Quick Answer: This blog gives instructions on how to file and pay sales tax in Oklahoma with the Vendor Use Return, a return commonly used by out-of-state sellers. Once a return is submitted, payment can be made electronically.

Do You Need to File an Oklahoma Sales Tax Return?

Once you have an active sales tax permit in Oklahoma, you will need to begin filing sales tax returns. Not sure if you need a permit in Oklahoma? No problem. Check out our blog, Do You Need to Get a Sales Tax Permit in Oklahoma?

Also, If you would rather ask someone else to handle your Oklahoma filings, our team at TaxValet can handle that for you with our Done-for-You Sales Tax Service. We specialize in eliminating the stress and hassle of sales tax.

Steps for Filling out Oklahoma’s Sales Tax Return

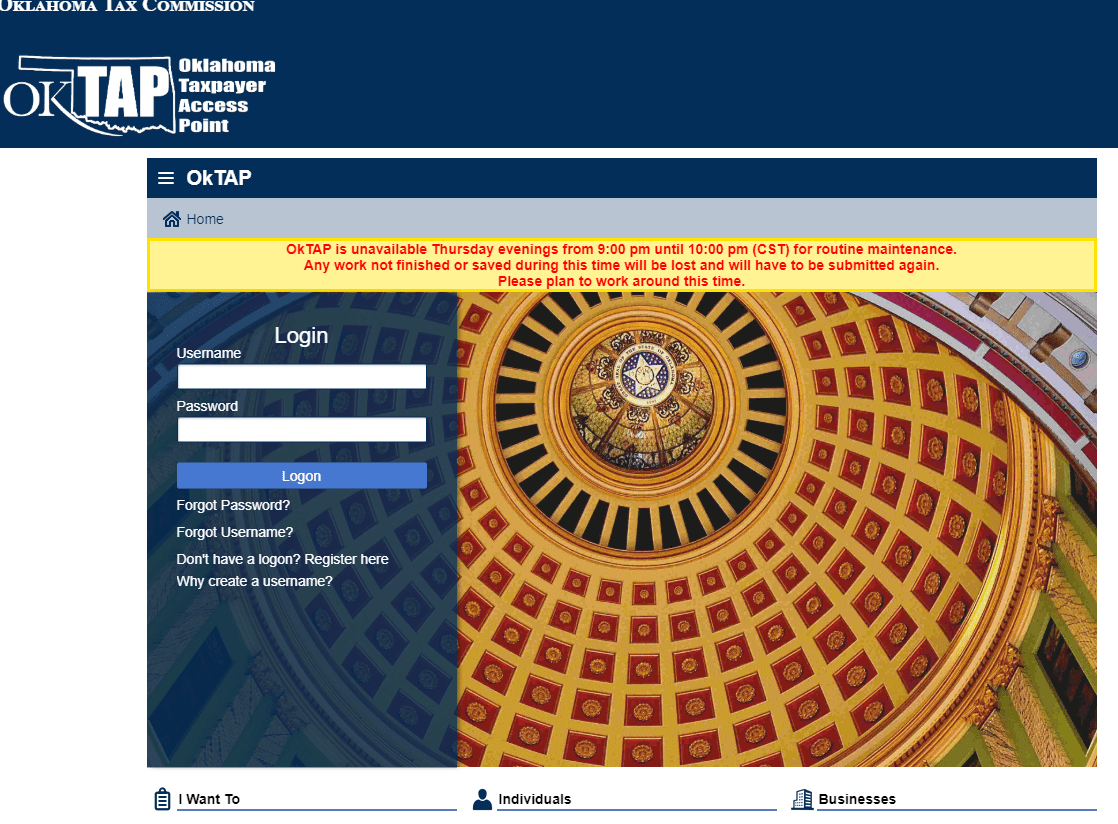

Step 1: The first step in filing your Oklahoma sales tax return is to log into the website at https://oktap.tax.ok.gov/oktap/web/_/.

