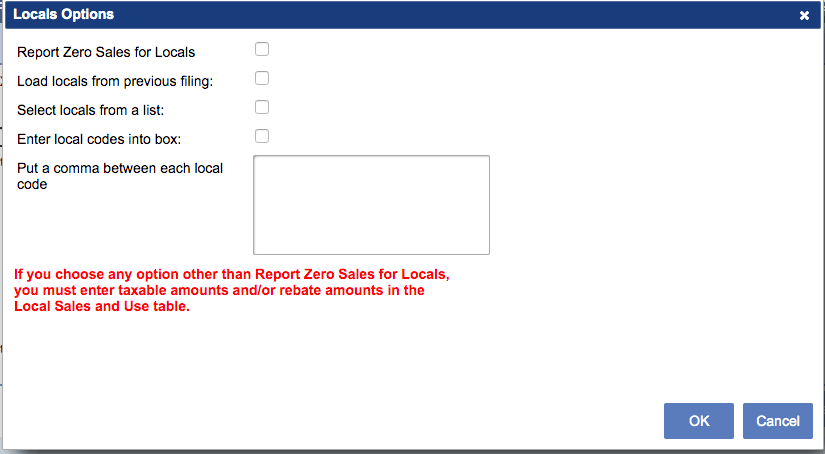

As you can see, Arkansas gives you a few different options to input your local sales data. I find it easiest to choose the “Select locals from a list” option. That is what I will outline here. It is okay, however, if you choose one of the other options. After selecting the option that you wish, select “OK”.

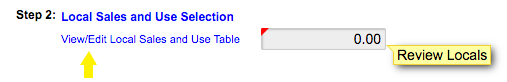

Select the “View/Edit” option shown above. On the next screen, you will enter in your local sales line-by-line. If you have access to the local code, I find it easiest to start with that box and use the tab key to move over one cell at a time, entering the sales data.

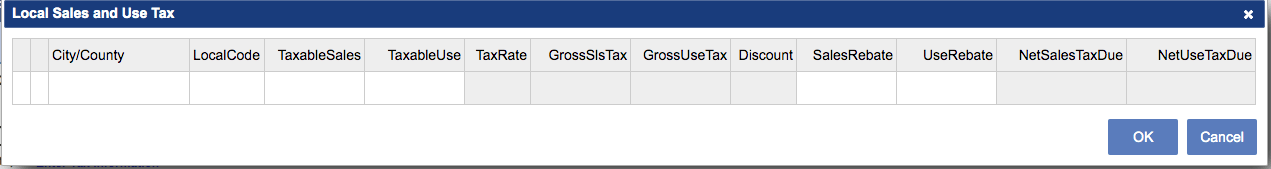

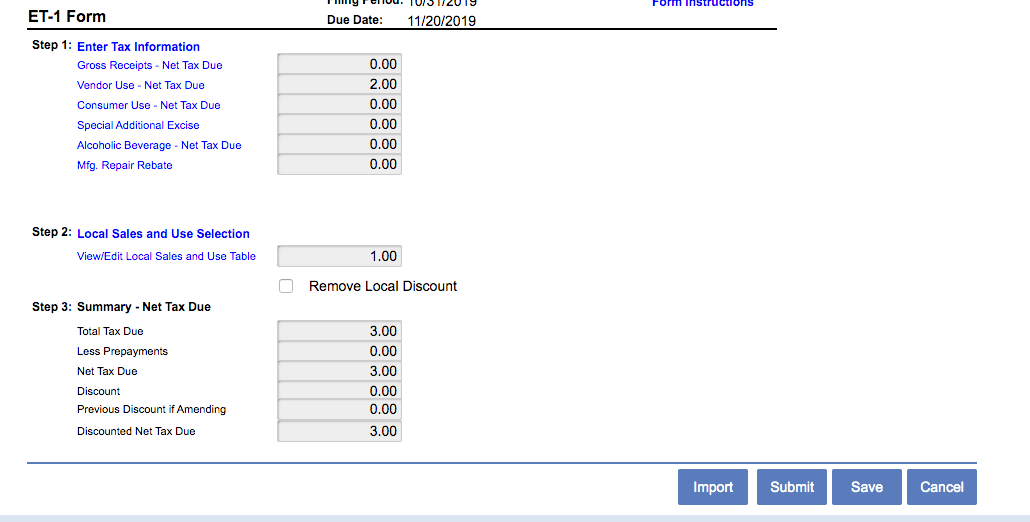

The final step in filing your sales tax return will be a screen with a summary of all the data you have entered. Make sure to double-check that your numbers are correct then submit your return.

How to Pay Arkansas Sales Tax

While you have filed your return, you still need to pay what is owed in sales tax to Arkansas. After you have reviewed and submitted your return, proceed with electronic payment.

You will be given the option of electronic payment immediately after submitting your return. If you do not already have your bank account information saved in Arkansas’s system, you will need to enter in your routing and account number. Key in the period for which you are filing as well as the payment amount. Be sure to enter the correct payment date as well. Nobody wants to pay late fees!

Once your return and payment have been processed, be sure to save all documentation.

Now you are done! You have officially filed and paid your Arkansas sales tax return. As a final step, it is always a good idea to verify that the correct amount of funds were withdrawn from your bank account on the correct day.

Things to Consider After Filing a Sales Tax Return in Arkansas

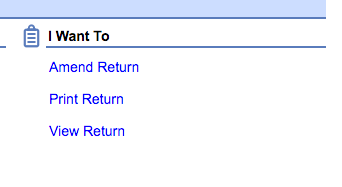

If you forgot to print or save a copy of your sales tax return, don’t fret. You can easily go back into the period to view and/or print the return that you just filed. Go back to the dashboard and click into the period that you just filed. Under “I Want To” click “File or amend a return”. You will be given the options shown below. Follow the “Print Return” link to print or save a copy for your records.

How to Get Help Filing an Arkansas Sales Tax Return

If you are stuck or have questions, you can contact the state of Arkansas directly at (501) 682-2242 between 8:00am and 4:30pm CST. You can also find additional resources at the Arkansas Department of Revenue (DOR) website, https://www.dfa.arkansas.gov/

But if you are looking for a team of experts to handle your sales tax returns for you each month, you should check out our Done-for-You Sales Tax Service. Feel free to contact us if you’re interested in becoming a client!

More from TaxValet:

Do You Need to Get a Sales Tax Permit in Arkansas?

by Jenniffer Oxford

How to Register for a Sales Tax Permit in Arkansas

by Tara Johnston

Receive Important Sales Tax Updates to Your Inbox!

Join our mailing list to receive free updates that could help protect your business from audit.

Get in Touch

Company

Disclaimer: Nothing on this page should be considered tax or legal advice. Information provided on this page is general in nature and is provided without warranty.

Copyright TaxValet 2023 | Privacy Policy | Site Map

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.