If you do not have a username and password, you will need to click on “Register here” and then follow the instructions for signing up. You can also reference this blog, How to Register for a Sales Tax Permit in Oklahoma, for more information.

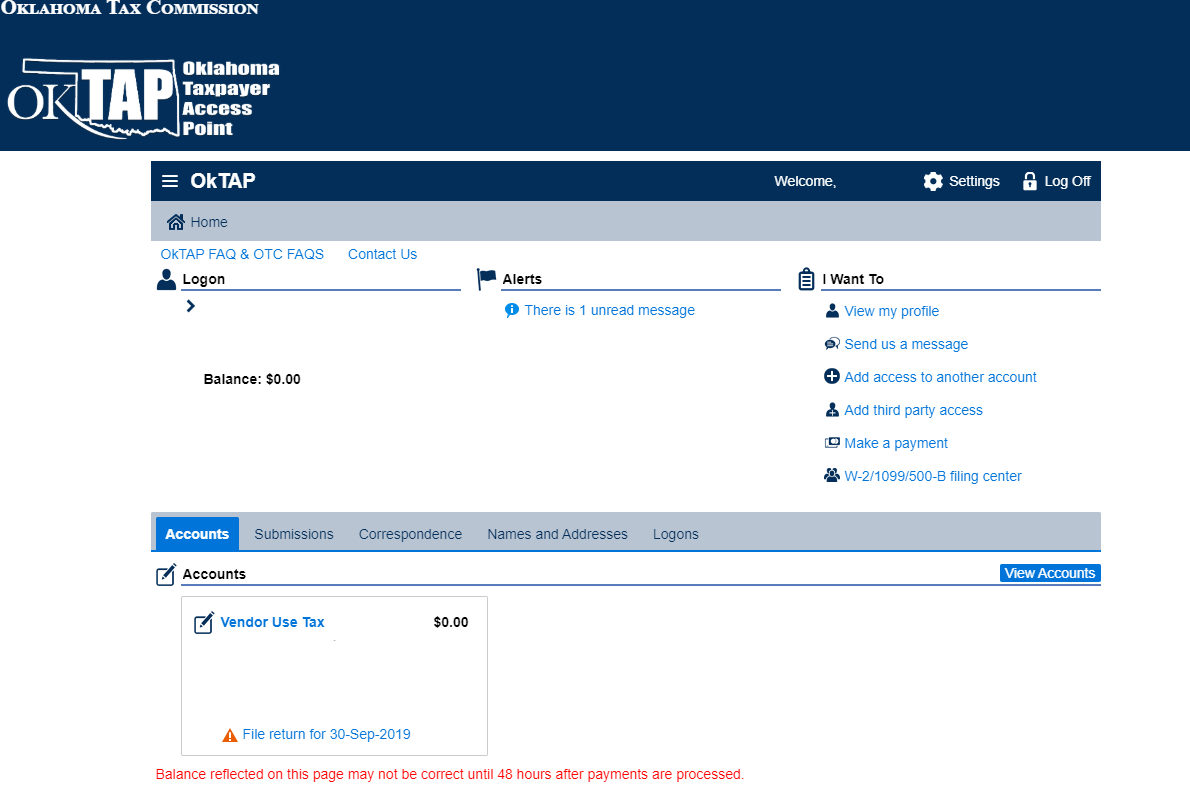

Step 2: You should now be on your homepage. Click on “File return” listed under the appropriate account. In this case, we are using a Vendor Use Tax account (used for out of state remote sellers).

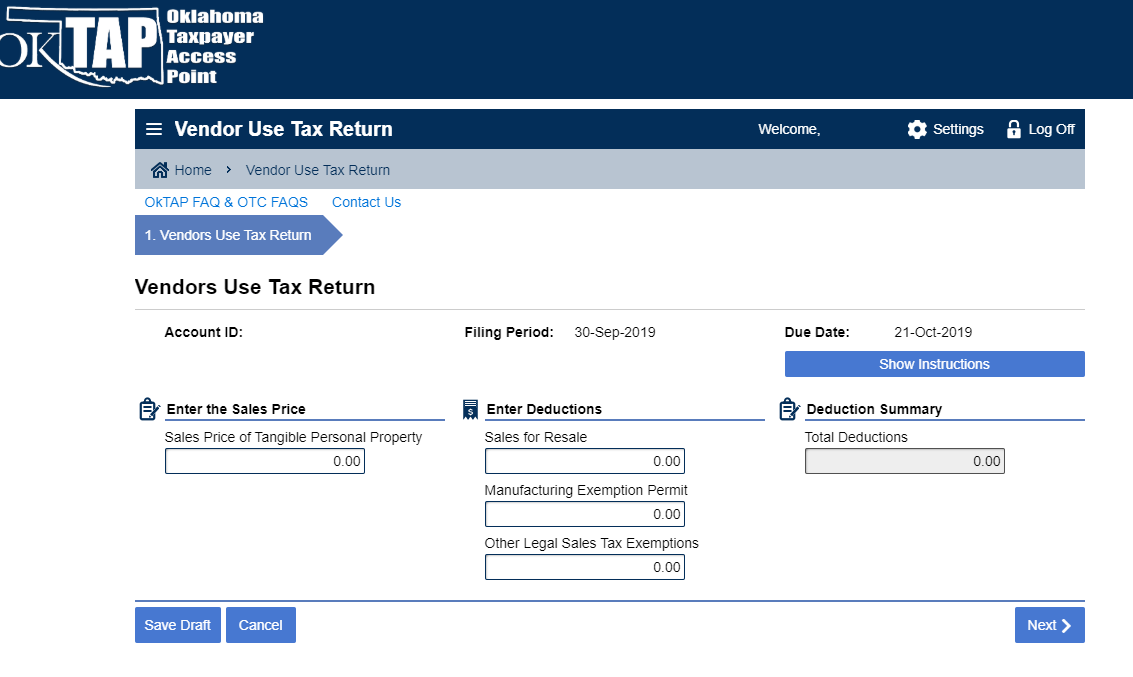

Step 3: Enter your sales information and click “Next.”

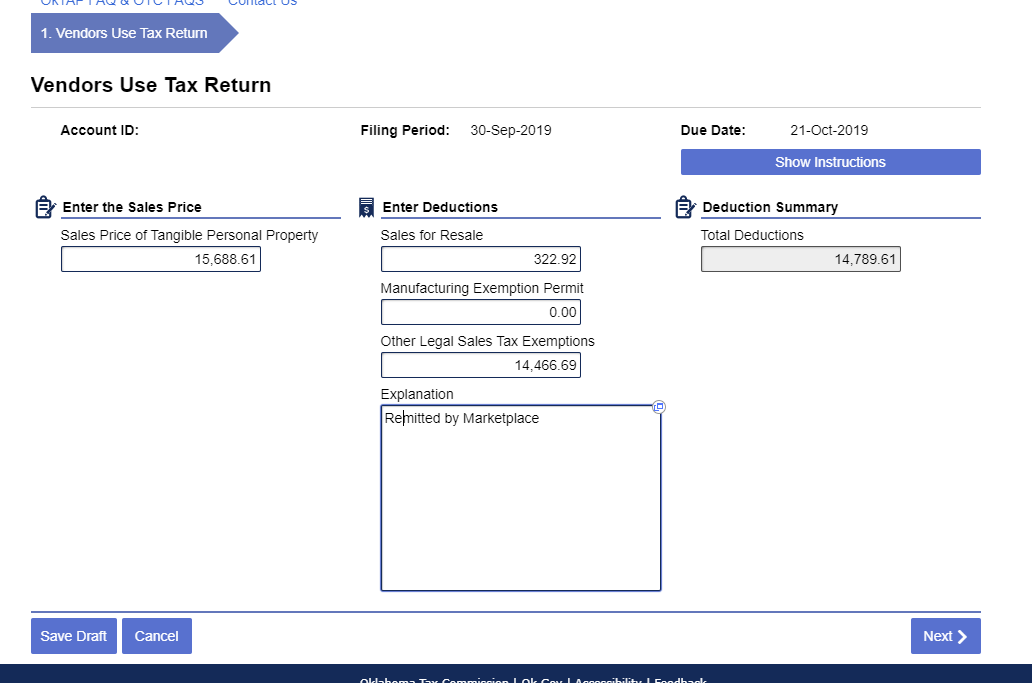

Step 4: The Oklahoma return uses the term “Sales Price.” This is really your gross sales.

If you have marketplace sales, enter the sales amount as “Other Legal Sales Tax Exemptions” and include an explanation that states “remitted by marketplace.”

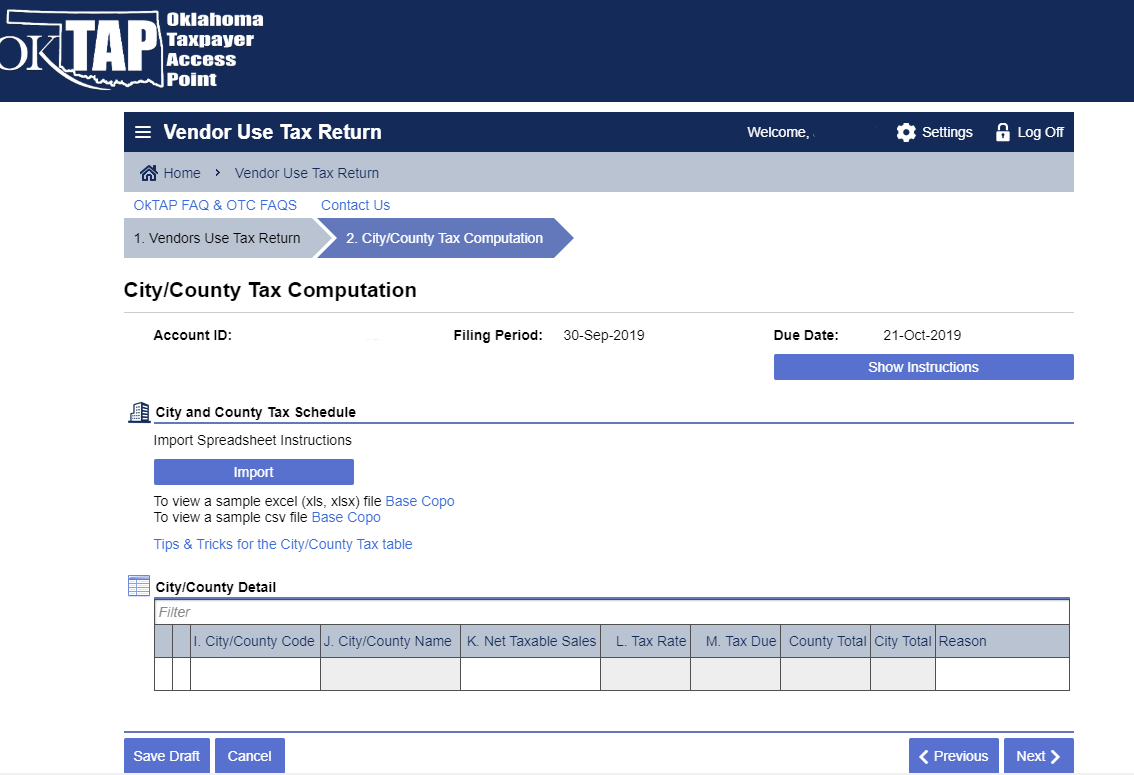

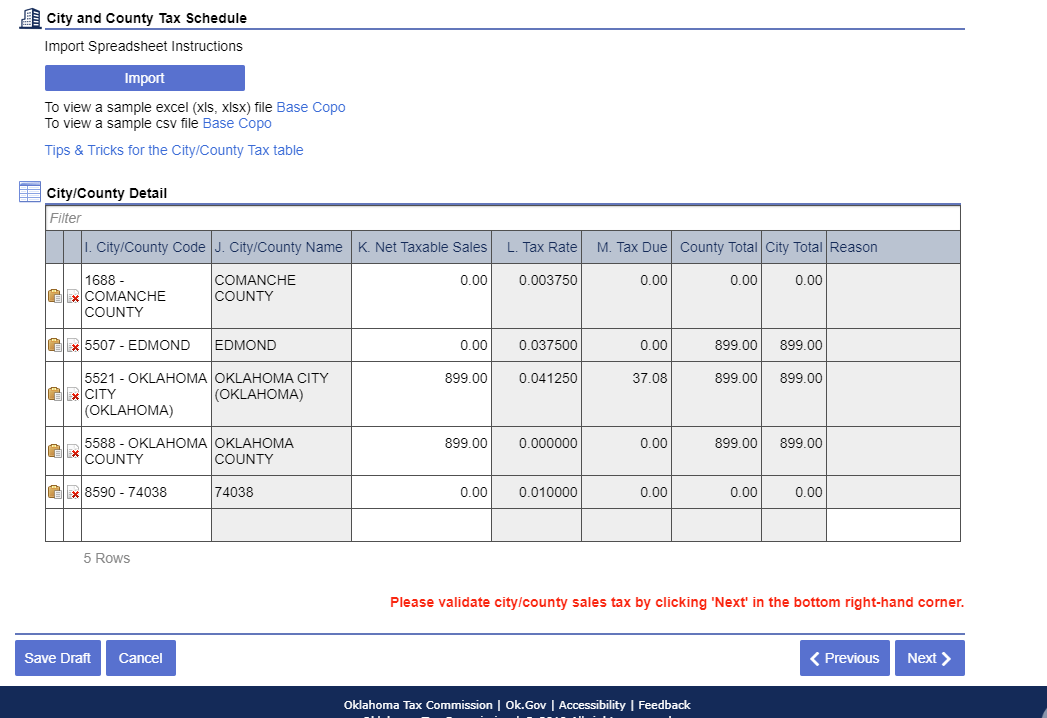

Step 5: Now you need to put in your city/county detail. If you have a lot of jurisdictions, you may want to use the import feature. You can click on the examples and the “tips & tricks” for additional instructions.

Once you are done entering the jurisdictions, click “Next.”

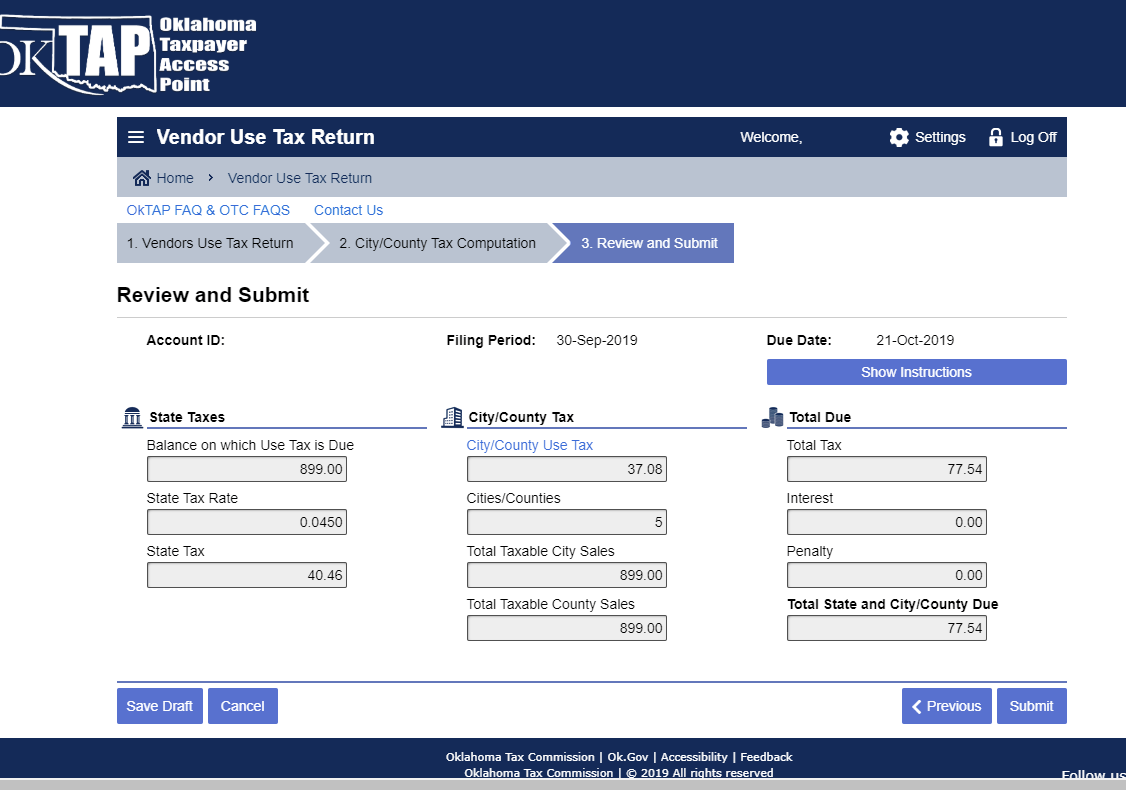

Step 6: You now will see the total amount of tax due. Review this information to make sure it matches your records. If all looks good, click “Submit.” If the information does not look correct, then click “Previous” and make your changes. Please note that once you click “Submit” you will not be able to make changes.

Hooray! You have now filed your return.

Make sure to save the confirmation number that comes up on the screen. We also recommend saving a copy of your return for your records.

How to Pay Oklahoma Sales Tax

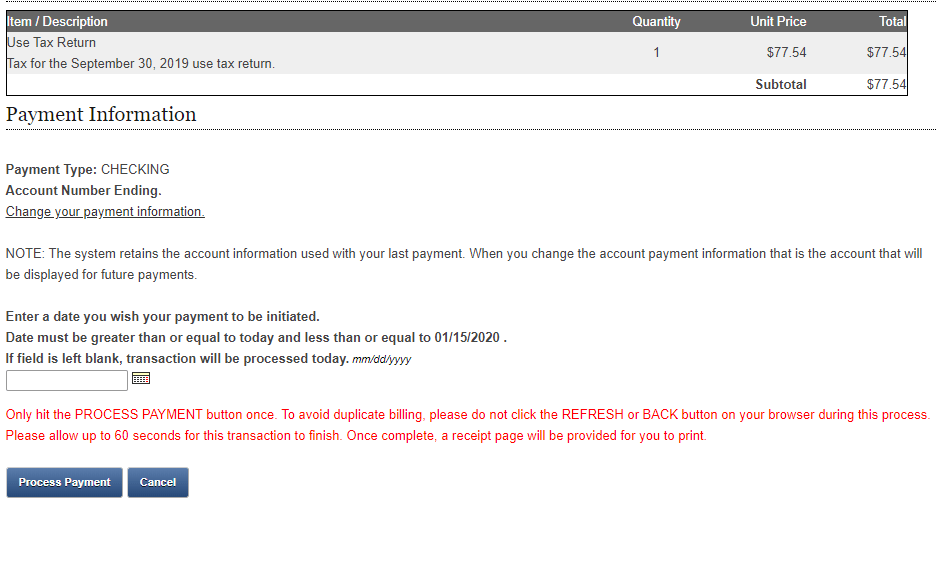

You are now ready to make a payment. There are numerous ways to pay, including ACH credit as well as using your bank account. In this example, we will be paying with a bank account.

To start, click on “Schedule Payment.” This will bring up your payment information. If you need to change your payment information, click “Change Your Payment Information” in the middle of the screen. Enter the date you want the payment to come out of your account then click “Process Payment.”

You have now made your sales tax payment to the state of Oklahoma! It was that easy.

Things to Consider After Filing a Sales Tax Return in Oklahoma

If you forgot to print or save your return, you still can!

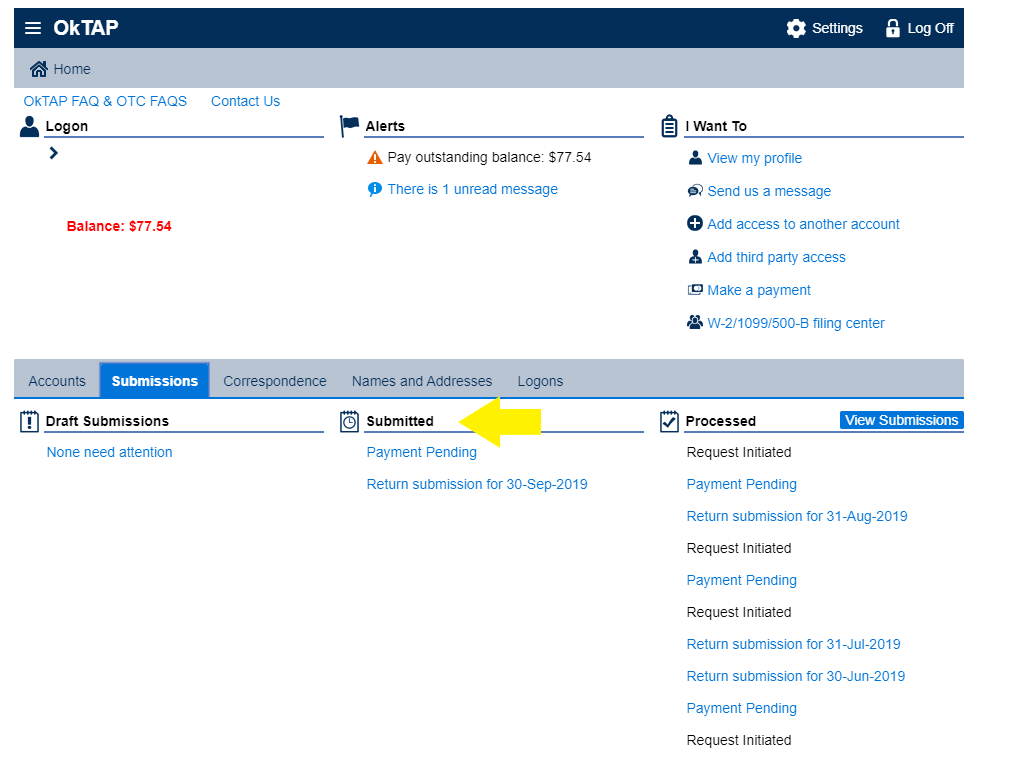

To print/save your return, go back to your homepage and click on “Submissions.” Under “Submitted” click on the tax return you want access to. Then click “Print Submission.”

How to Get Help Filing an Oklahoma Sales Tax Return

If you are stuck or have questions, you can contact the Taxpayer Service Center in Oklahoma directly at (405) 521-3160 or by email at otcmaster@tax.ok.gov. You can also access the “Contact Us” area on your homepage to send an email directly from your account.

If instead, you are looking for a team of experts to handle your sales tax returns for you each month, you should check out our Done-for-You Sales Tax Service. Feel free to contact us if you’re interested in becoming a client!

Get in Touch

Company

Disclaimer: Nothing on this page should be considered tax or legal advice. Information provided on this page is general in nature and is provided without warranty.

Copyright TaxValet 2023 | Privacy Policy | Site Map

Disclaimer: Our attorney wanted you to know that no financial, tax, legal advice or opinion is given through this post. All information provided is general in nature and may not apply to your specific situation and is intended for informational and educational purposes only. Information is provided “as is” and without warranty.

What you should do now

- Get a Free Sales Tax Plan and see how Tax Valet can help solve your sales tax challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.